Positioning for the Future | 177

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

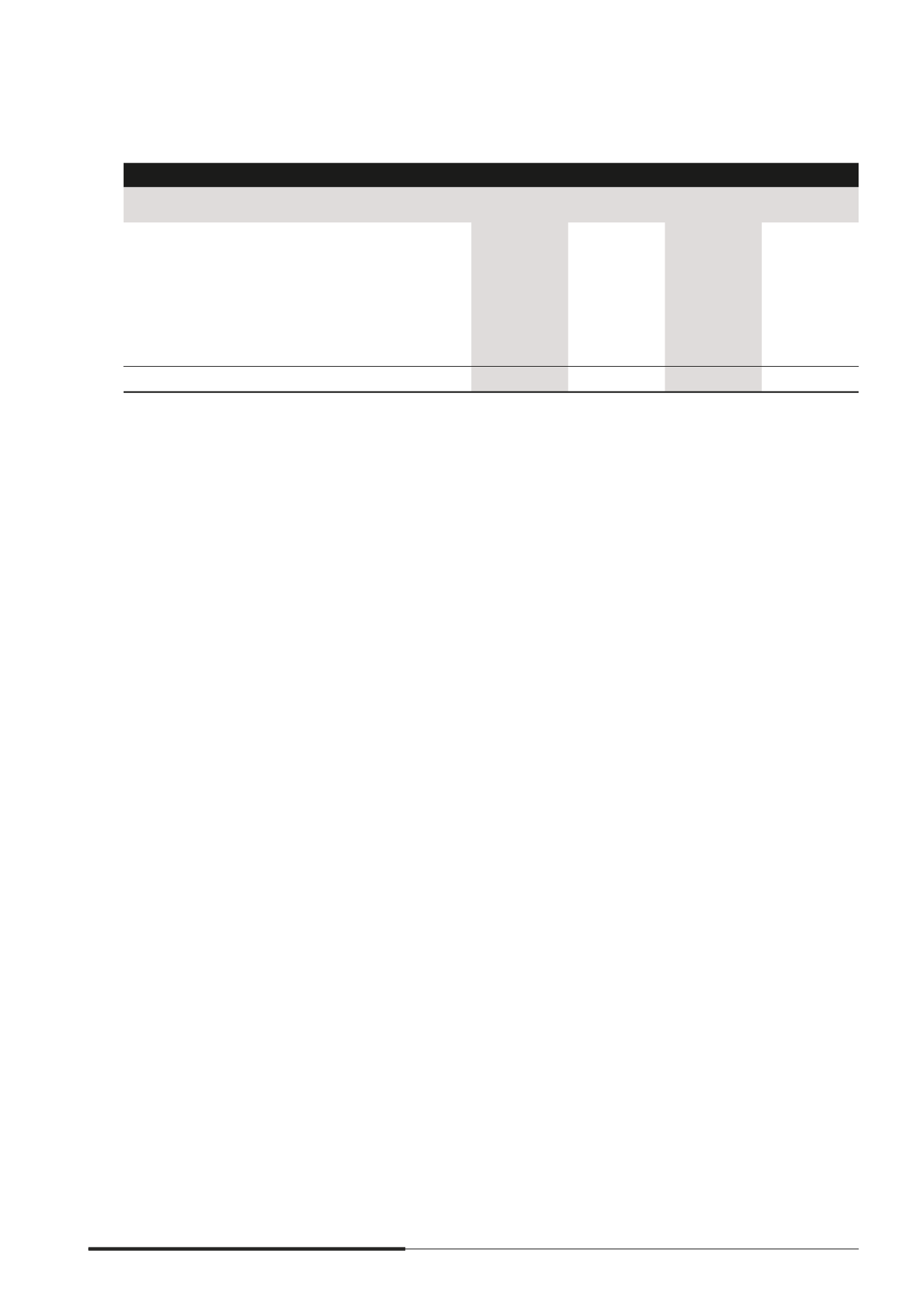

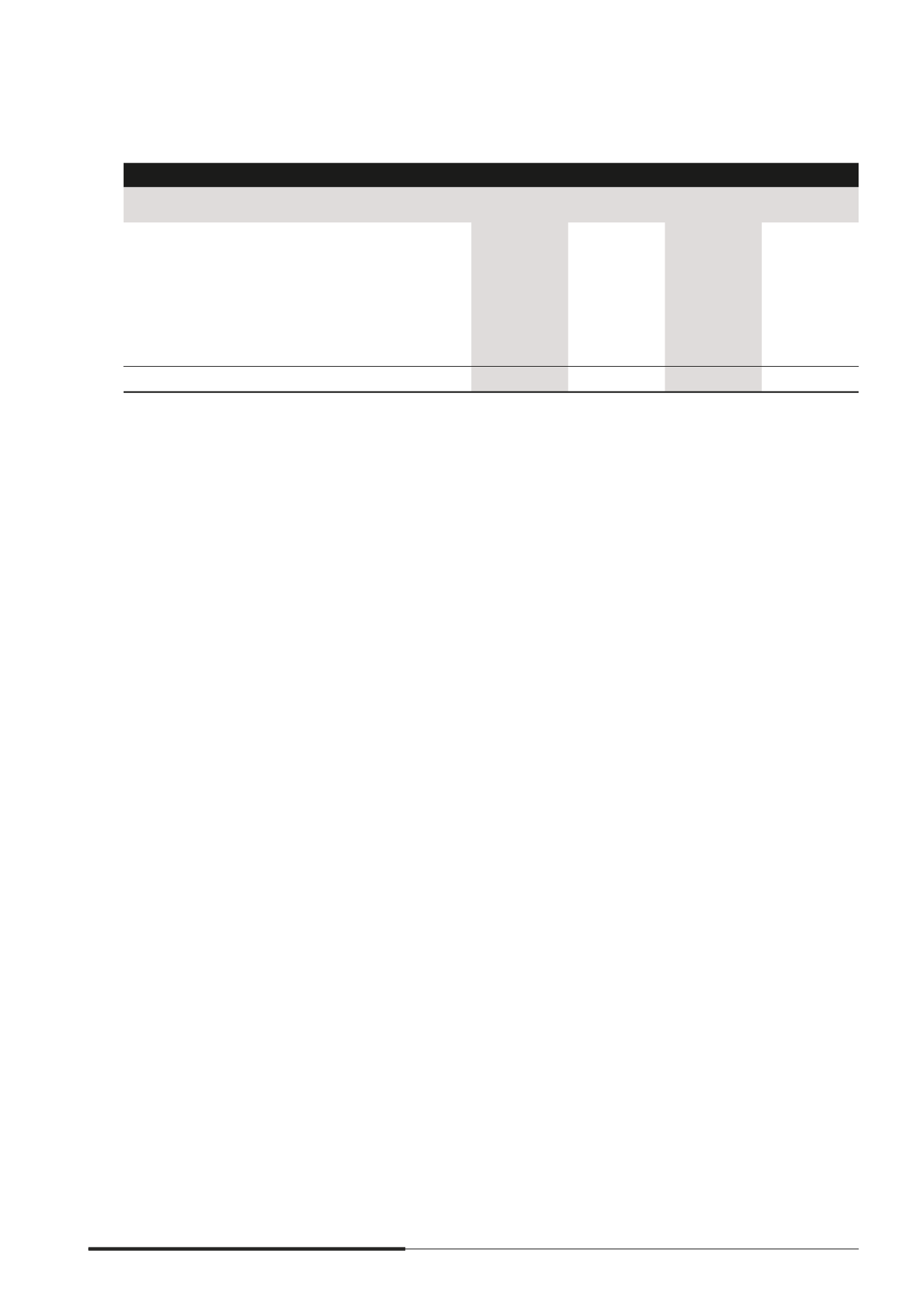

24 OTHER RESERVES

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Reserve for own shares

(36,989)

(51,691)

(36,989)

(51,691)

Capital reserve

460,967

415,047

287,245

287,245

Equity compensation reserve

97,906

120,800

46,348

53,415

Hedging reserve

24,928

(21,356)

–

–

Available-for-sale reserve

5,677

5,018

–

–

Foreign currency translation reserve

284,864

(121,145)

–

–

837,353

346,673

296,604

288,969

Reserve for own shares comprises the purchase consideration for issued shares of the Company acquired and

held in treasury.

The capital reserve comprises mainly the value of the options granted to bondholders to convert their convertible

bonds into ordinary shares of the Company and share of associates’ and joint ventures’ capital reserve.

The equity compensation reserve comprises the cumulative value of employee services received for the issue of

the options and shares under the share plans of the Company (note 22(b)).

The hedging reserve comprises the effective portion of the cumulative net change in the fair value of hedging

instruments related to hedged transactions that have not yet affected promt or loss.

The available-for-sale reserve comprises the cumulative net change in the fair value of available-for-sale investment

until the investment is derecognised.

The foreign currency translation reserve comprises all foreign exchange differences arising from the translation of

the mnancial statements of foreign entities, as well as from the translation of foreign currency loans used to hedge

or form part of the Group’s net investments in foreign entities.