186 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

31 NOTES TO THE CONSOLIDATED STATEMENT OF CASH FLOWS

(cont’d)

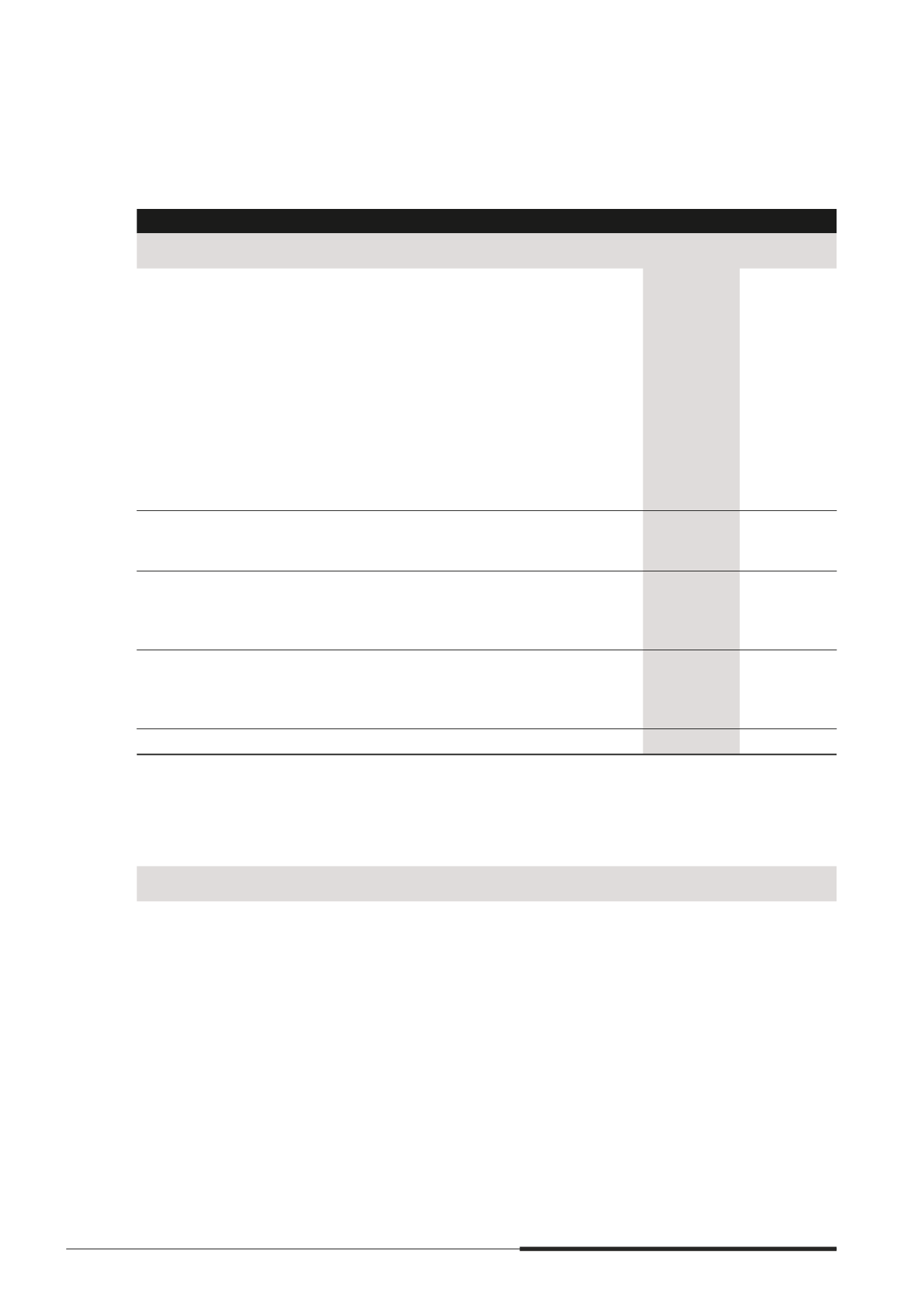

(b) Effects of acquisitions

The cash nows and net assets of subsidiaries acquired are provided below

Recognised values

Note

2014

$’000

2013

$’000

Restated

The Group

Property, plant and equipment

95,154

7,010

Investment properties

5

363,514

746,708

Development properties for sale

306,509

251,565

Cash and cash equivalents

38,731

13,183

Other current assets

3,183

2,109

Current liabilities

(59,590)

(89,056)

Long-term bank borrowings

(34,950)

(41,055)

Shareholder’s loans

(115,116)

(83,344)

Deferred tax liabilities

(813)

(1,143)

Non-controlling interests

(183,116)

(173,550)

413,506

632,427

Amounts previously accounted for as associates,

joint ventures and other mnancial assets, at fair value

(22,176)

(36,303)

Net assets acquired

391,330

596,124

Goodwill arising from acquisition

4

–

13,214

Gain from bargain purchase

(12,790)

–

Assumption of shareholder’s loans

115,116

83,344

Total purchase consideration

493,656

692,682

Less

Deferred payment and other adjustments

(87,986)

