190 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

32 BUSINESS COMBINATIONS

(cont’d)

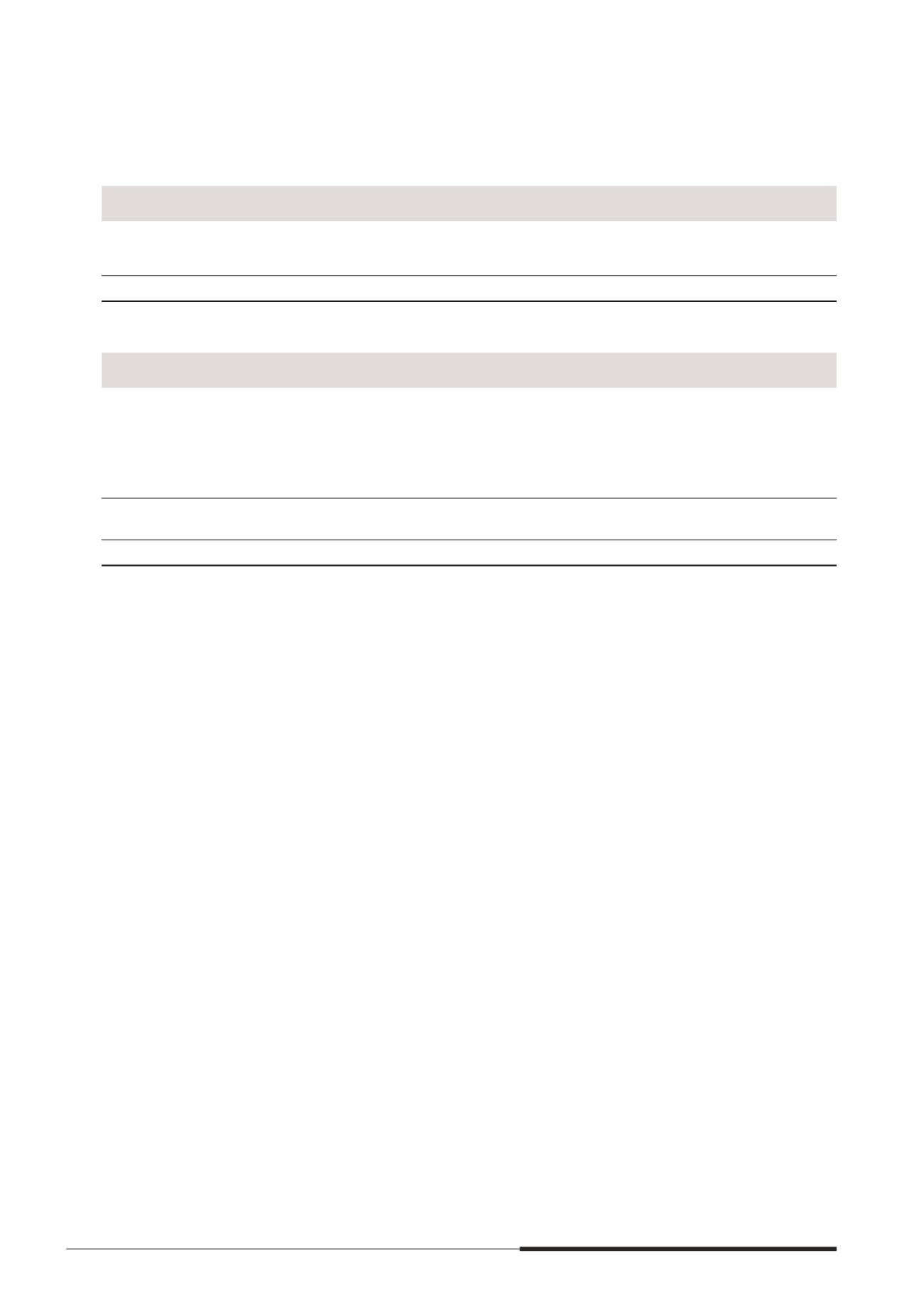

(IIHFWV RI FDVK ÁRZV RI WKH *URXS

2013

$’000

Purchase consideration paid

91,298

Less Cash and cash equivalents in subsidiary acquired

(2,807)

