Positioning for the Future | 183

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

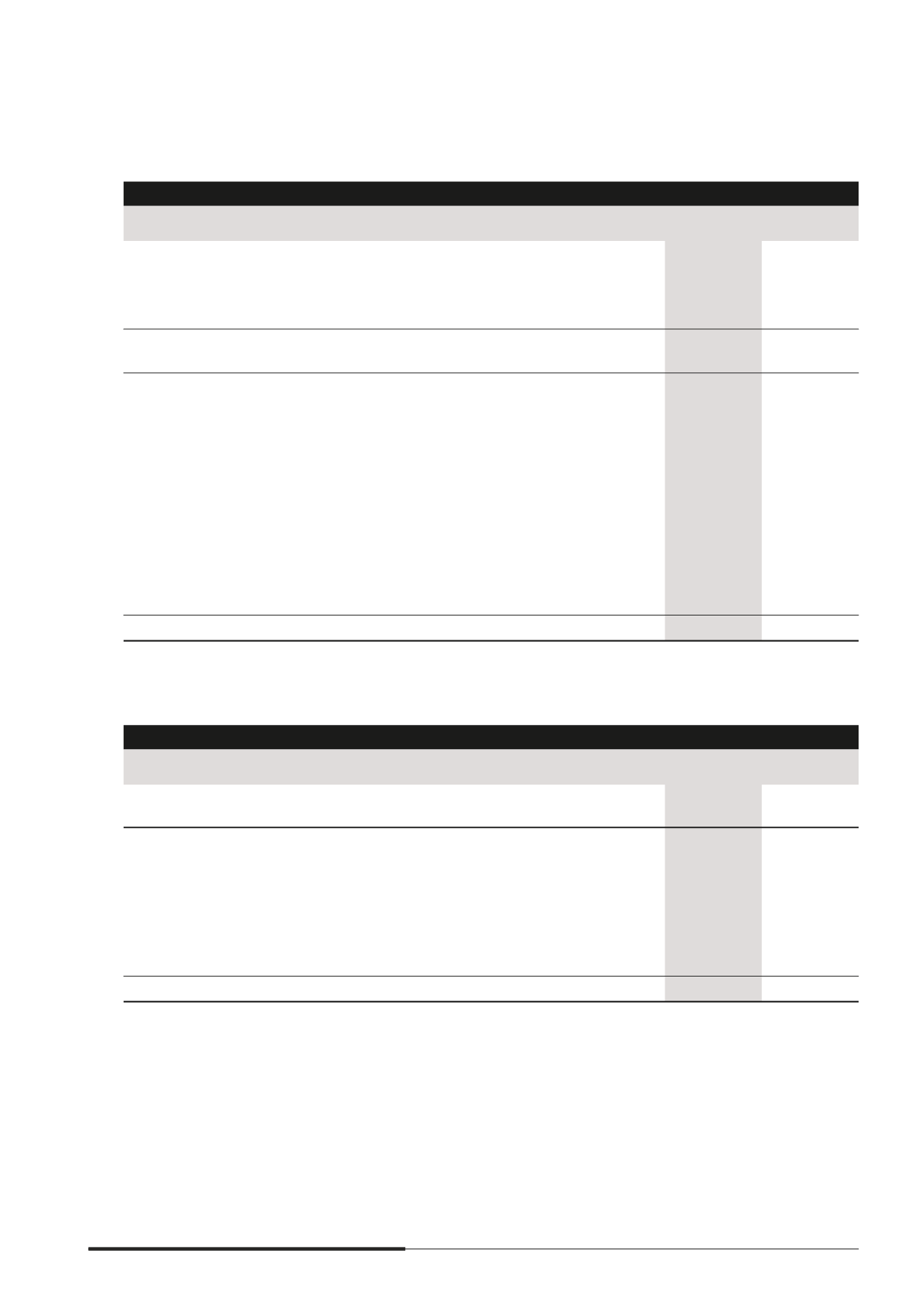

28 TAX EXPENSE

(cont’d)

Reconciliation of effective tax rate

The Group

2014

$’000

2013

$’000

Restated

Continuing Operations

Promt before tax

1,997,467

1,776,883

Less Share of results of associates and joint ventures

(969,935)

(902,612)

Promt before share of results of associates and joint ventures,

tax and discontinued operation

1,027,532

874,271

Income tax using Singapore tax rate of 17% (2013 17%)

174,680

148,626

Adjustments

Expenses not deductible for tax purposes

184,120

158,572

Income not subject to tax

(184,803)

(171,559)

Effect of unrecognised tax losses and other deductible

temporary differences

20,035

17,963

Effect of different tax rates in foreign jurisdictions

44,783

61,161

Effect of taxable distributions from REITs

33,167

28,017

Over provision in respect of prior years

(9,697)

(63,761)

Group relief

(1,447)

(600)

Withholding taxes

7,498

27,374

Others

(1,428)

(655)

266,908

205,138

Tax expense on continuing operations excluded the Group’s tax expense on gain on sale of discontinued operation.

