156 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

9

DEFERRED TAX

(cont’d)

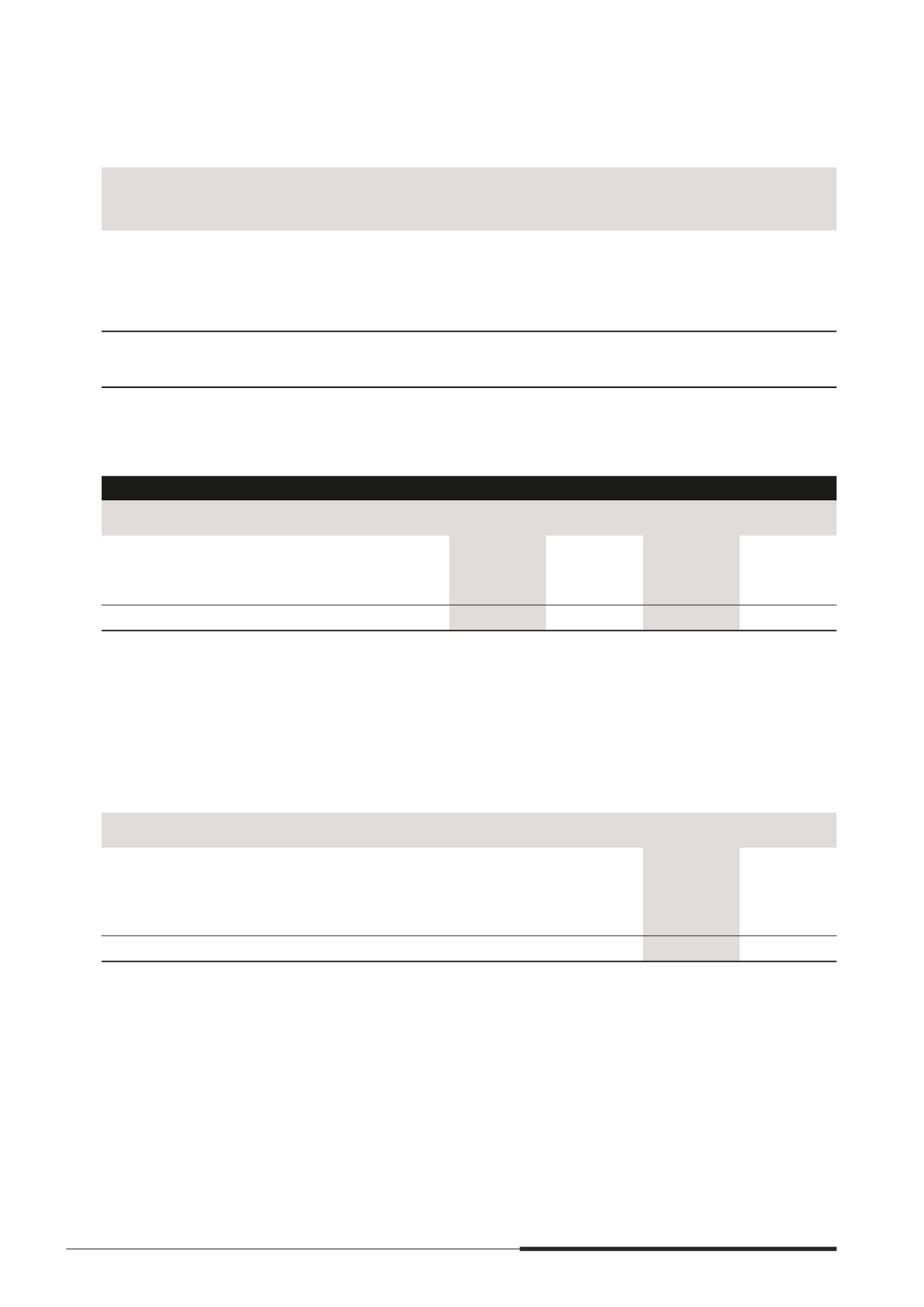

At 1/1/2013

$’000

Recognised

LQ SURÀW

or loss

$’000

Recognised

in equity

$’000

At

31/12/2013

$’000

Recognised

LQ SURÀW

or loss

$’000

At

31/12/2014

$’000

The Company

Deferred tax liabilities

Discounts on compound

mnancial instruments

33,558

(22,783)

16,288

27,063

(6,946)

20,117

Deferred tax assets

Provisions

(2,589)

1,094

–

(1,495)

125

(1,370)

Deferred tax liabilities and assets are offset when there is a legally enforceable right to set off current tax assets

against current tax liabilities and when the deferred taxes relate to the same taxation authority. The following

amounts, determined after appropriate offsetting, are shown on the balance sheets

