Positioning for the Future | 161

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

13 TRADE RECEIVABLES

(cont’d)

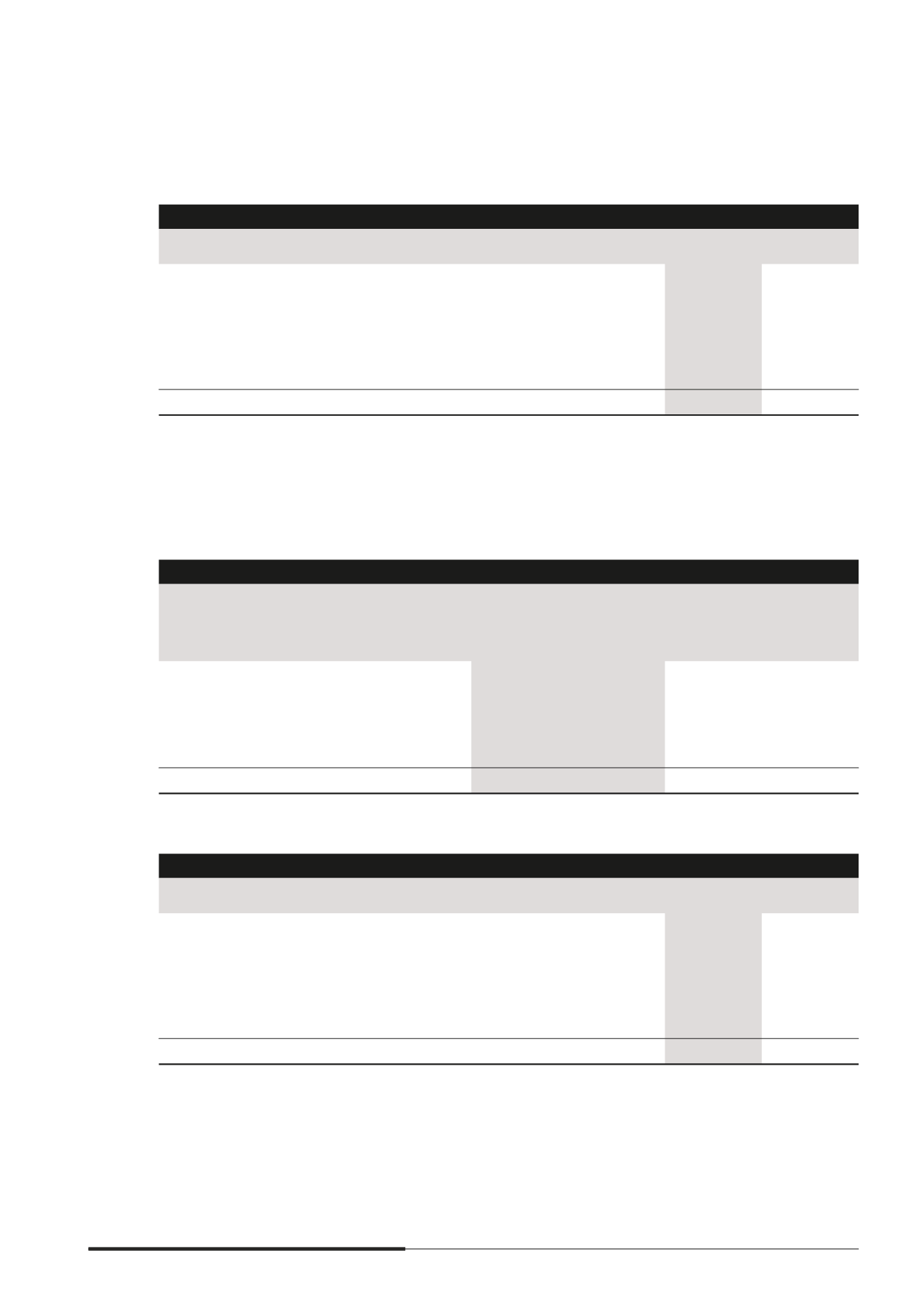

(a) The maximum exposure to credit risk for trade receivables at the reporting date (by strategic business units)

was

The Group

2014

$’000

2013

$’000

Restated

CapitaLand Singapore

20,932

39,347

CapitaLand China

1,890

2,505

CapitaMalls Asia

40,582

53,254

Ascott

47,890

47,338

Others

6,938

27,739

118,232

170,183

The credit quality of trade and other receivables is assessed based on credit policies established by the

Risk Committee. The Group monitors customer credit risk by grouping trade and other receivables based

on their characteristics. Trade and other receivables with high credit risk will be identimed and monitored by

the respective strategic business units.

