Positioning for the Future | 193

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

33 FINANCIAL RISK MANAGEMENT

(cont’d)

(b) Market risk

(cont’d)

(ii) Foreign currency risk

(cont’d)

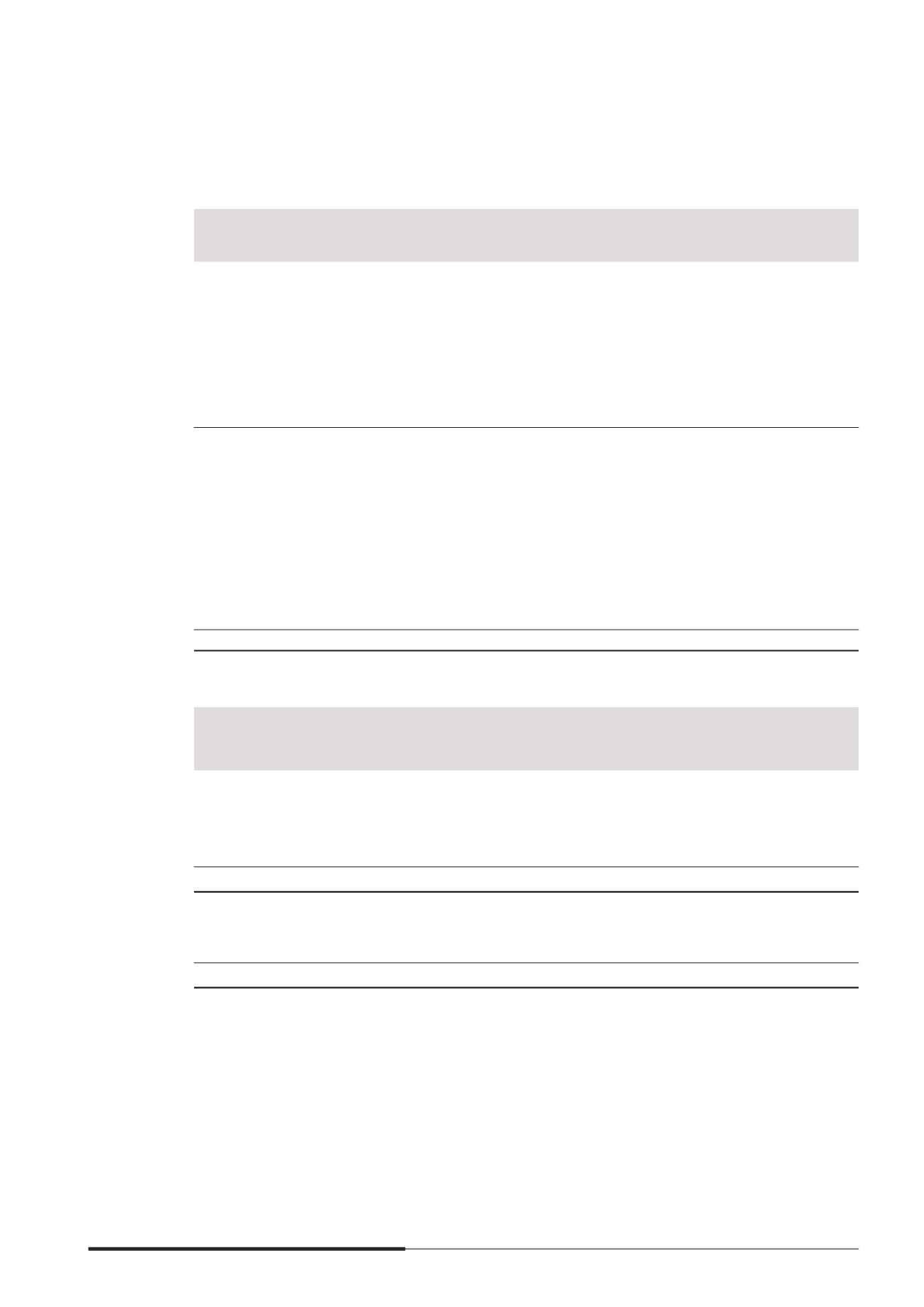

US

Dollars

$’000

Australian

Dollars

$’000

Chinese

Renminbi

$’000

Hong

Kong

Dollars

$’000

Japanese

Yen

$’000

Euro

$’000

Malaysian

Ringgit

$’000

Others

#

$’000

Total

Foreign

Currencies

$’000

The Group

2013 (Restated)

Other mnancial assets

–

–

–

3,809

209,817

–

–

–

213,626

Trade and other

receivables

119,367 121,688

306,264

7,523

277,638 197,363

58,730 285,430 1,374,003

Cash and cash

equivalents

223,902 116,615 1,054,132

3,070

143,399

29,684 104,677

85,404 1,760,883

Borrowings

(946,715)(1,014,406) (517,497) (221,585) (1,219,507) (423,507) (435,741) (455,769) (5,234,727)

Trade and other

payables

(302,629) (16,782) (1,155,908) (15,099)

(60,228) (54,192) (71,757) (78,874) (1,755,469)

Gross currency

exposure

(906,075) (792,885) (313,009) (222,282) (648,881) (250,652) (344,091) (163,809) (3,641,684)

Add/Less

Net mnancial

liabilities

denominated in the

respective entities’

functional currencies

138,798 913,875

442,809 177,239

531,090 414,556 391,442 221,620 3,231,429

Cross currency swaps/

forward foreign

exchange contracts

502,308

–

–

–

122,700

(906)

1,165

–

625,267

Less

Available-for-sale

mnancial assets

–

–

–

(3,810)

–

–

–

–

(3,810)

Net currency exposure

(264,969) 120,990

129,800 (48,853)

4,909 162,998

48,516

57,811

211,202

#

Others include mainly United Arab Emirates Dirham, Sterling Pound, Thai Baht, Indian Rupee and Vietnamese Dong.

