176 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

23 SHARE CAPITAL

(cont’d)

Capital Management

The Group’s policy is to build a strong capital base so as to maintain investor, creditor and market conmdence and

to sustain future development of the business. The Group monitors the return on capital, which the Group demnes as

total shareholders’ equity, excluding non-controlling interests, and the level of dividends to ordinary shareholders.

The Group also monitors capital using a net debt equity ratio, which is demned as net borrowings divided by total

equity (including non-controlling interests).

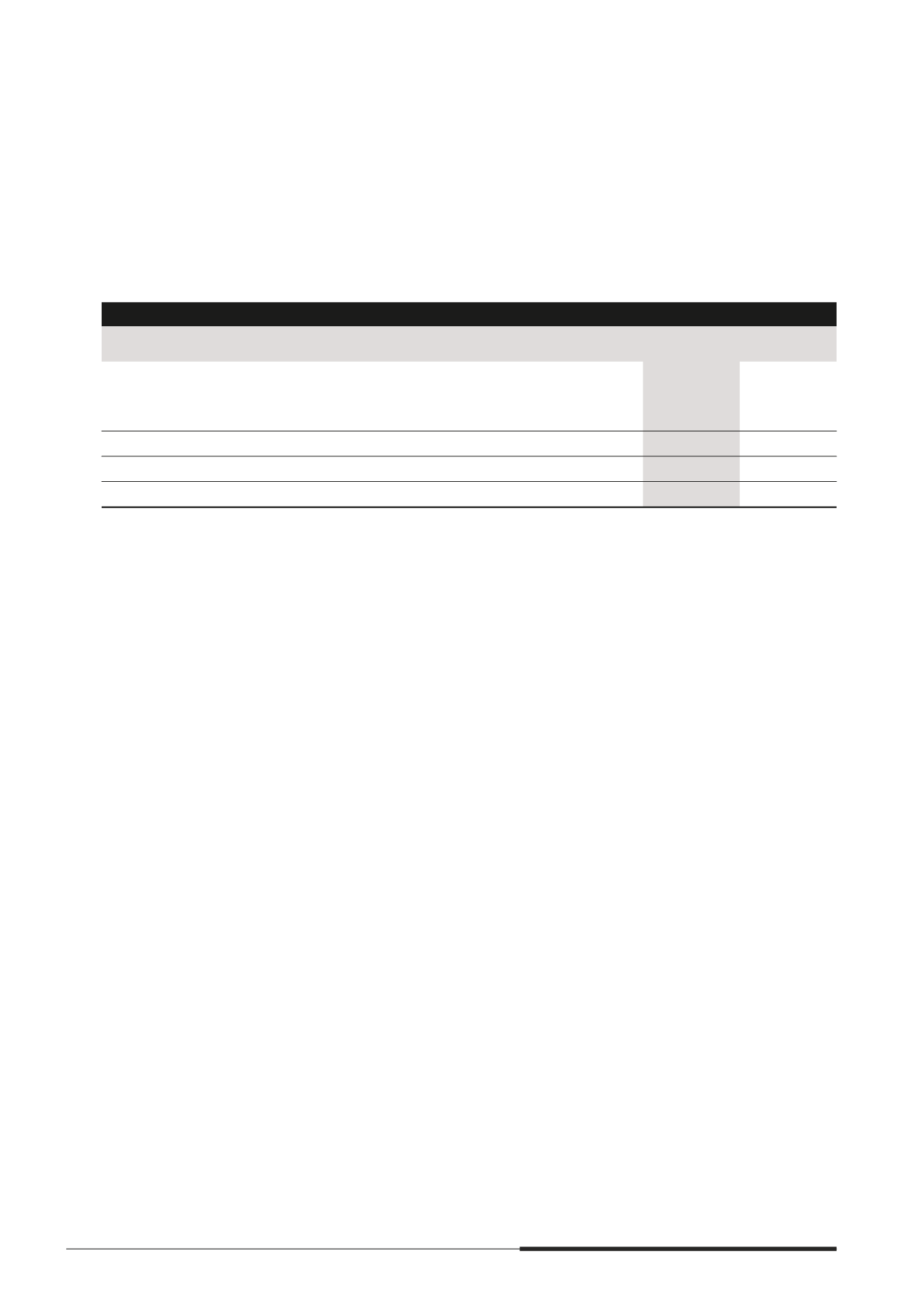

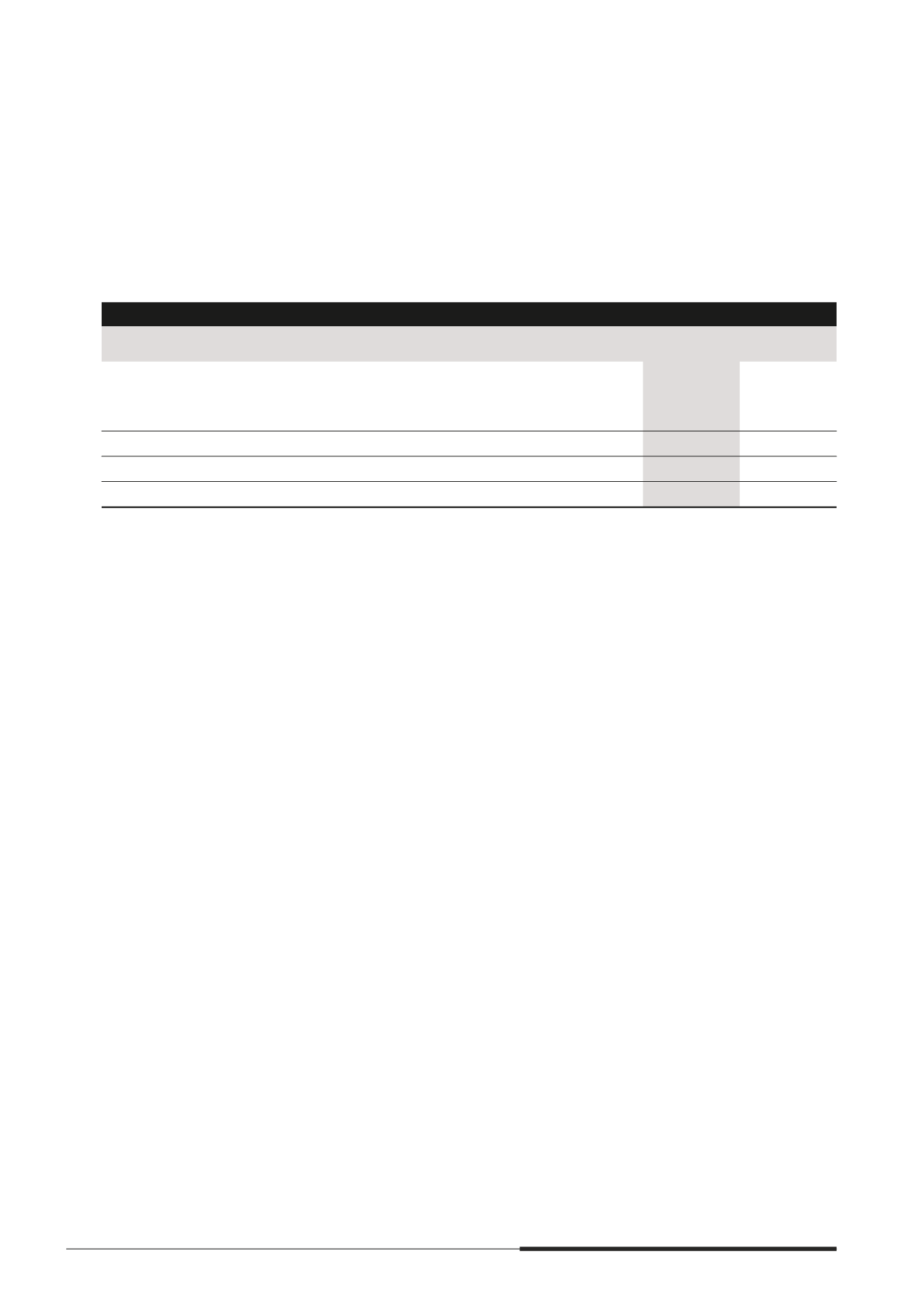

The Group

2014

$’000

2013

$’000

Restated

Bank borrowings and debt securities

15,985,818 15,936,163

Cash and cash equivalents

(2,749,397) (6,306,325)

Net debt

13,236,421

9,629,838

Total equity

23,208,531 24,454,783

Net debt equity ratio

0.57

0.39

The Group seeks to strike a balance between the higher returns that might be possible with higher level of

borrowings and the liquidity and security afforded by a sound capital position.

In addition, the Company has a share purchase mandate as approved by its shareholders which allows the

Company greater nexibility over its share capital structure with a view to improving, inter alia, its return on equity.

The shares which are purchased are held as treasury shares which the Company may transfer for the purposes

of or pursuant to its employee share-based incentive schemes so as to enable the Company to take advantage of

tax deductions under the current taxation regime. The use of treasury shares in lieu of issuing new shares would

also mitigate the dilution impact on existing shareholders.

The Group’s subsidiaries in The People’s Republic of China (PRC) are subject to foreign exchange rules and

regulations promulgated by the PRC government which may impact how the Group manages capital. In addition,

mve of the Group’s subsidiaries (2013 mve) are required to maintain certain minimum base capital and mnancial

resources, or shareholders’ funds as they are holders of Capital Markets Services licenses registered with the

Monetary Authority of Singapore or the Securities Commission Malaysia to conduct the regulated activity of Real

Estate Investment Trust management. These subsidiaries have complied with the applicable capital requirements

throughout the year.

There were no changes in the Group’s approach to capital management during the year.