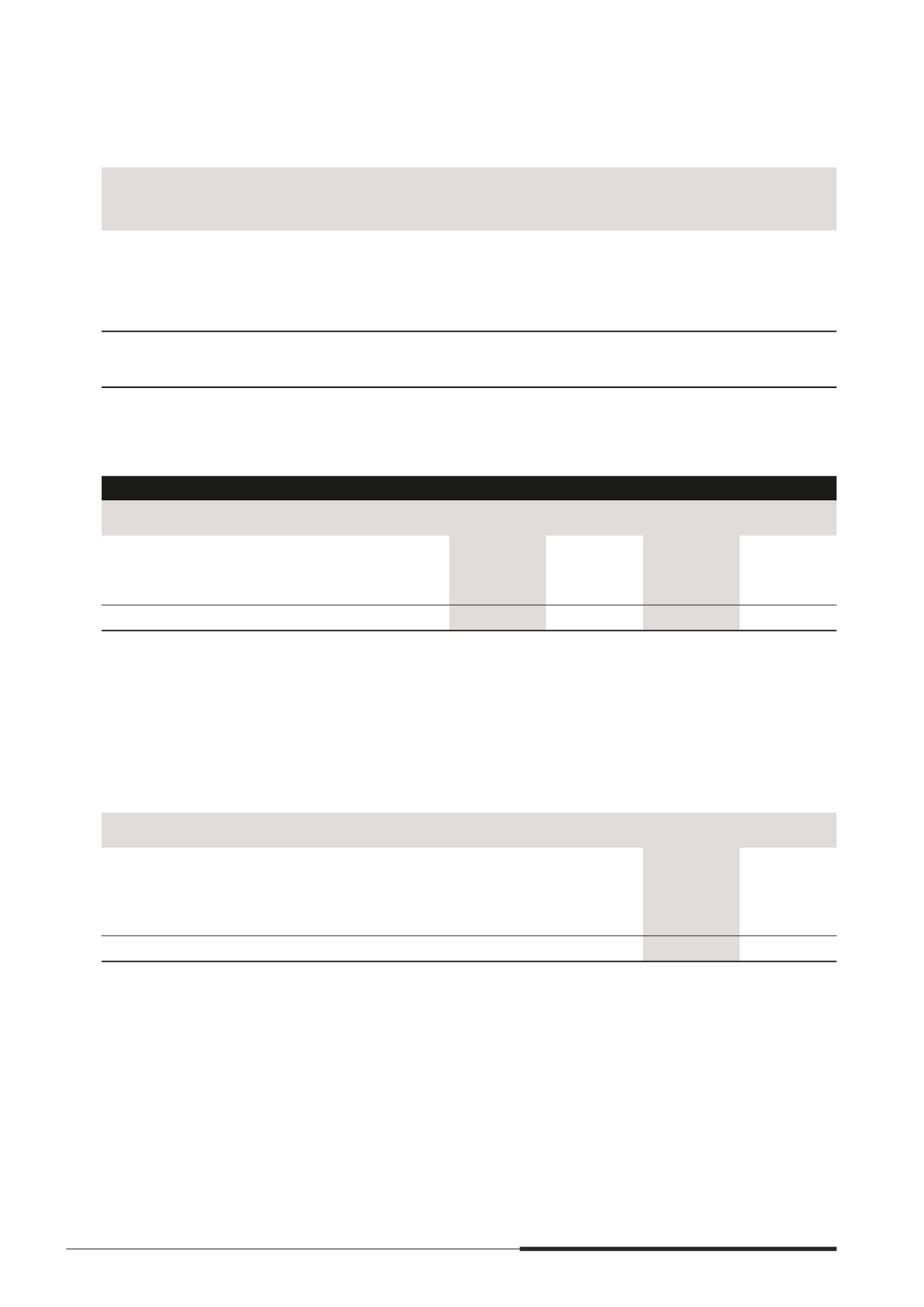

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Deferred tax liabilities

730,993

678,989

20,117

27,063

Deferred tax assets

(83,526)

(77,149)

(1,370)

(1,495)

647,467

601,840

18,747

25,568

As at 31 December 2014, deferred tax liabilities amounting to $9.7 million (2013 $7.9 million) had not been

recognised for taxes that would be payable on the undistributed earnings of certain subsidiaries and joint ventures

as these earnings would not be distributed in the foreseeable future.

A deferred tax asset is recognised to the extent that it is probable that future taxable promts will be available against

which temporary differences can be utilised. Deferred tax assets are reviewed at each reporting date and are

reduced to the extent that it is no longer probable that the related tax benemt will be realised. The Group has not

recognised deferred tax assets in respect of the following

2014

$’000

2013

$’000

Restated

Deductible temporary differences

194,069

113,181

Tax losses

522,165

429,894

Unutilised capital allowances

4,507

4,211

720,741

547,286

Deferred tax assets have not been recognised in respect of these items because it is not probable that future taxable

promts will be available against which the subsidiaries of the Group can utilise the benemts. The tax losses are

subject to agreement by the tax authorities and compliance with tax regulations in the respective countries in which

the subsidiaries operate. Tax losses arising in certain foreign tax jurisdictions have the expiry dates ranging from

5 to 9 years (2013 5 to 9 years). The deductible temporary differences do not expire under current tax legislation.