Net cash outnow on acquisition

88,491

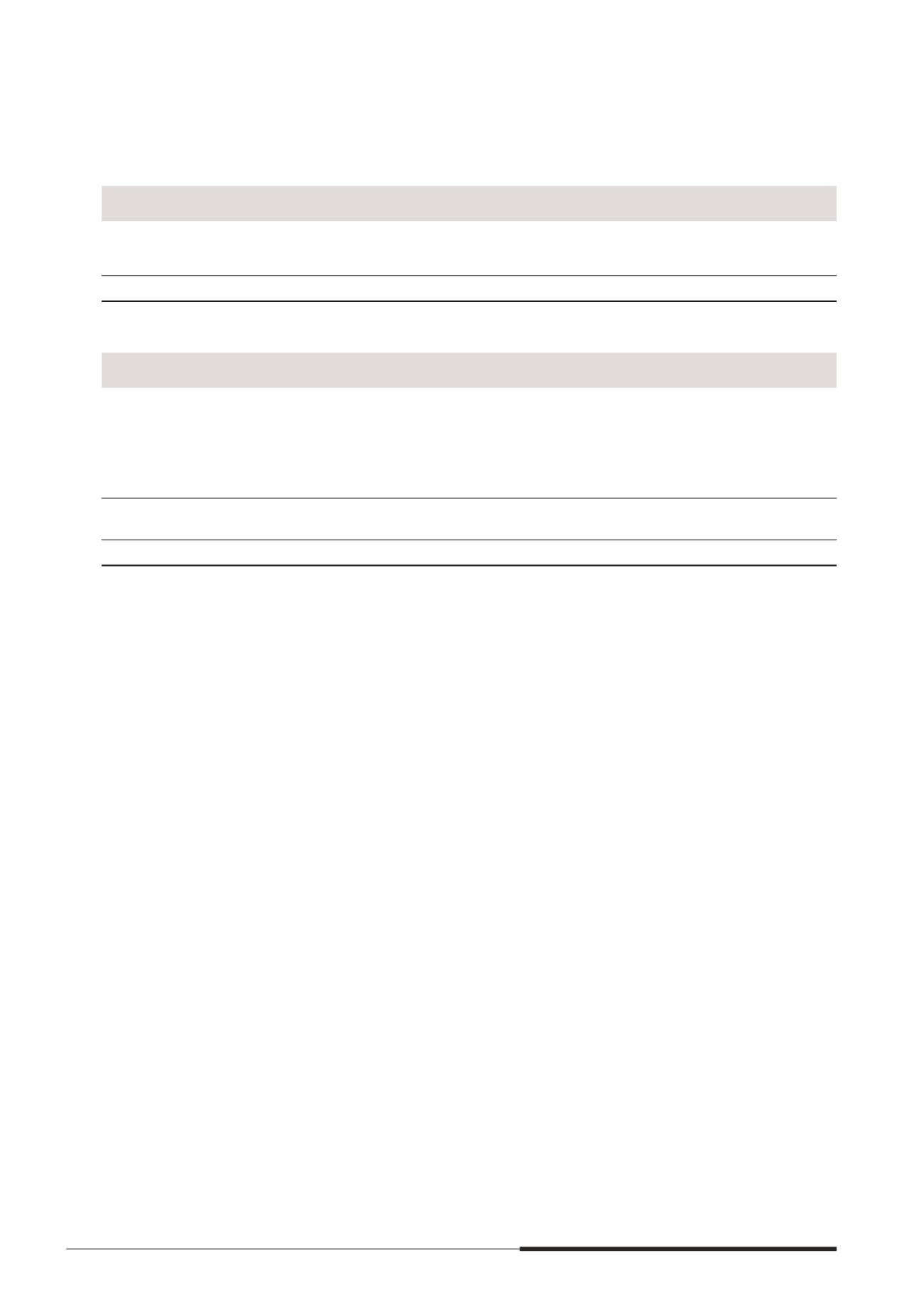

,GHQWLÀDEOH DVVHWV DFTXLUHG DQG OLDELOLWLHV DVVXPHG

2013

$’000

Property, plant and equipment

365

Investment properties

76,420

Current assets

3,482

Current liabilities

(1,711)

Non-current liabilities

(472)

Total identimable net assets

78,084

Goodwill on acquisition

13,214

Purchase consideration

91,298

Acquisition-related costs

Acquisition-related costs of $1.0 million related to stamp duties, legal and due diligence fees were included in

administrative expenses in the consolidated income statement for the year ended 31 December 2013.

33 FINANCIAL RISK MANAGEMENT

(a) Financial risk management objectives and policies

The Group and the Company are exposed to market risk (including interest rate, foreign currency and

price risks), credit risk and liquidity risk arising from its diversimed business. The Group’s risk management

approach seeks to minimise the potential material adverse effects from these exposures. The Group uses

mnancial instruments such as currency forwards, interest rate swaps and cross currency swaps as well as

foreign currency borrowings to hedge certain mnancial risk exposures.

The Board of Directors has overall responsibility for the establishment and oversight of the Group’s risk

management framework. The Board has established the Risk Committee to strengthen its risk management

processes and framework. The Risk Committee is assisted by an independent unit called the Risk Assessment

Group (RAG). RAG generates a comprehensive portfolio risk report to assist the committee. This quarterly

report measures a spectrum of risks, including property market risks, construction risks, interest rate risks,

remnancing risks and currency risks.