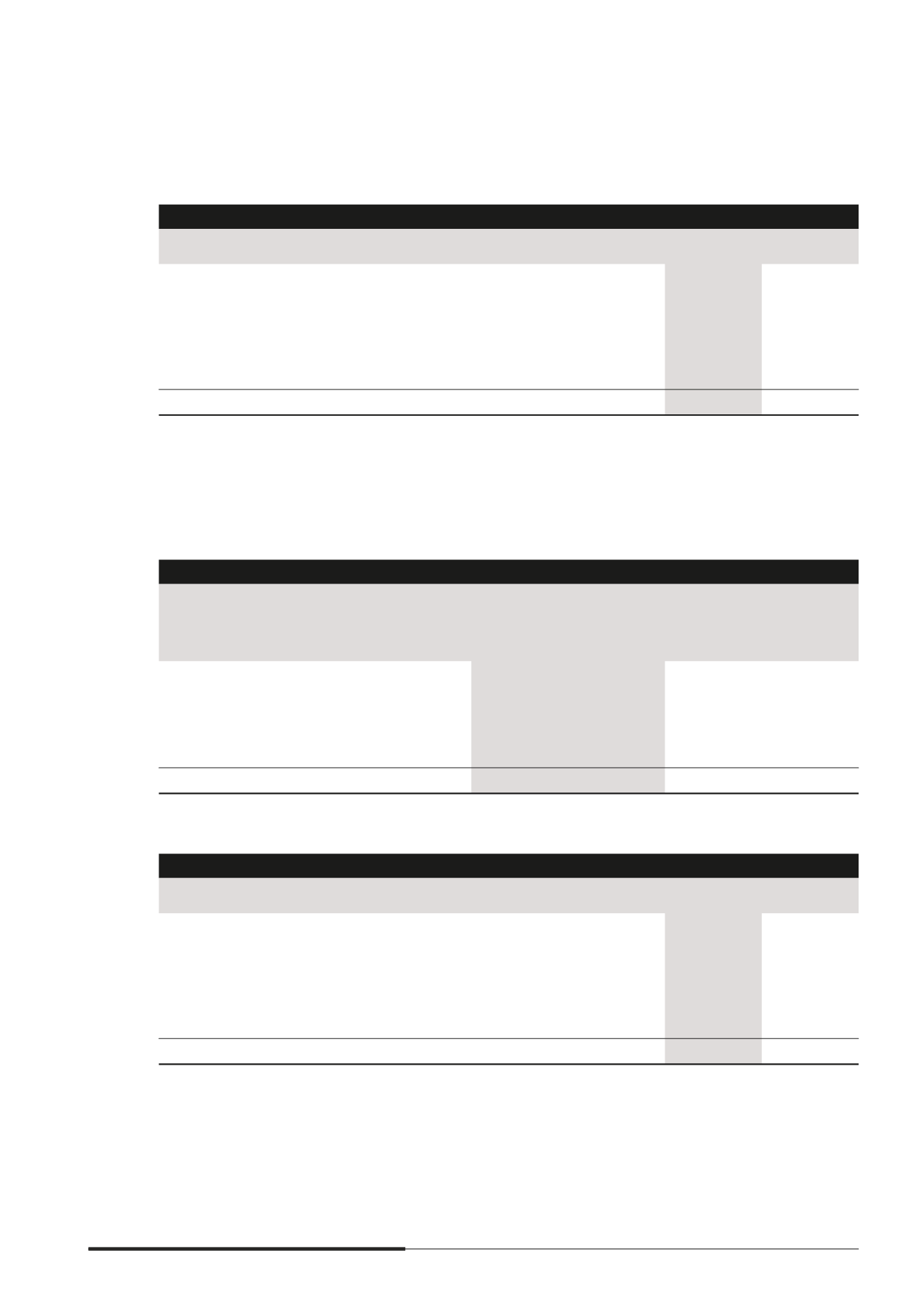

(b) The ageing of trade receivables at the reporting date was

The Group

Gross

amount

2014

$’000

Allowance

for doubtful

receivables

2014

$’000

Gross

amount

2013

$’000

Allowance

for doubtful

receivables

2013

$’000

Restated

Restated

Not past due

92,404

–

116,725

–

Past due 1 – 30 days

15,923

(54)

21,788

(249)

Past due 31 – 90 days

7,058

(2,827)

7,486

(35)

More than 90 days

13,841

(8,113)

43,257

(18,789)

129,226

(10,994)

189,256

(19,073)

(c) The movements in allowance for doubtful receivables in respect of trade receivables were as follows

The Group

2014

$’000

2013

$’000

Restated

At 1 January

(19,073)

(18,812)

Allowance utilised

4,492

246

Allowance during the year

(1,091)

(1,986)

Reversal of allowance during the year

4,871

–

Translation differences

(193)

1,479

At 31 December

(10,994)

(19,073)

Based on historical default rates, the Group believes that no allowance for doubtful receivables is necessary

in respect of the receivables not past due.