The tax on sale of discontinued operation was included in Apromt from discontinued operation, net of tax’ in the

income statement (note 39).

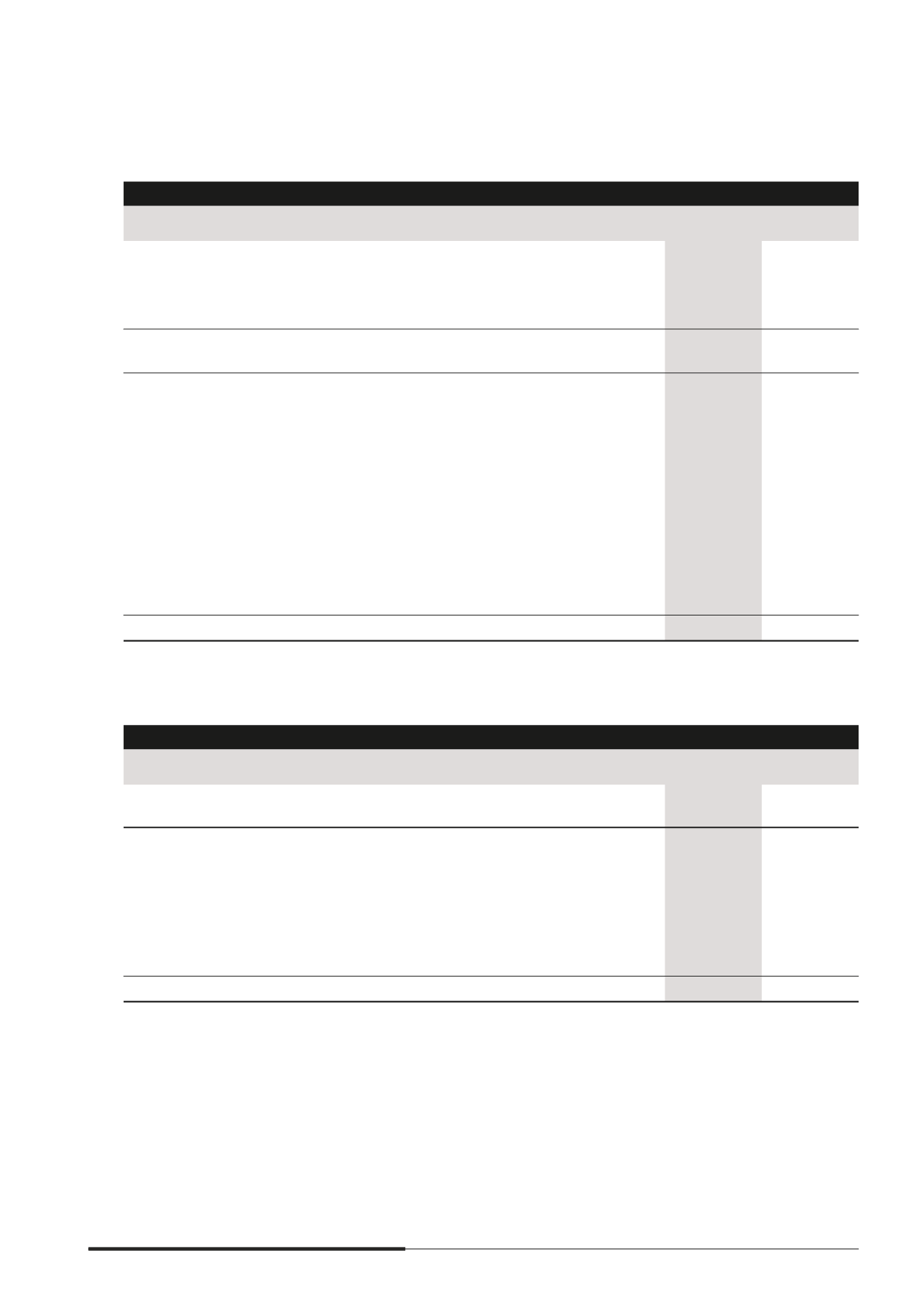

The Company

2014

$’000

2013

$’000

Promt before tax

579,040

130,837

Income tax using Singapore tax rate of 17% (2013 17%)

98,437

22,242

Adjustments

Expenses not deductible for tax purposes

402

47,417

Income not subject to tax

(103,101)

(88,827)

Effect of other deductible temporary differences

(1,138)

(2,986)

Group relief

205

(1,421)

Others

(867)

969

(6,062)

(22,606)