166 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

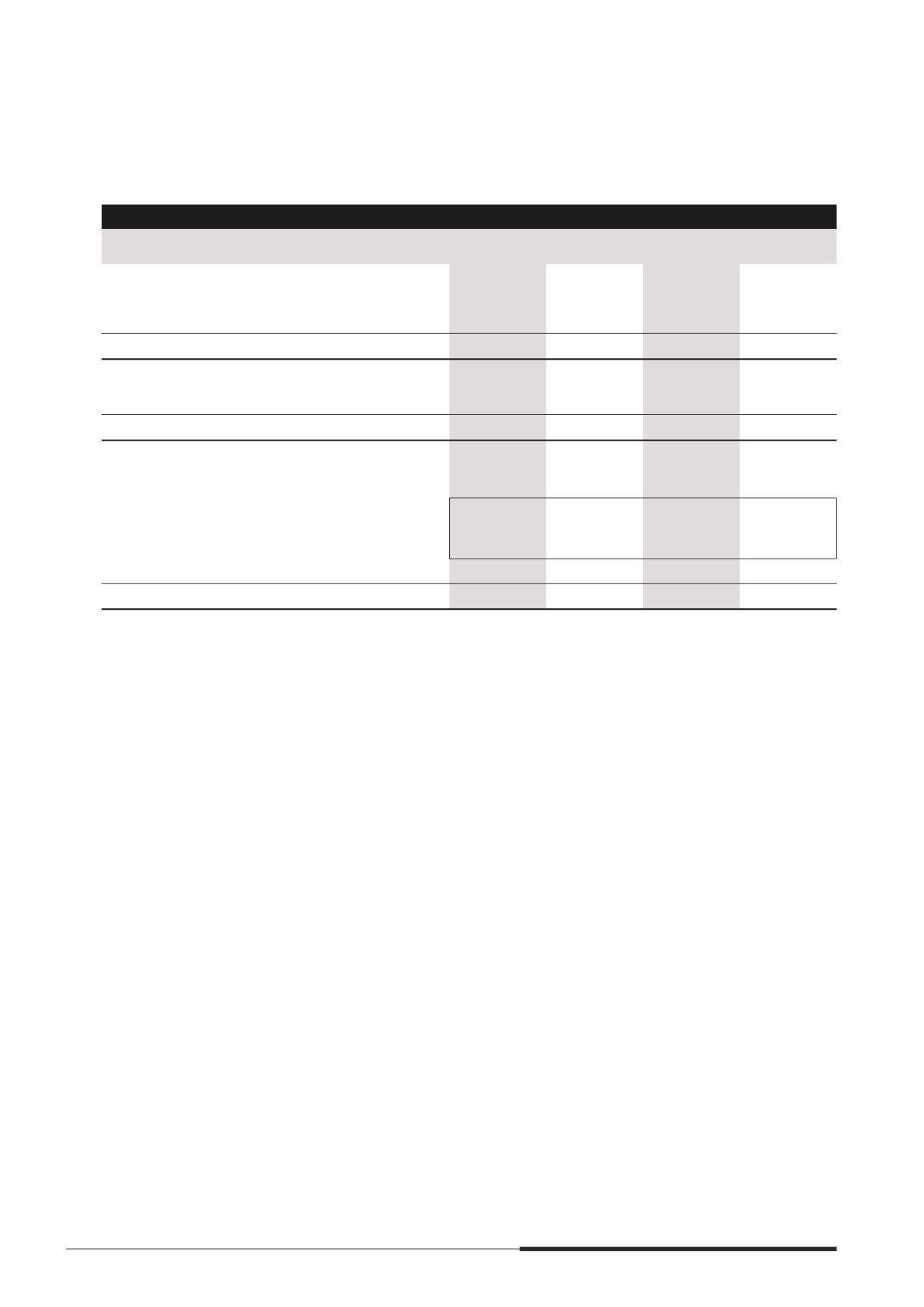

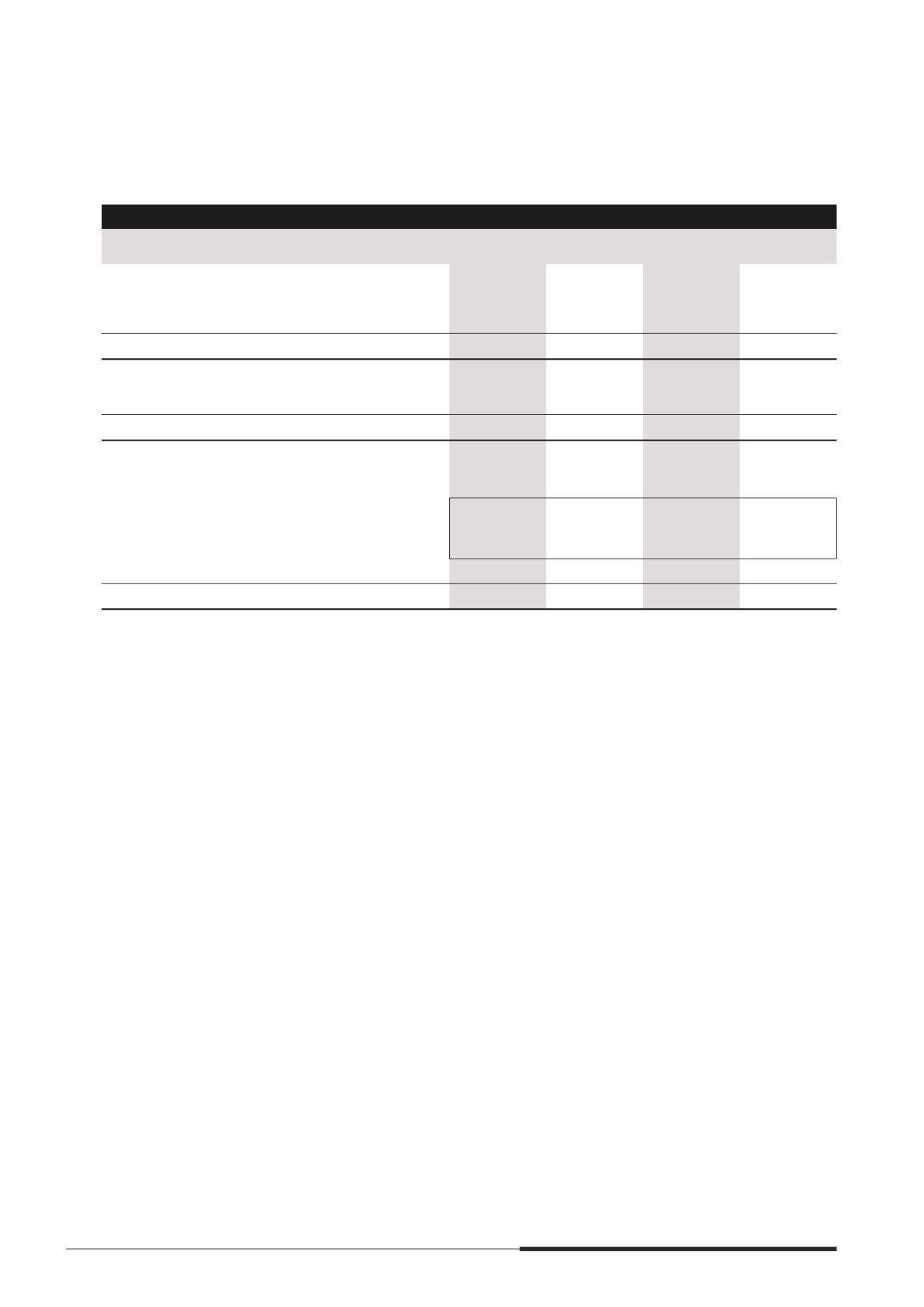

20 DEBT SECURITIES

Debt securities comprise medium term notes, mxed rate notes, noating rate notes and bonds issued by the

Company and subsidiaries in the Group.

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Convertible bonds

3,395,836

3,532,686

3,234,116

3,190,458

Notes and bonds

4,379,316

3,840,317

–

–

7,775,152

7,373,003

3,234,116

3,190,458

Secured notes and bonds

204,969

214,068

–

–

Unsecured notes and bonds

7,570,183

7,158,935

3,234,116

3,190,458

7,775,152

7,373,003

3,234,116

3,190,458

Repayable

Not later than 1 year

427,665

254,972

7,669

–

Between 1 and 2 years

941,682

701,684

630,048

–

Between 2 and 5 years

1,719,563

1,926,372

243,017

862,186

After 5 years

4,686,242

4,489,975

2,353,382

2,328,272

After 1 year

7,347,487

7,118,031

3,226,447

3,190,458

7,775,152

7,373,003

3,234,116

3,190,458

(a) The repayment schedule for convertible bonds was based on the mnal maturity dates.

(b) As at 31 December 2014, the effective interest rates for debt securities ranged from 0.51% to 4.60% (2013

0.52% to 5.15%) per annum.

(c) Details of the outstanding convertible bonds as at 31 December 2014 are as follows

(i) $184.3 million (2013 $184.3 million) principal amount of convertible bonds of the Company due on

15 November 2016 with interest rate at 2.10% per annum (2.10% bonds). These bonds are convertible

