Positioning for the Future | 155

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

9

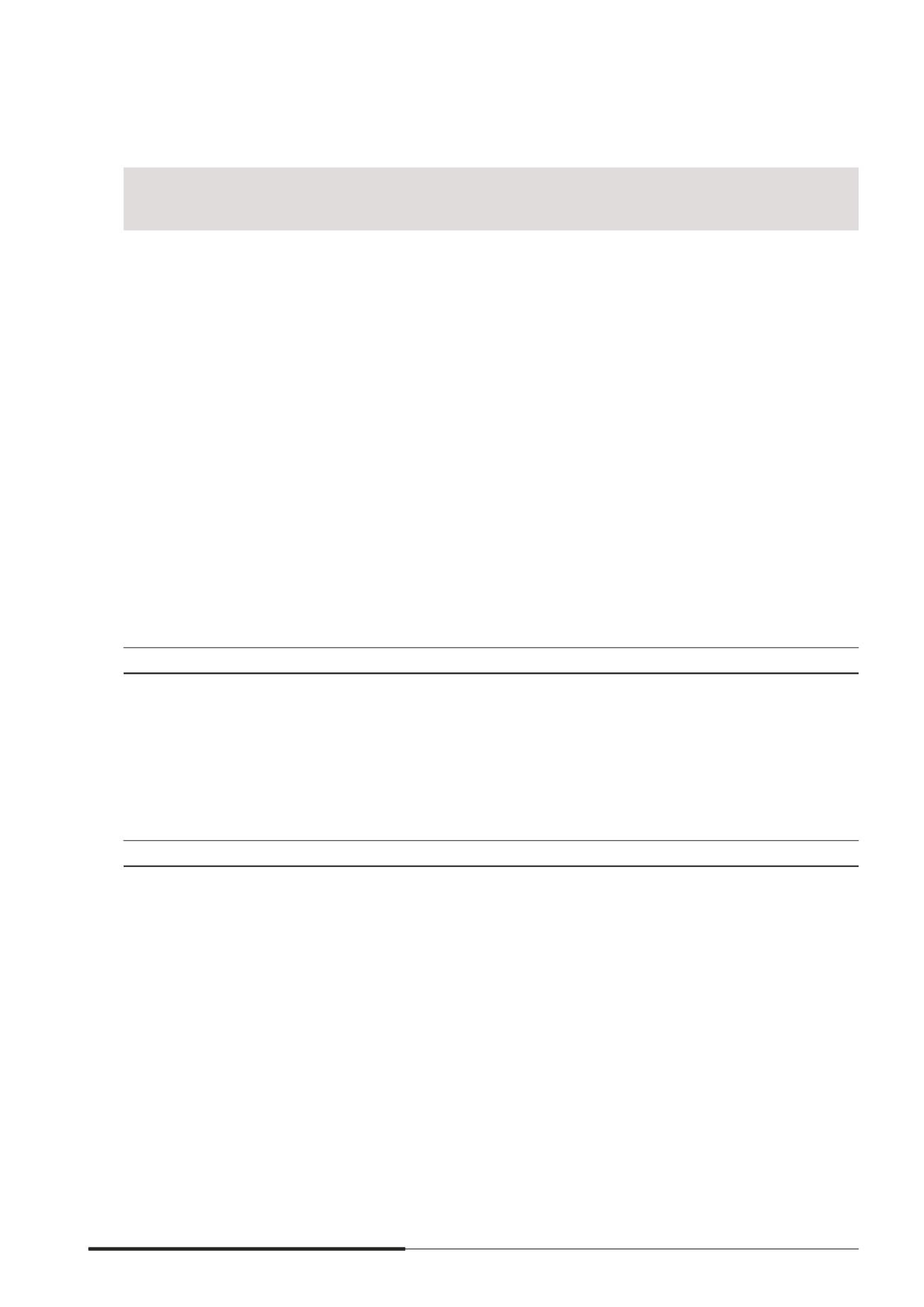

DEFERRED TAX

(cont’d)

At 1/1/2013

as restated

$’000

Recognised

LQ SURÀW

or loss

$’000

Recognised

in equity

$’000

Acquisition/

Disposal of

subsidiaries

$’000

Translation

differences

$’000

At

31/12/2013

as restated

$’000

The Group

Deferred tax liabilities

Accelerated tax depreciation

28,405

1,988

–

–

2,501

32,894

Discounts on compound

mnancial instruments

33,558

(22,783)

16,288

–

–

27,063

Accrued income and

interest receivable

17,908

6,042

–

142

38

24,130

Capital allowances of assets

in investment properties

2,175

(2,175)

–

–

–

–

Promts recognised on

percentage of completion

and fair value adjustments

on initial recognition of

development properties

for sale

437,820

(91,679)

–

(31,898)