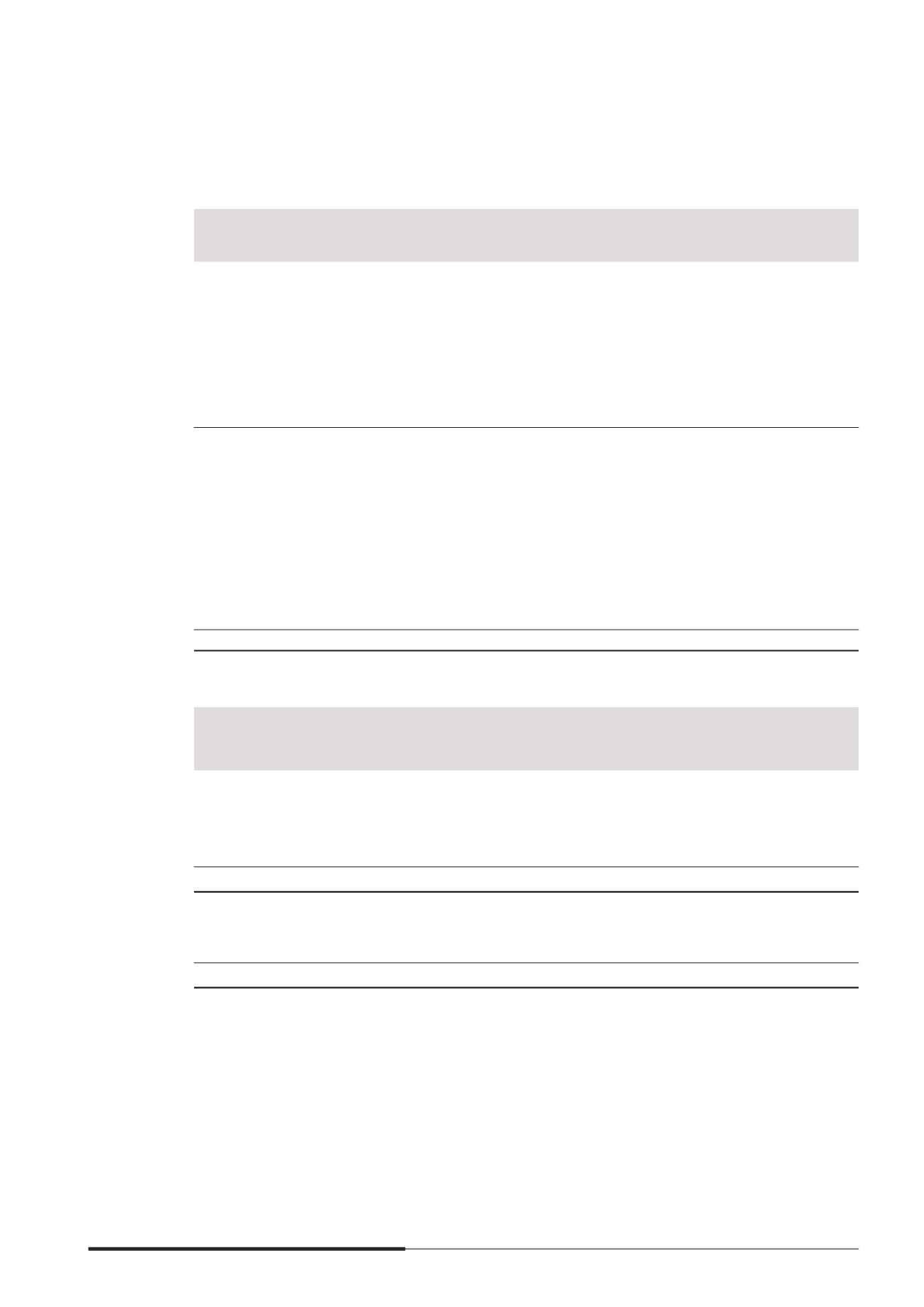

US

Dollars

$’000

Total

Foreign

Currency

$’000

The Company

2014

Cash and cash equivalents

174

174

Trade and other receivables

6

6

Currency exposure

180

180

2013

Cash and cash equivalents

91

91

Trade and other receivables

7

7

Currency exposure

98

98

Sensitivity analysis

It is estimated that a mve percentage point strengthening in foreign currencies against the Singapore

Dollar would increase the Group’s promt before tax by approximately $5.7 million (2013 $10.6 million)

and increase the Group’s other components of equity by approximately $0.1 million (2013 $0.2 million).

A mve percentage point weakening in foreign currencies against the Singapore Dollar would have an

equal but opposite effect. The Group’s outstanding forward foreign exchange contracts and cross

currency swaps have been included in this calculation. The analysis assumed that all other variables,

in particular interest rates, remain constant and does not take into account the translation related risk,

associated tax effects and share of non-controlling interests.

There was no signimcant exposure to foreign currencies for the Company as at 31 December 2014 and

31 December 2013.