into new ordinary shares at the conversion price of $6.01 per share on or after 26 December 2006 and

may be redeemed at the option of the Company on specimed dates.

(ii) $1.0 billion principal amount of convertible bonds of the Company due on 20 June 2022 with interest

rate at 2.95% per annum. These bonds are convertible into new ordinary shares at the conversion price

of $11.5218 per share on or after 20 June 2008 and may be redeemed at the option of the Company

or at the option of the bond holders on specimed dates.

(iii) $235.3 million (2013 $235.3 million) principal amount of convertible bonds of the Company due on

5 March 2018 with interest rate at 3.125% per annum (3.125% bonds). These bonds are convertible

into new ordinary shares at the conversion price of $7.1468 per share on or after 15 April 2008 and

may be redeemed at the option of the Company or at the option of the bond holders on specimed

dates. The redemption price upon maturity is 109.998% of the principal amount. $7.8 million will be

redeemed by the bond holders on 5 March 2015. The redemption price on 5 March 2015 is 106.578%

of the principal amount.

(iv) $467.0 million (2013 $467.0 million) principal amount of convertible bonds of the Company due on

3 September 2016 with interest rate at 2.875% per annum (2.875% bonds). These bonds are convertible

into new ordinary shares at the conversion price of $4.6619 (2013 $4.6836) per share on or after

14 October 2009 and may be redeemed at the option of the Company or at the option of the bond

holders on specimed dates.