–

Cash of subsidiaries acquired

(38,731)

(13,183)

Cash outnow on acquisition of subsidiaries

366,939

679,499

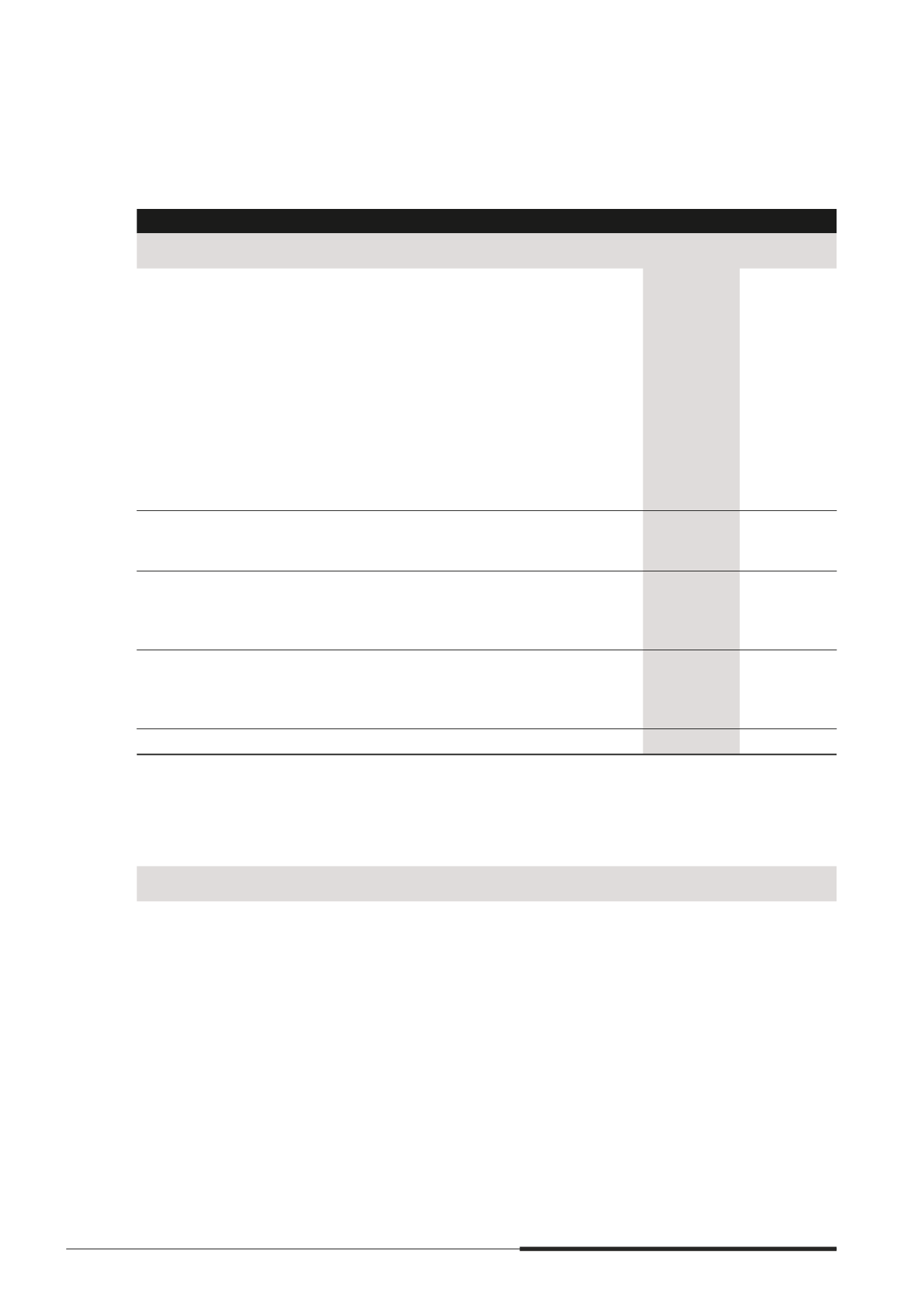

(c) Disposal of subsidiaries

There was no disposal of signimcant subsidiaries in 2014.

The list of signimcant subsidiaries disposed in 2013 is as follows

Name of subsidiary

Date disposed

Effective

interest disposed

Beijing CapitaLand Xin Ming Real Estate Development Co., Ltd.

March 2013

100%

Radiant I Pte. Ltd.

#

April 2013

65%

Crystal II Pte. Ltd.

#

April 2013

65%

Abbey Road Limited

#

July 2013

45%

Australand*

November 2013

20%

#

These subsidiaries were sold to CapitaMalls China Development Fund III, an associate, in which the Group has an effective

interest of 32.7% as at 31 December 2013.

* The Group retained an effective interest of 39.1% in Australand as at 31 December 2013. In March 2014, the Group completed

the sale of its remaining 39.1% interest in Australand.

For the year 2013, the disposed subsidiaries previously contributed net promt of $64.9 million from 1 January

2013 to the respective dates of disposal.