Positioning for the Future | 169

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

22 EMPLOYEE BENEFITS

(cont’d)

E (TXLW\ FRPSHQVDWLRQ EHQHÀWV

(cont’d)

Share Plans of the Company

(cont’d)

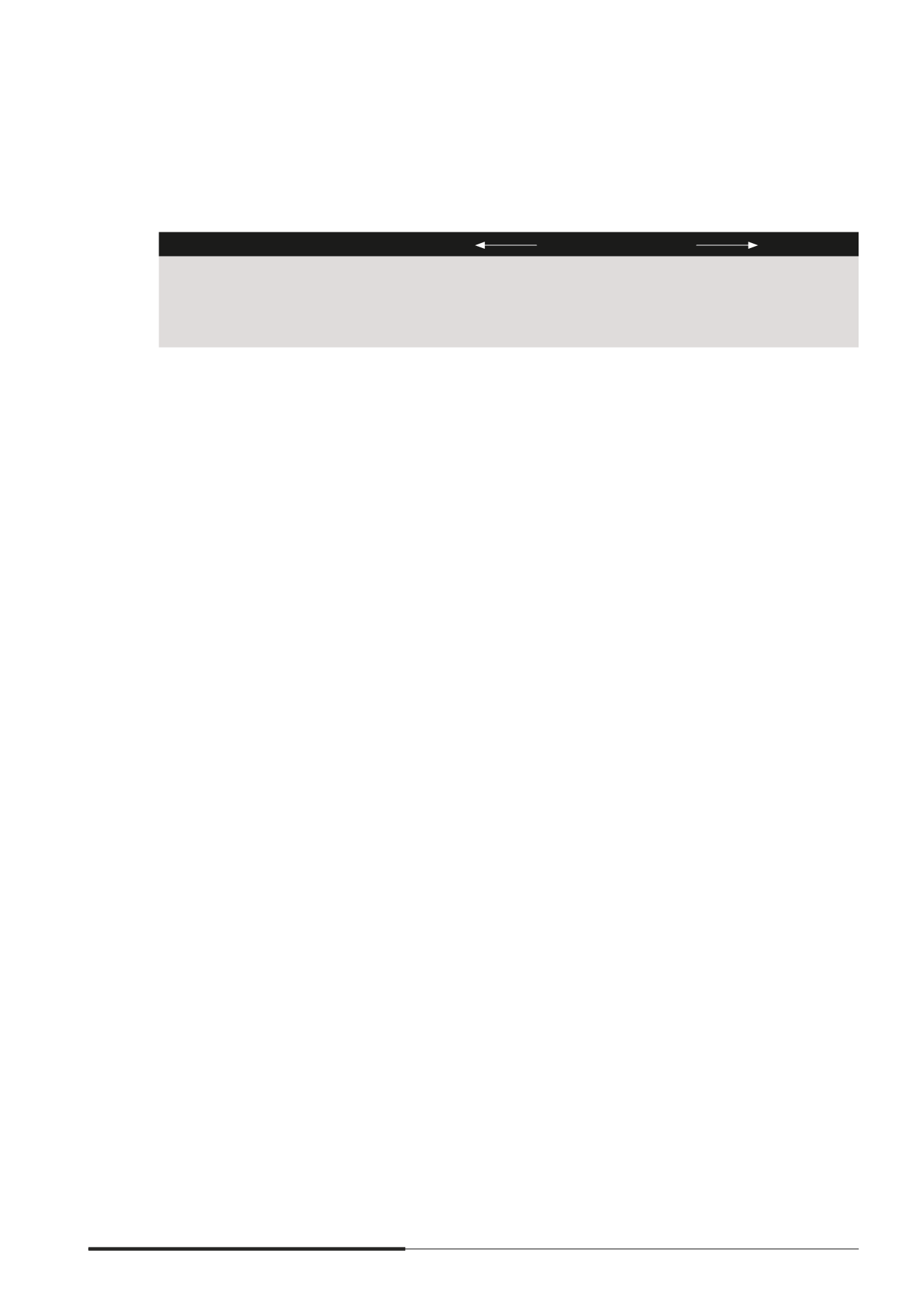

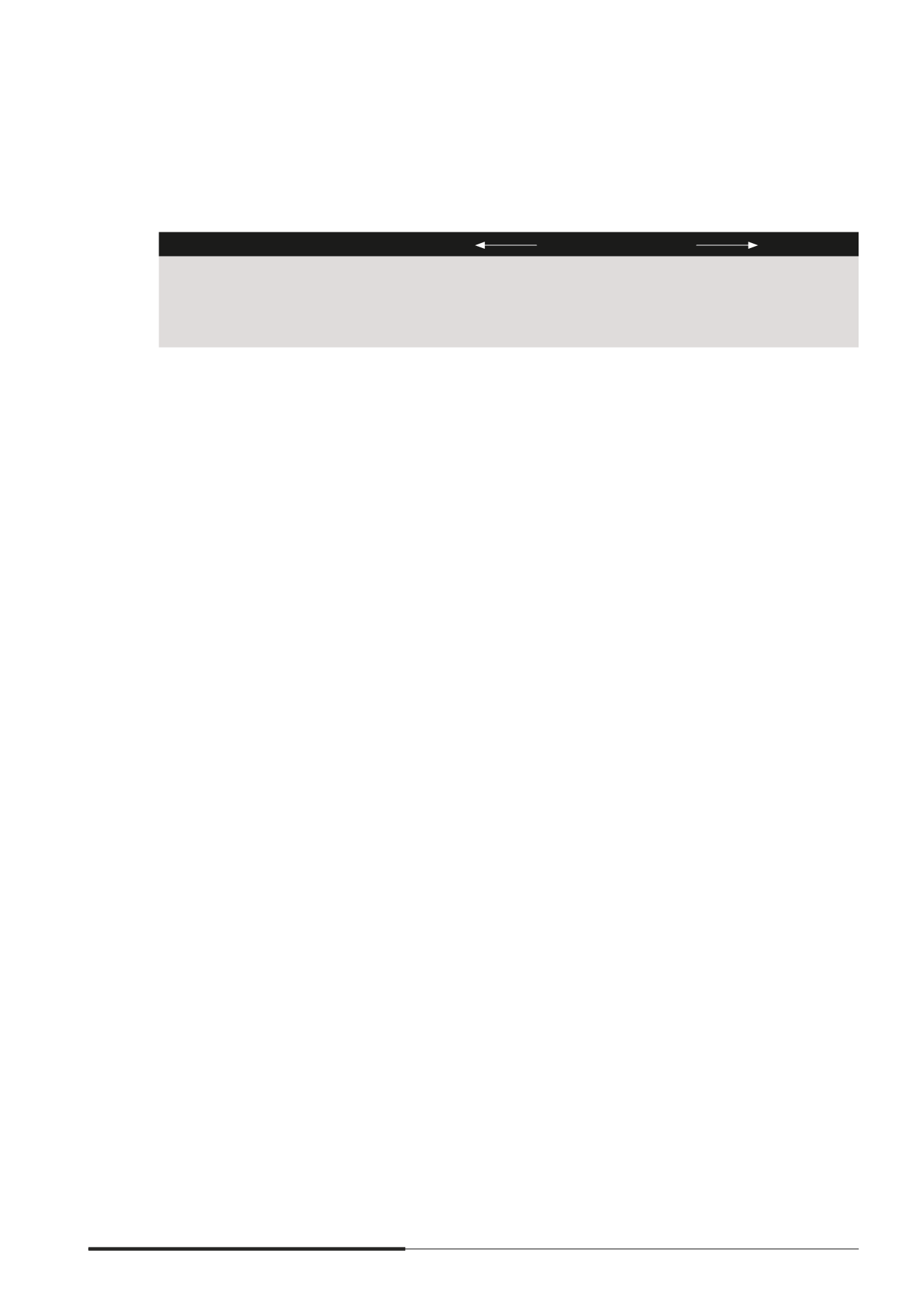

The details of options and awards in the Company since commencement of the Share Plans were as follows

Aggregate Options/Shares

Granted

No. of

options/

shares

Exercised/

Released

No. of

options/

shares

Lapsed/

Cancelled

No. of

options/

shares

Balance as of

31 December

2014

No. of

options/

shares

CapitaLand Share Option Plan

159,442,307 (117,310,594) (36,335,356)

5,796,357

CapitaLand Performance Share Plan 2000

34,594,651 (17,393,355) (17,201,296)

–

CapitaLand Restricted Stock Plan 2000

33,689,553 (27,125,079) (6,564,474)

–

CapitaLand Performance Share Plan 2010

16,054,266

–

(5,420,302) 10,633,964

CapitaLand Restricted Share Plan 2010

35,867,383 (12,341,271) (6,302,614) 17,223,498

The total number of new shares issued and/or to be issued pursuant to the 2010 Share Plans did not exceed

8% (2013 8%) of the total number of shares (excluding treasury shares) in the capital of the Company.

CapitaLand Share Option Plan

The Company ceased to grant options under the CapitaLand Share Option Plan with effect from 2007.

Statutory information regarding the CapitaLand Share Option Plan is set out below

(i) The exercise price of the options is set either at

-

A price equal to the volume-weighted average price on the SGX-ST over the three consecutive

trading days immediately preceding the grant of the option (Market Price), or such higher price

as may be determined by the ERCC in its absolute discretion; or

-

A discount not exceeding 20% of the Market Price in respect of that option.

(ii) The options vest between one year and four years from the grant date.

(iii) The options granted expire after mve or 10 years from the dates of the grant.