Positioning for the Future | 157

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

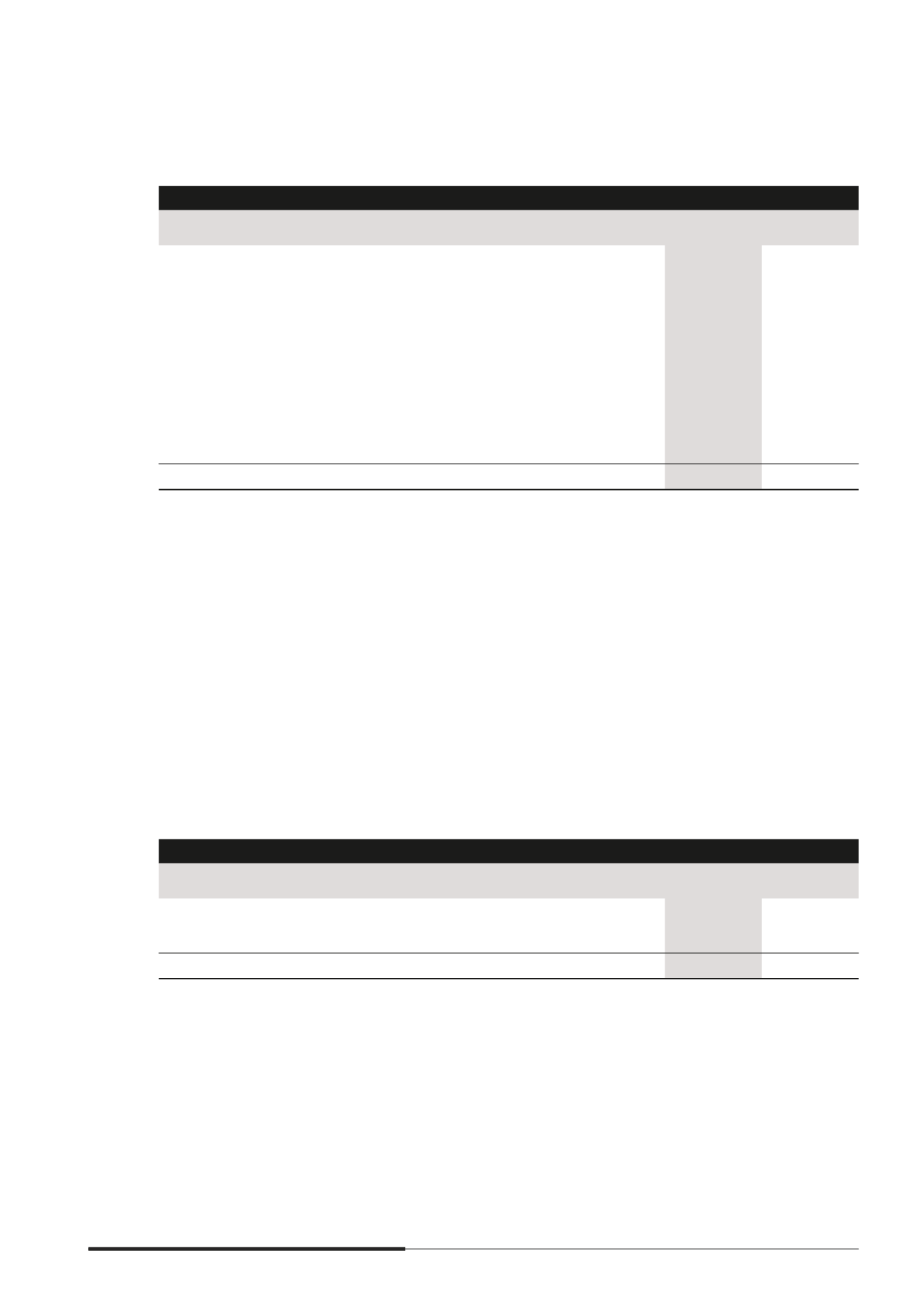

10 OTHER NON-CURRENT/CURRENT ASSETS

(a) Other non-current assets

The Group

Note

2014

$’000

2013

$’000

Restated

Available-for-sale equity securities

- at cost

13,931

13,931

- at fair value

193,606

213,626

Derivative assets

57,952

8,889

Amounts due from

- joint ventures

8(b)

365

365

- non-controlling interests

16,556

19,806

Interest receivables

(i)

74,688

70,427

Other receivables

(ii)

27,870

50,970

Deposits

(iii)

624,405

165,291

1,009,373

543,305

(i) Interest receivables include (i) $62.3 million (2013 $56.6 million) in respect of a loan to an associate

which bears an interest rate of 1.47% (2013 2.09%) per annum and is due by 31 December 2016; and

(ii) $12.4 million (2013 $13.8 million) in respect of a loan to a joint venture which bears an interest rate

of 0.98% (2013 0.95%) per annum and is not expected to be repaid within the next 12 months.

