Positioning for the Future | 165

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

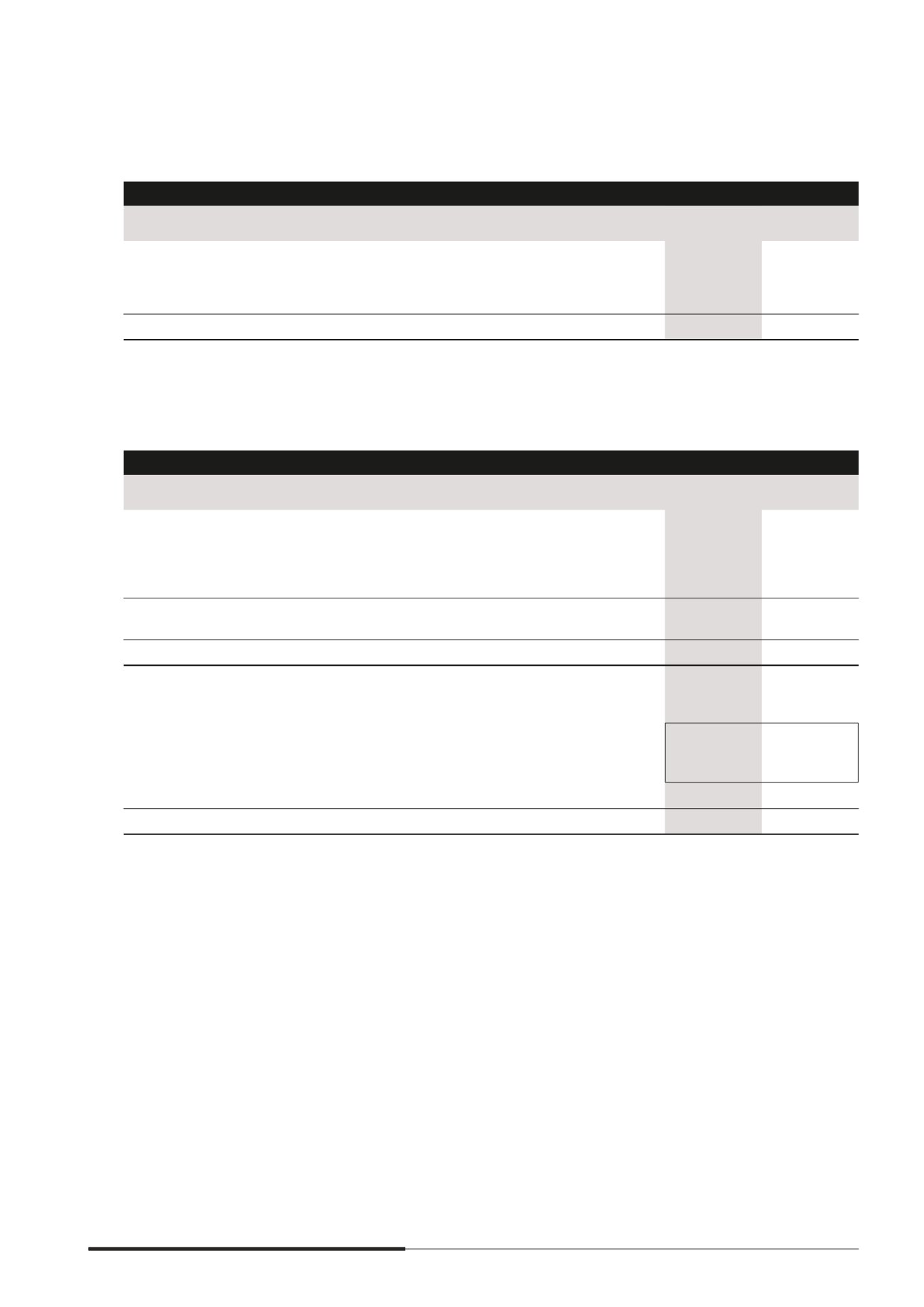

18 AMOUNTS DUE FROM/(TO) SUBSIDIARIES

(cont’d)

Movements in allowance for doubtful receivables were as follows

The Company

2014

$’000

2013

$’000

At 1 January

(29,119)

(29,375)

Allowance during the year

(6,407)

(365)

Reversal of allowance during the year

–

621

At 31 December

(35,526)

(29,119)

All balances with subsidiaries are unsecured and repayable on demand. The interest-bearing loan due from a

subsidiary bore effective interest rate at 0.08% per annum.

