170 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

22 EMPLOYEE BENEFITS

(cont’d)

E (TXLW\ FRPSHQVDWLRQ EHQHÀWV

(cont’d)

CapitaLand Share Option Plan

(cont’d)

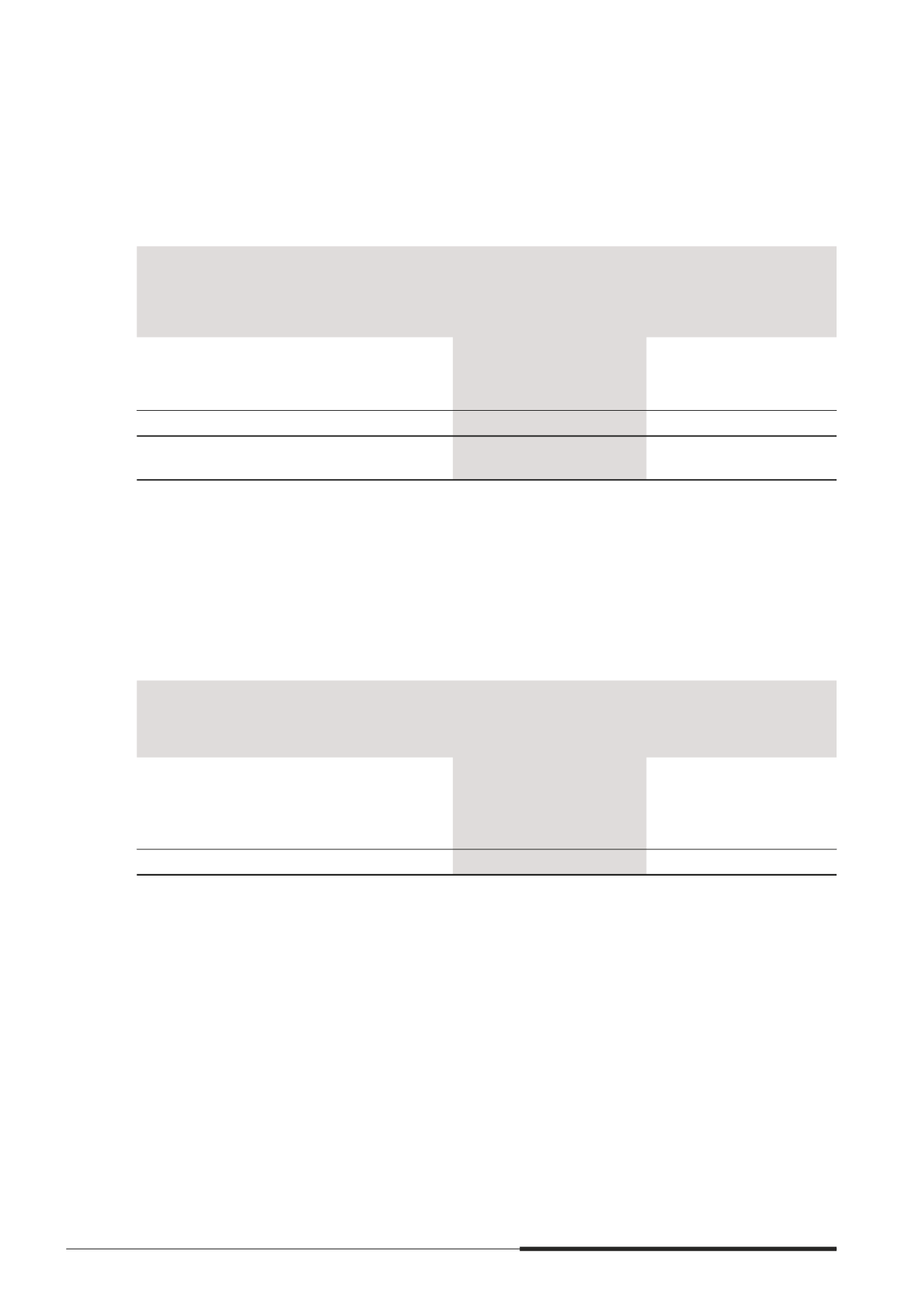

Movements in the number of outstanding options and their related weighted average exercise prices are

as follows

Weighted

average

exercise

price

2014

$

No. of

options

2014

(‘000)

Weighted

average

exercise

price

2013

$

No. of

options

2013

(‘000)

At 1 January

2.99

7,168

2.87

8,107

Exercised

1.68

(824)

1.88

(872)

Lapsed/Cancelled

3.44

(548)

3.49

(67)

At 31 December

3.13

5,796

2.99

7,168

Exercisable on 31 December

3.13

5,796

2.99

7,168

Options exercised in 2014 resulted in 824,178 (2013 871,704) shares being issued at a weighted average

market price of $2.97 (2013 $3.54) each. Options were exercised on a regular basis throughout the year.