(ii) Other receivables as at 31 December 2014 included non-current consideration receivable of $21.2

million relating to the sale of a piece of land in Bahrain in 2014.

Other receivables as at 31 December 2013 included non-current consideration receivable of $45.4

million relating to the sale of a joint venture in 2011. The total consideration is receivable in four unequal

annual instalments commencing 2012. In 2014, the amount was reclassimed to current receivable in

accordance with its maturity date (note 14).

(iii) The amount as at 31 December 2014 and 2013 relates to deposits paid for land and development costs

of new acquisitions.

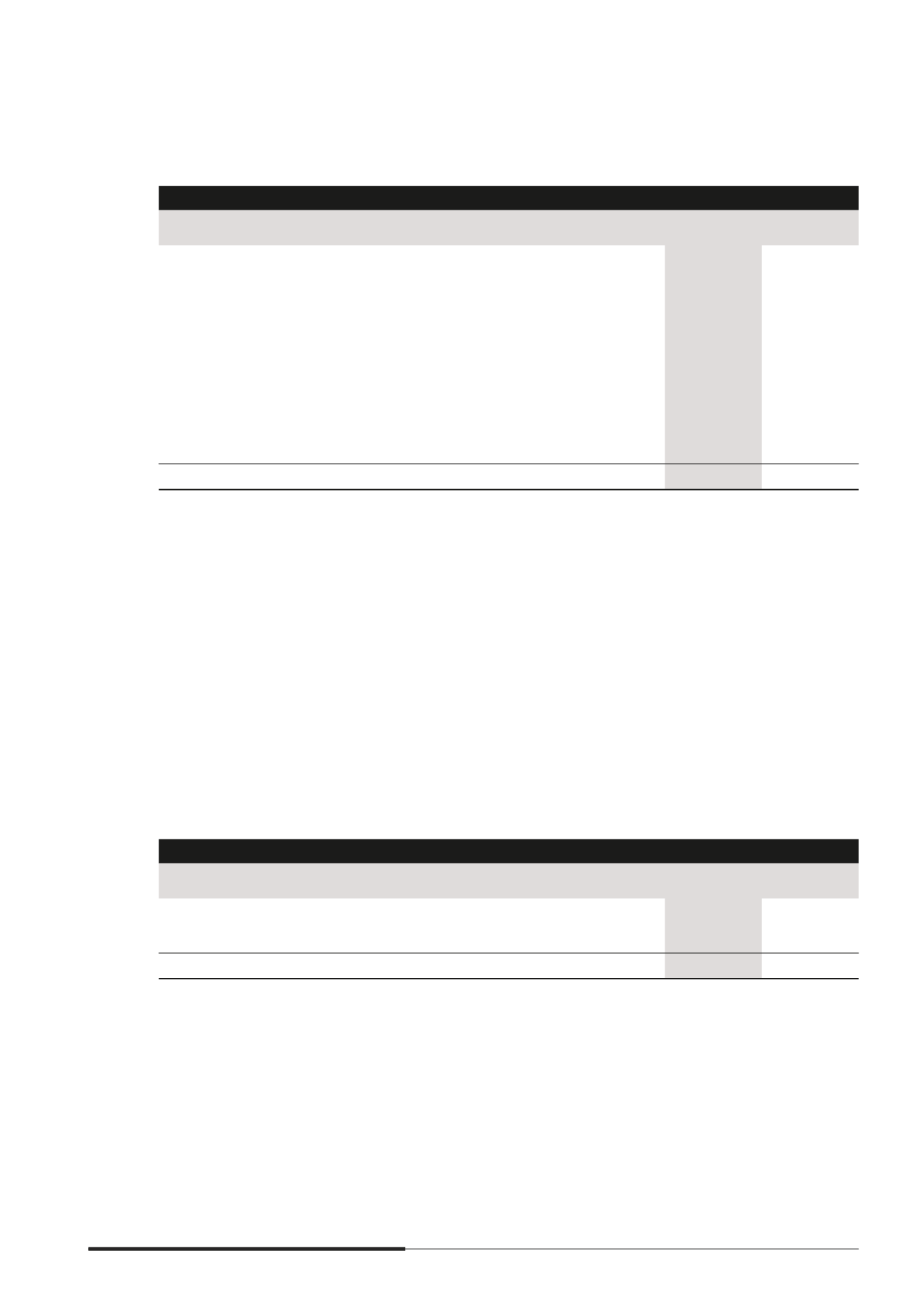

(b) Other current assets

The Group

2014

$’000

2013

$’000

Available-for-sale money market investment, at fair value

–

195,000

Derivative assets

2,309

1,923

2,309

196,923