16,147

330,390

Fair value adjustments arising

from a business combination

18,975

–

–

–

950

19,925

Fair value changes of

investment properties

188,874

51,923

–

(24,273)

8,979

225,503

Unremitted earnings

46,665

(9,790)

–

(18,266)

(2,648)

15,961

Others

30,282

57,914

–

(69,933)

(3,260)

15,003

Total

804,662

(8,560)

16,288

(144,228)

22,707

690,869

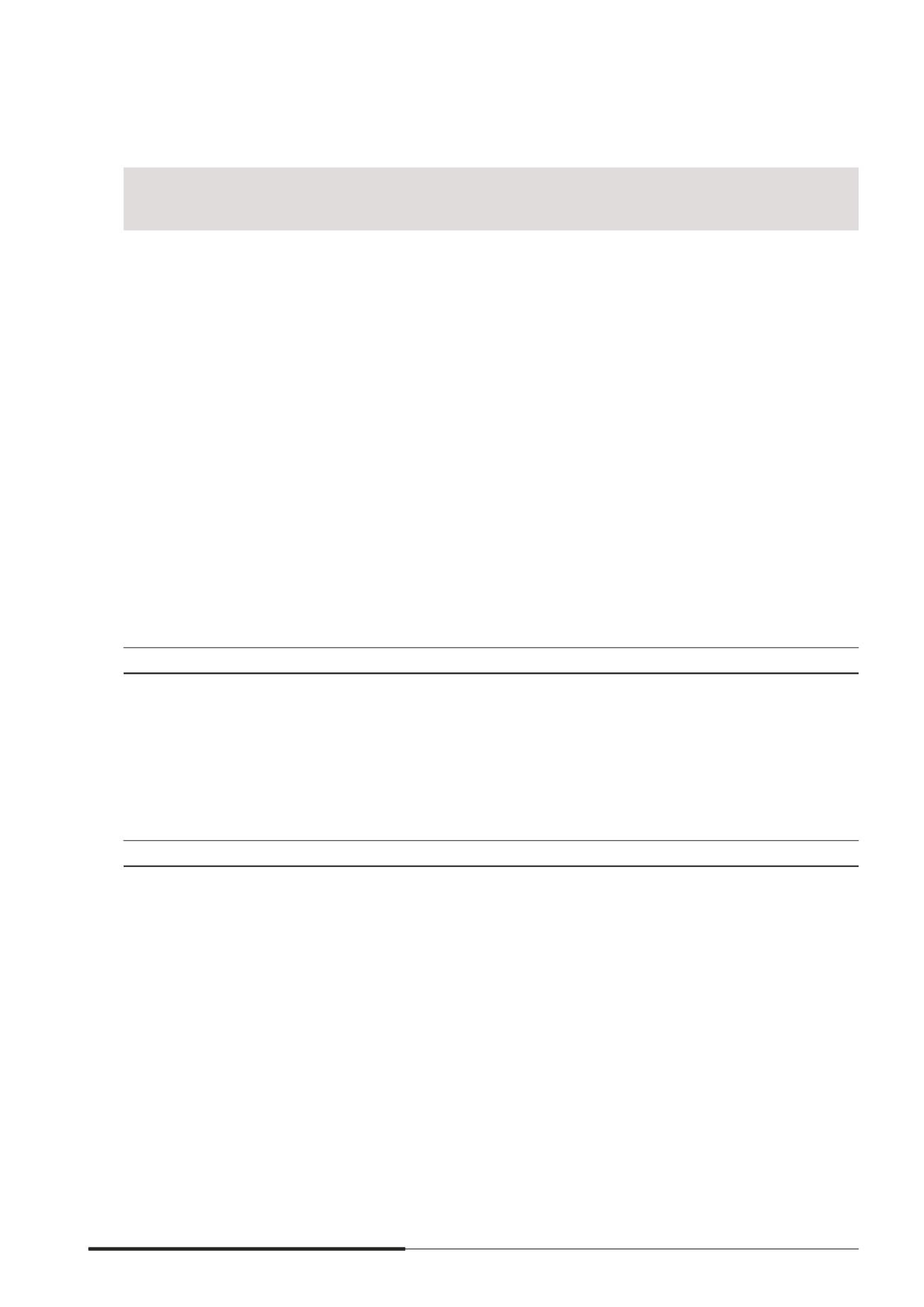

Deferred tax assets

Unutilised tax losses

(67,693)

(49,121)

–

99,829

5,957

(11,028)

Provisions and expenses

(55,857)

(25,331)

–

37,151

2,769

(41,268)

Deferred income

(20,507)

5,058

–

14,014

1,435

–

Fair value adjustments on initial

recognition of development

properties for sale

(23,085)

9,713

–

–

(1,117)

(14,489)

Others

(25,610)

(3,550)

–

6,151

765

(22,244)

Total

(192,752)

(63,231)

–

157,145

9,809

(89,029)