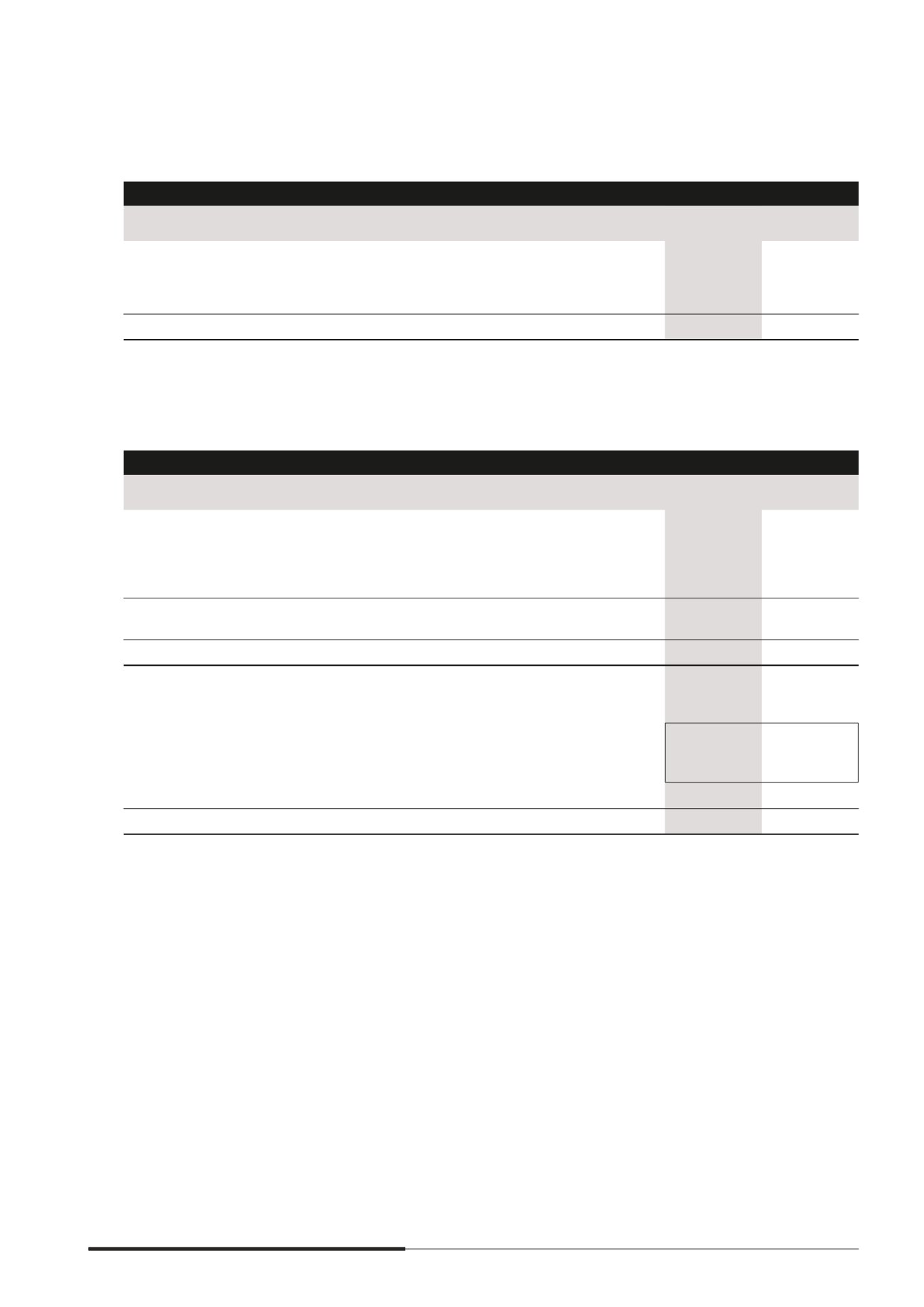

19 BANK BORROWINGS

The Group

2014

$’000

2013

$’000

Restated

Bank borrowings

- secured

5,630,733

5,109,090

- unsecured

2,567,019

3,436,703

8,197,752

8,545,793

Finance lease (secured)

12,914

17,367

8,210,666

8,563,160

Repayable

Not later than 1 year

3,041,494

1,024,912

Between 1 and 2 years

1,232,872

1,922,099

Between 2 and 5 years

3,115,917

4,989,401

After 5 years

820,383

626,748

After 1 year

5,169,172

7,538,248

8,210,666

8,563,160

(a) The Group’s borrowings are denominated mainly in Singapore Dollars, US Dollars, Australian Dollars, Chinese

Renminbi and Japanese Yen. As at 31 December 2014, the effective interest rates for bank borrowings ranged

from 0.51% to 12.50% (2013 0.38% to 12.30%) per annum.

(b) Bank borrowings are secured by the following assets, details of which are disclosed in the respective notes

to the mnancial statements

(i) mortgages on the borrowing subsidiaries’ property, plant and equipment, investment properties,

development properties for sale and serviced residences and shares of certain subsidiaries of the

Group; and

(ii) assignment of all rights, titles and benemts with respect to the properties mortgaged.