Positioning for the Future | 153

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

8

JOINT VENTURES

(cont’d)

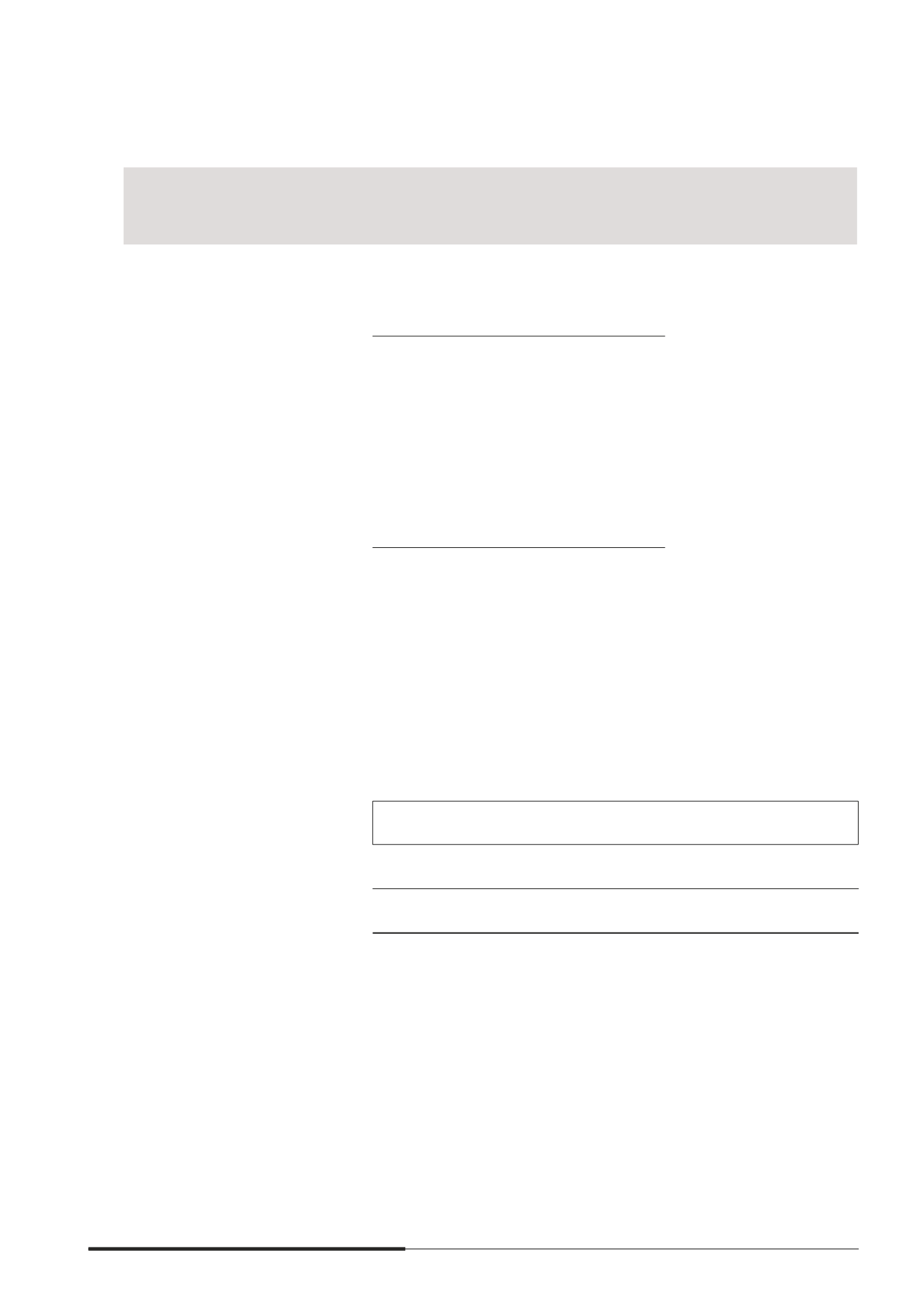

RCS

Trust

$’000

OTH

Group

$’000

CTM

Group

$’000

Other

individually

immaterial

joint ventures

$’000

Total

$’000

2013

Revenue

225,788

238,546

–

Promt/(Loss)

1

after tax

205,417

268,453

(10,007)

Other comprehensive income

–

2,625

42,903

Total comprehensive income

205,417

271,078

32,896

1

Includes

- depreciation and amortisation

(91)

(1,941)

(151)

- interest income

42

306

8

- interest expense

(33,843)

(26,165)

–

- tax expense

–

(26,222)

–

Current assets

2

14,472

103,058

547,260

Non-current assets

3,018,792

3,015,164

496,253

Current liabilities

3

(82,338)

(63,584)

(8,297)

Non-current liabilities

4

(1,019,738)

(1,644,581)

