196 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

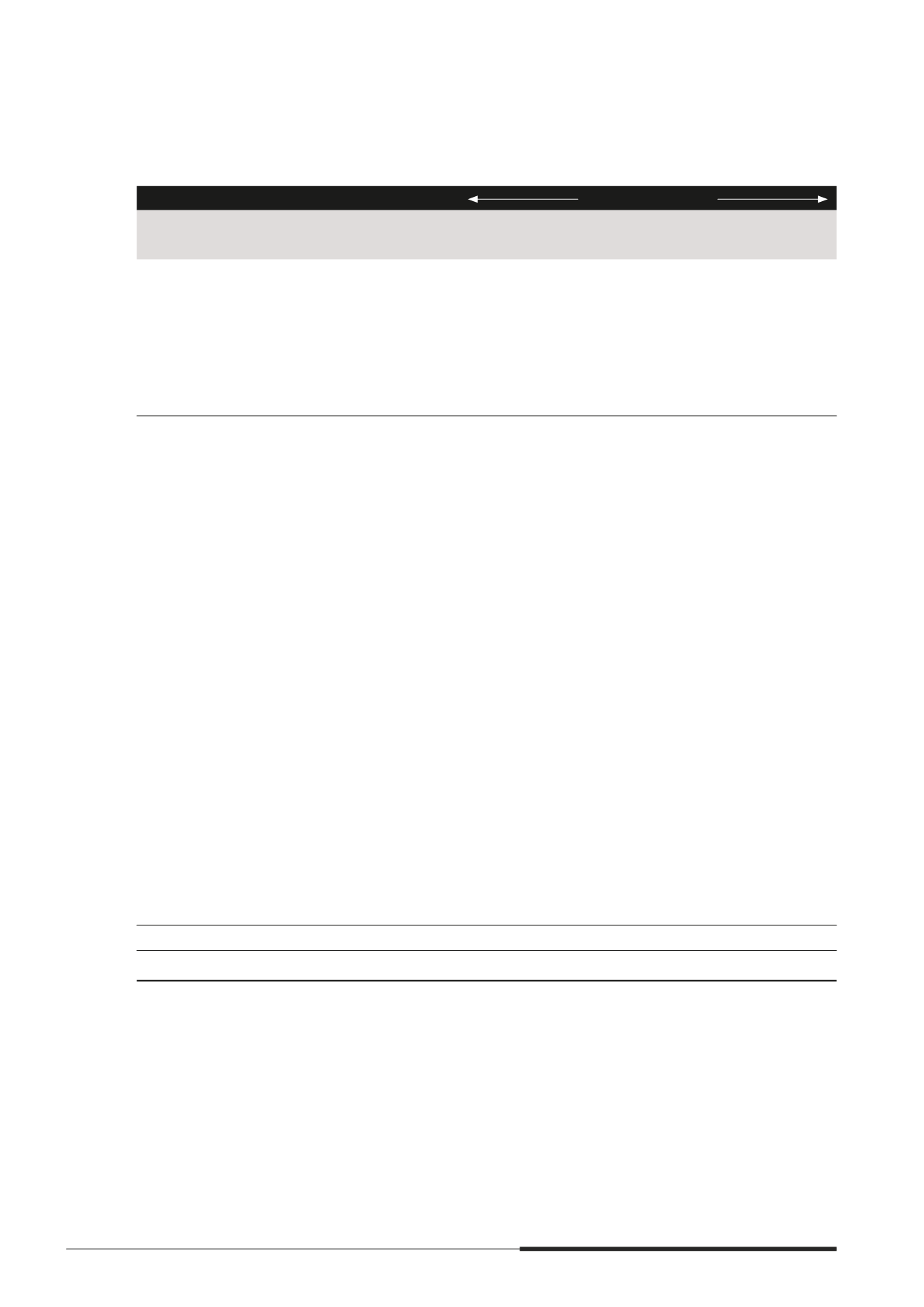

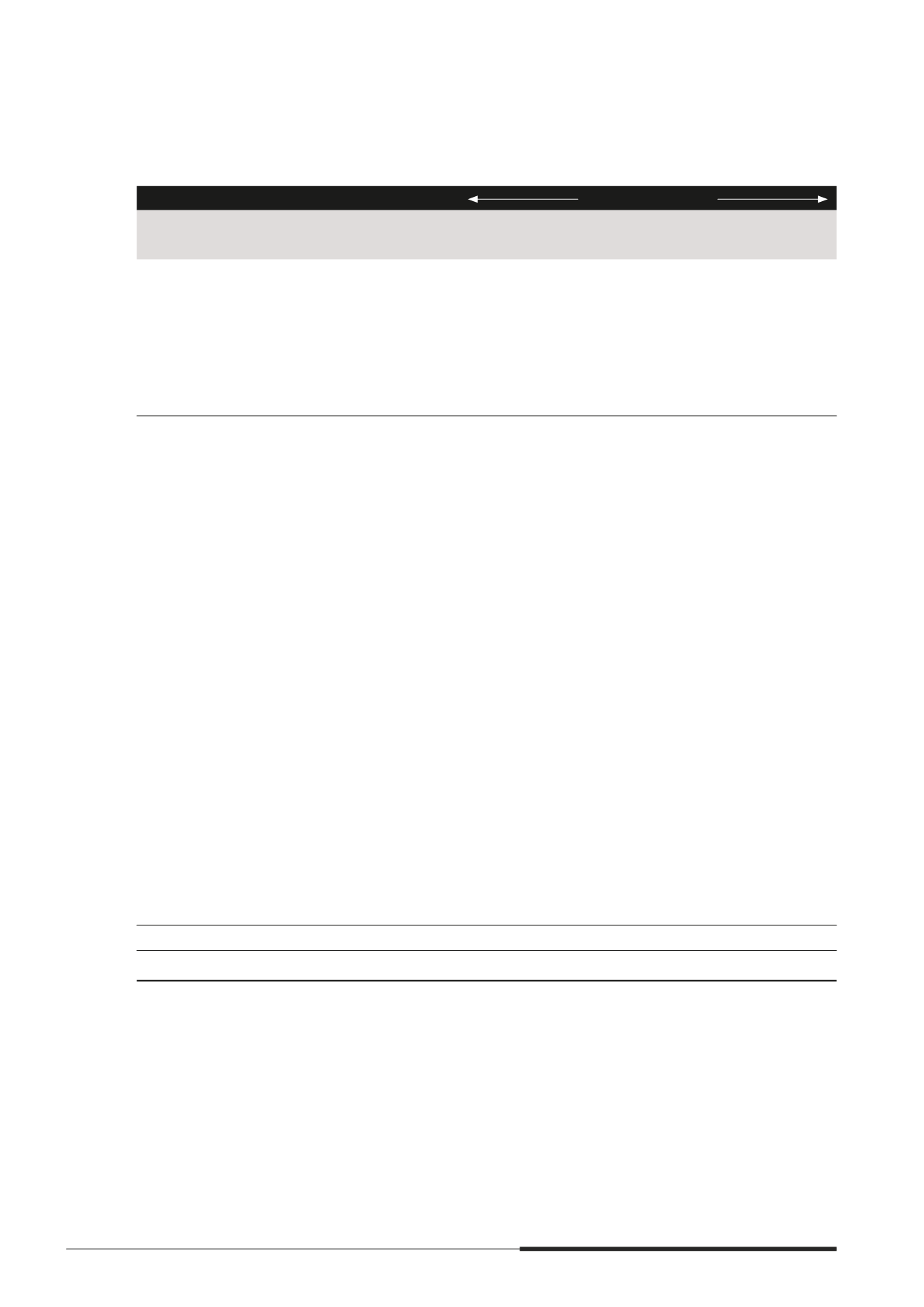

33 FINANCIAL RISK MANAGEMENT

(cont’d)

(d) Liquidity risk

(cont’d)

&RQWUDFWXDO FDVK ÁRZV

Carrying

amount

$’000

Total

$’000

Not later

than 1 year

$’000

Between

1 and 5 years

$’000

After

5 years

$’000

The Group

2013 (Restated)

Financial liabilities,

at amortised cost

Bank borrowings

(8,563,160)

(9,063,975) (1,176,827) (7,238,801)

(648,347)

Debt securities

(7,373,003)

(8,880,524)

(435,426) (3,400,242) (5,044,856)

Trade and other payables

#

(2,902,766)

(2,940,644) (2,367,982)

(528,329)

(44,333)

(18,838,929) (20,885,143) (3,980,235) (11,167,372) (5,737,536)

'HULYDWLYH ÀQDQFLDO

assets/(liabilities),

at fair value

Interest rate swaps

(net-settled)

- assets

929

1,024

(1,072)

1,772

324

- liabilities

(30,295)

(49,836)

(24,106)

(25,730)

–

Forward foreign

exchange contracts

(net-settled)

- assets

1,550

1,550

1,550

–

–

- liabilities

(14,171)

(14,171)

(14,171)

–

–

Forward foreign

exchange contracts

(gross-settled)

373

- outnow

(7,259)

(7,259)

–

–

- innow

7,633

7,633

–

–

Cross currency swaps

(gross-settled)

7,960

- outnow

(649,200)

(13,248)

(73,876)

(562,076)

- innow

666,722

14,730

81,896

570,096

Cross currency swaps

(gross-settled)

(25,171)

- outnow

(173,816)

(4,282)

(17,128)

(152,406)

- innow

158,262

1,667

6,669

149,926

(58,825)

(59,091)

(38,558)

(26,397)

5,864

(18,897,754) (20,944,234) (4,018,793) (11,193,769) (5,731,672)

#

Excludes quasi-equity loans, progress billings, liability for employee benemts and provisions.