The weighted average share price during the year was $3.11 (2013 $3.36).

The fair value of services received in return for options granted is measured by reference to the fair value of

options granted. The fair value of the options granted is measured based on Enhanced Trinomial (Hull and

White) valuation model.

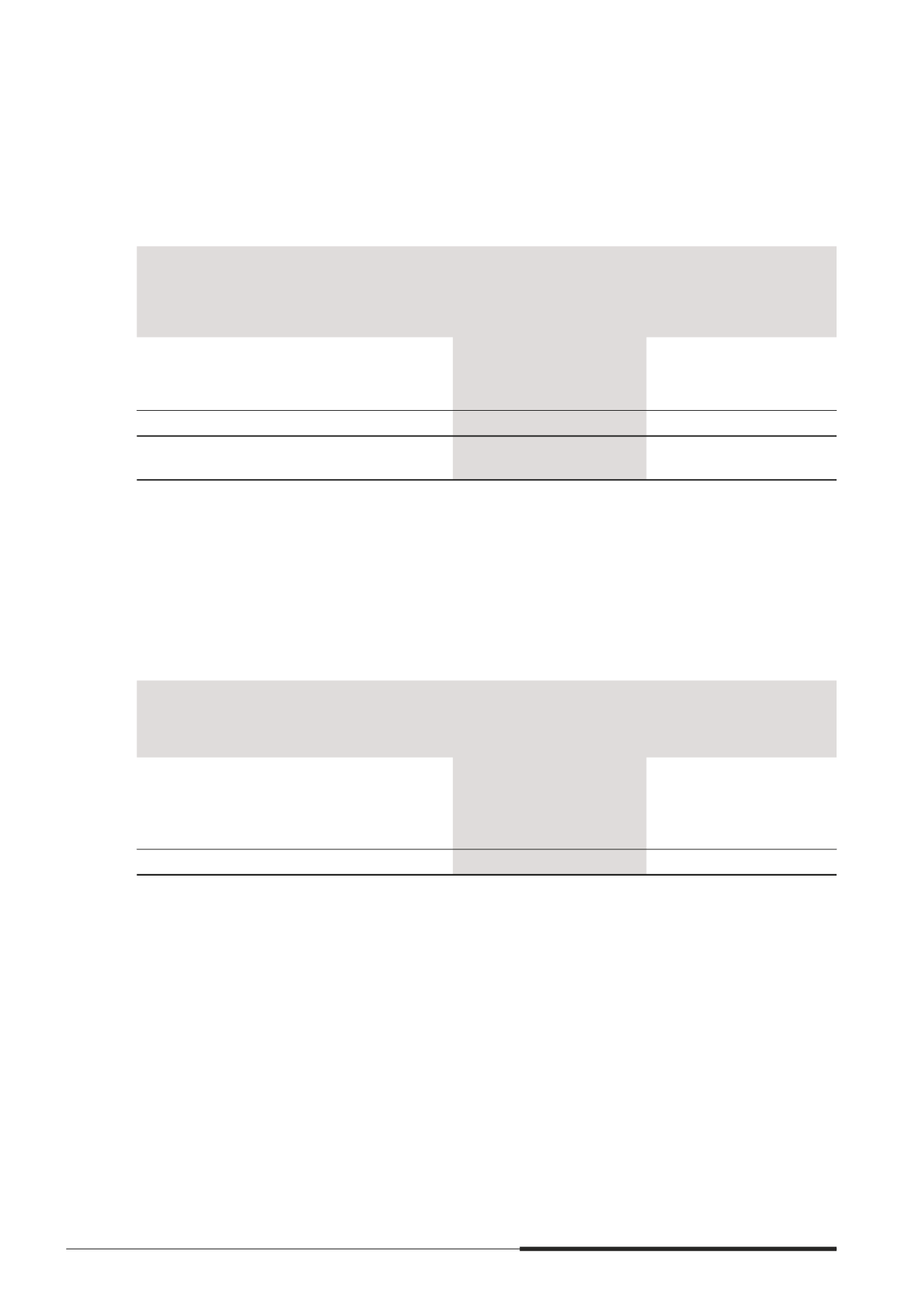

Options outstanding at the end of the year are summarised below

Range of Exercise Price

Options

outstanding

2014

(‘000)

Weighted

average

contractual

life

(years)

Options

outstanding

2013

(‘000)

Weighted

average

contractual

life

(years)

$0.45 to $0.50

–

–

137

0.16

$0.51 to $1.43

–

–

15

0.65

$1.44 to $2.16

507

0.21

1,095

1.19

$2.17 to $4.10

5,289

1.20

5,921

2.21

5,796

7,168