158 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

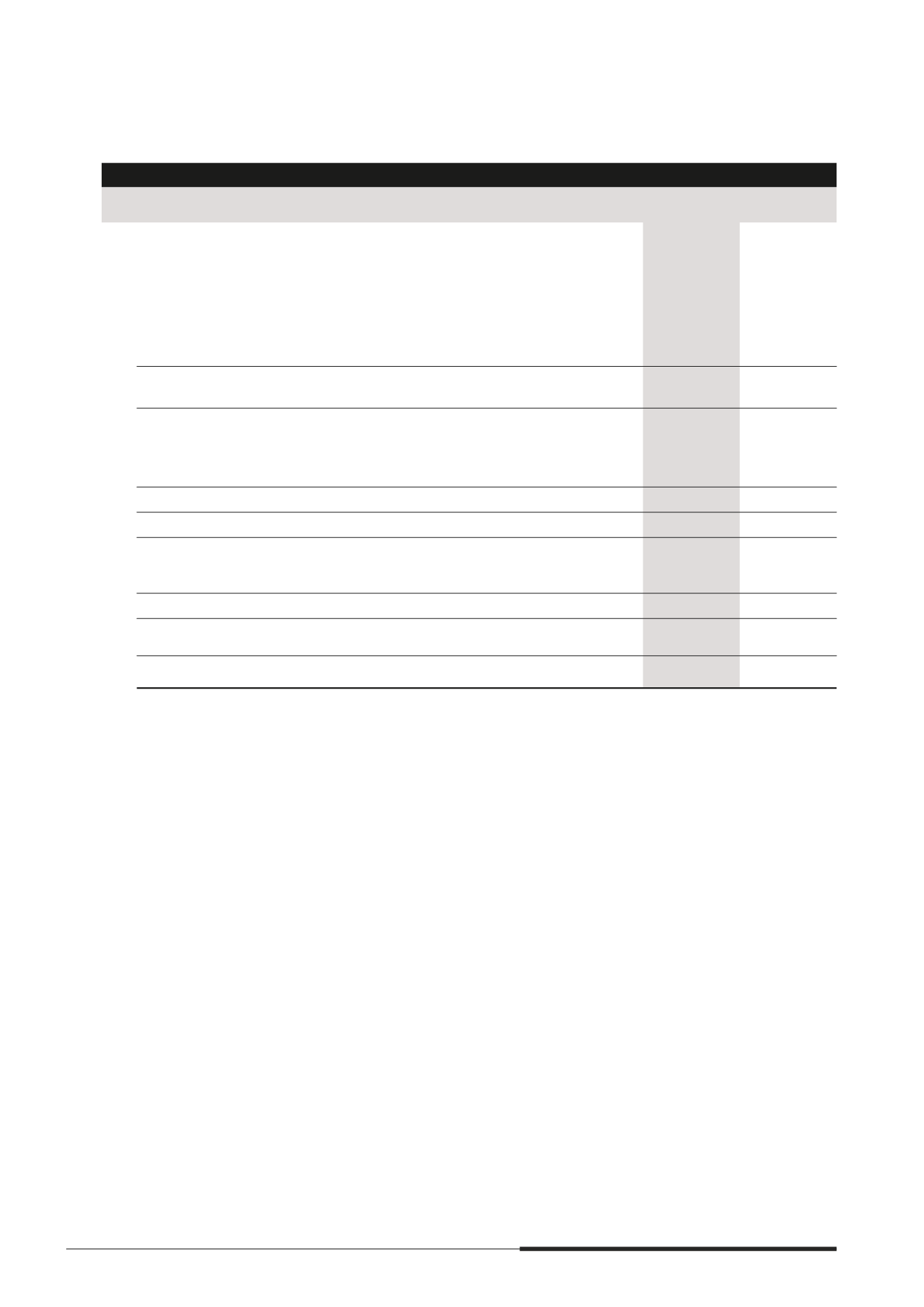

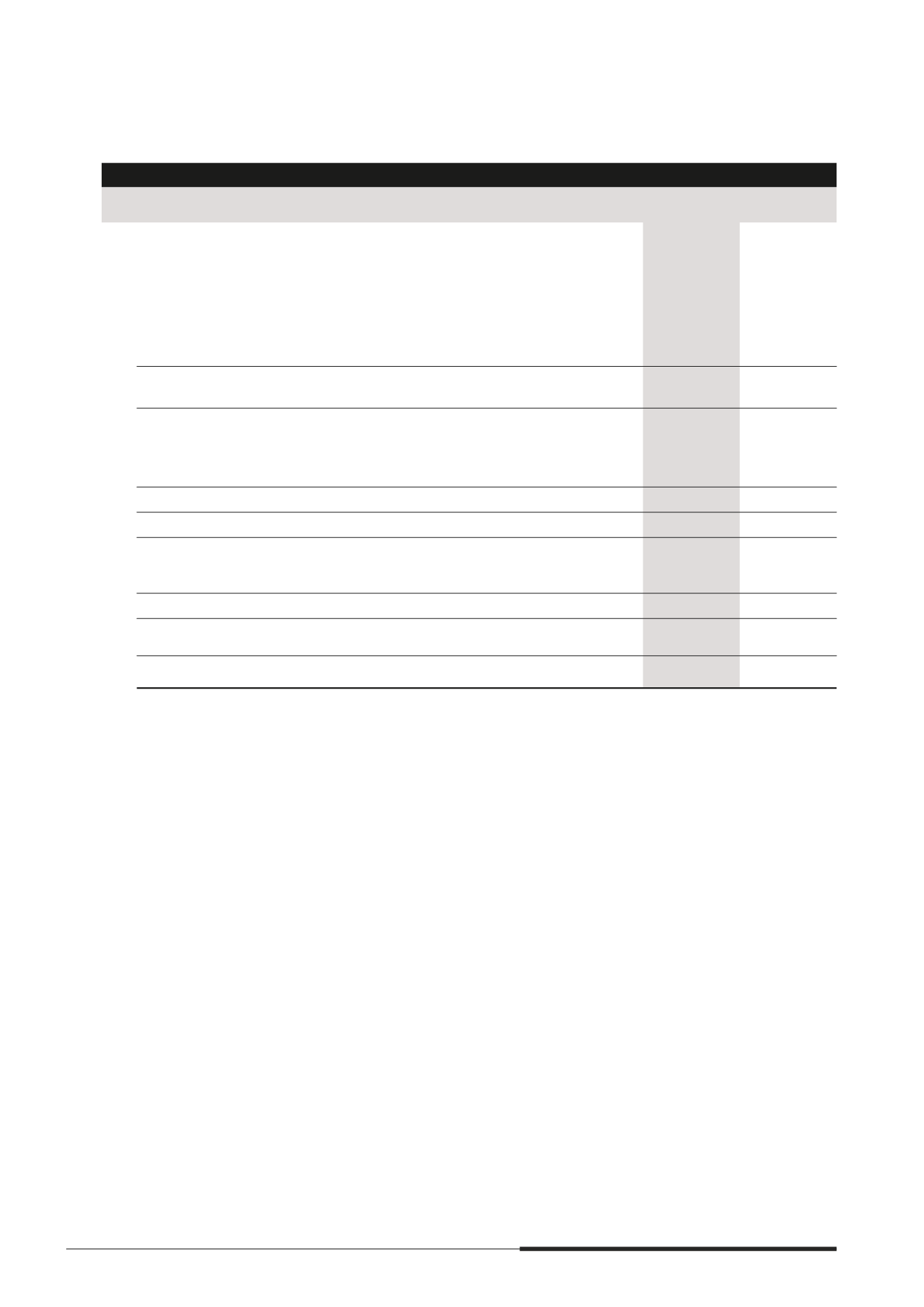

11 DEVELOPMENT PROPERTIES FOR SALE AND STOCKS

The Group

2014

$’000

2013

$’000

Restated

(a) Properties under development, units for which

revenue is recognised using percentage of

completion method

Costs incurred and attributable promts

3,412,627

3,184,265

Allowance for foreseeable losses

(109,190)

(17,190)

3,303,437

3,167,075

Progress billings

(867,944)

(441,485)

2,435,493

2,725,590

Other properties under development

Costs incurred

3,896,048

4,133,268

Allowance for foreseeable losses

(70,602)

(361,048)

3,825,446

3,772,220

Properties under development

6,260,939

6,497,810

(b) Completed development properties, at cost

1,432,370

889,307

Allowance for foreseeable losses

(20,303)

(5,463)

Completed development properties

1,412,067

883,844

(c) Consumable stocks

645

734

Total development properties for sale and stocks

7,673,651

7,382,388

(d) The Group adopts the percentage of completion method of revenue recognition for residential projects

under progressive payment scheme in Singapore. The stage of completion is measured in accordance with

the accounting policy stated in note 2.15. Signimcant assumptions are required in determining the stage of

completion and the total estimated development costs. In making the assumptions, the Group evaluates

them by relying on past experience and the work of specialists.

The Group makes allowance for foreseeable losses taking into account the Group’s recent experience

in estimating net realisable values of completed units and properties under development by reference

to comparable properties, timing of sale launches, location of property, expected net selling prices and

development expenditure. Market conditions may, however, change which may affect the future selling prices

on the remaining unsold residential units of the development properties and accordingly, the carrying value

of development properties for sale may have to be written down in future periods.

(e) As at 31 December 2014, development properties for sale amounting to approximately $5,207.1 million

(2013 $4,471.9 million) were mortgaged to banks to secure credit facilities of the Group (note 19).