–

Net assets

1,931,188

1,410,057

1,035,216

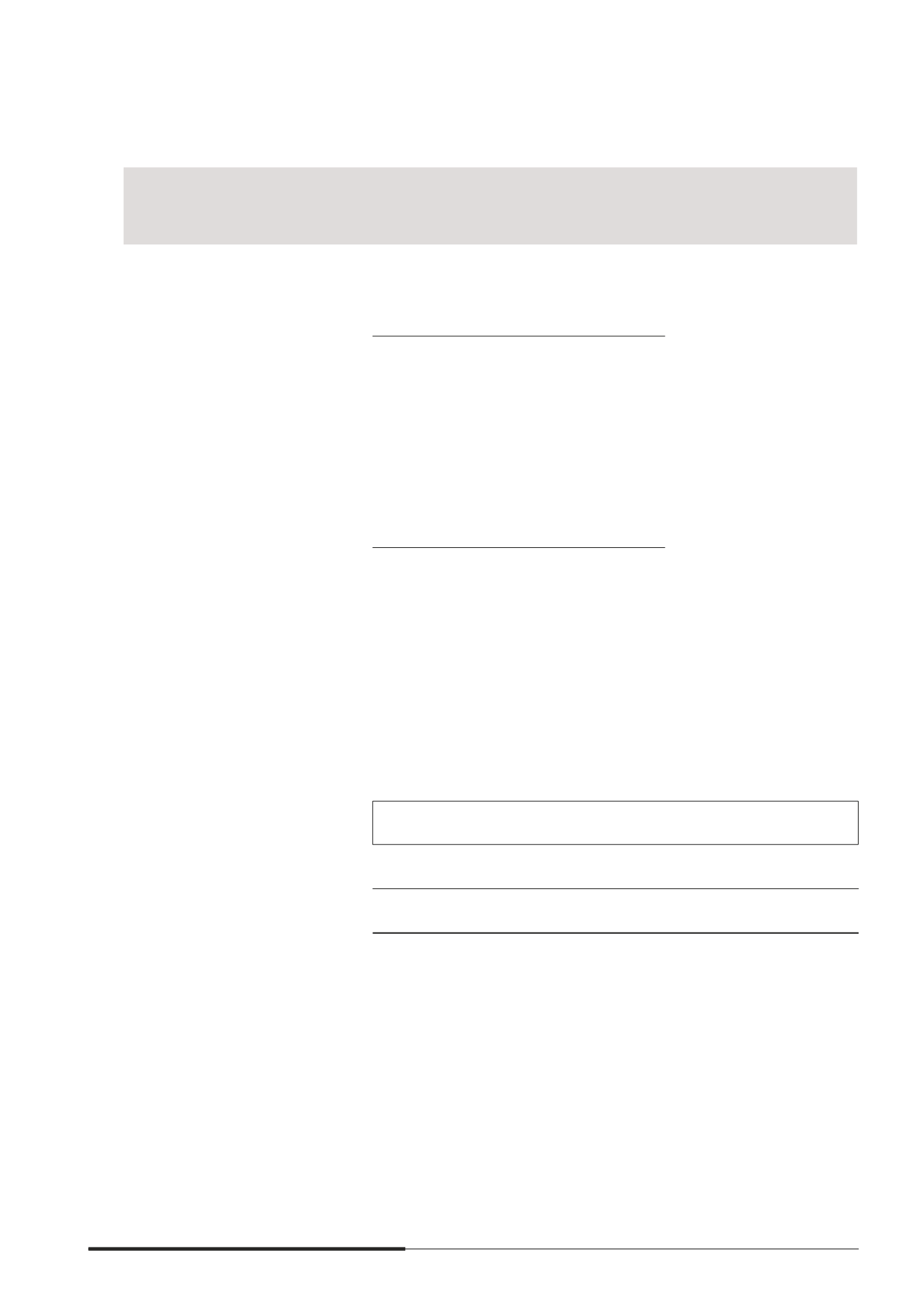

2

Includes cash and cash equivalents

6,447

57,135

39,910

3

Includes current mnancial liabilities

(excluding trade and other

payables and provisions)

–

(13,099)

–

4

Includes non-current mnancial liabilities

(excluding trade and other

payables and provisions)

(1,000,729)

(1,644,581)

–

Carrying amount of interest in

joint venture at beginning of

the year

1,107,984

714,990

490,825

Additions during the year

8,378

–

135,625

Group’s share of

- Promt/(Loss)

123,250

134,227

(6,254)

65,457

316,680

- Other comprehensive income

–

1,312

26,814

9,882

38,008

- Total comprehensive income

123,250

135,539

20,560

75,339

354,688

Dividends received during the year

(80,899)

(145,500)

–

Carrying amount of interest in

joint venture at end of the year

1,158,713

705,029

647,010

445,560

2,956,312

(e) The Group’s share of the capital commitments of the joint ventures is $578.8 million (2013 $655.1 million).

(f) The Group’s share of the contingent liabilities of the joint ventures is $15.7 million (2013 $19.5 million).