178 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

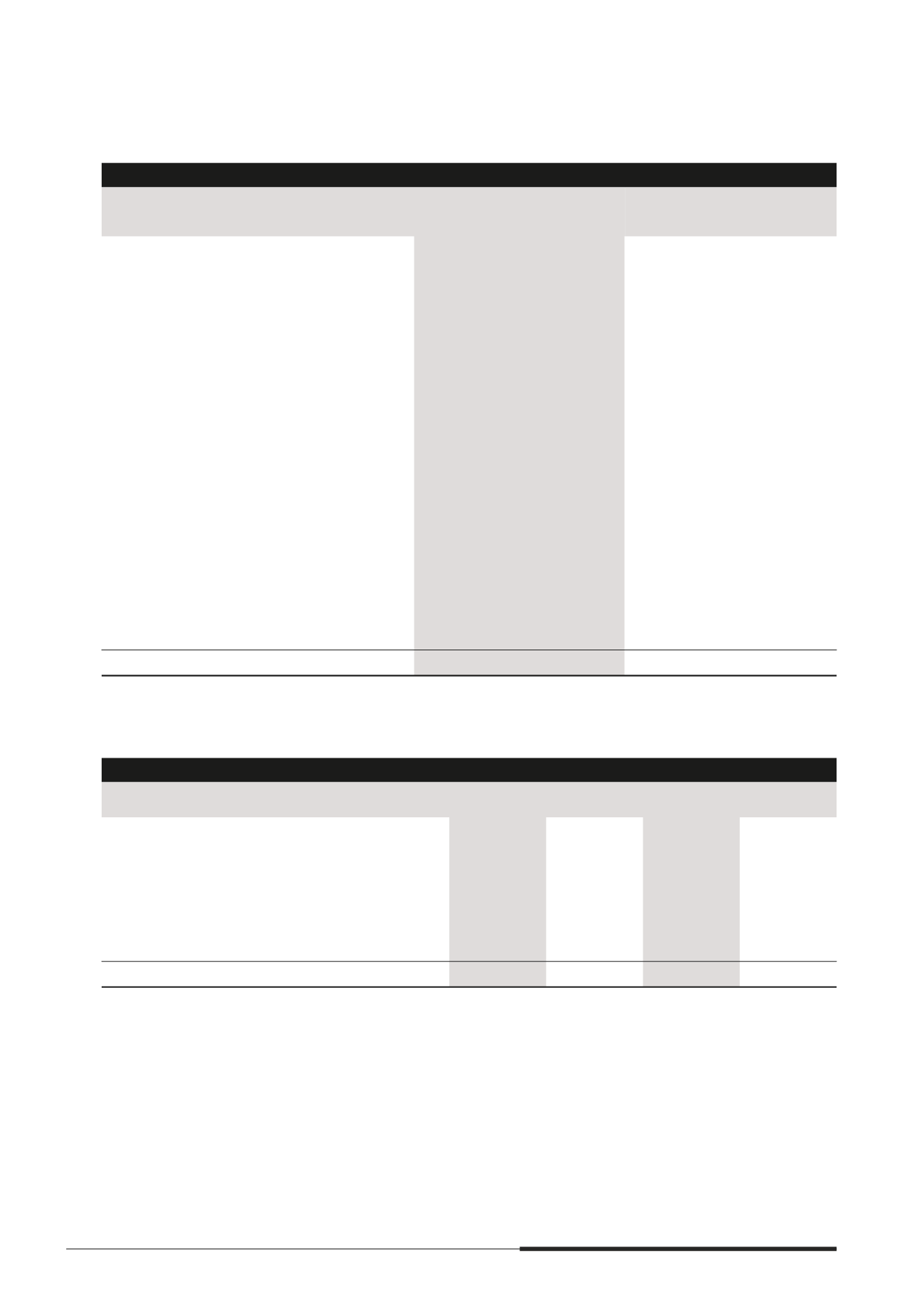

25 OTHER COMPREHENSIVE INCOME

2014

2013

Before

tax

$’000

Tax

expense

$’000

Net

of tax

$’000

Before

tax

$’000

Tax

expense

$’000

Net of

tax

$’000

Restated Restated Restated

The Group

Exchange differences arising from

translation of foreign operations and

foreign currency loans, forming part

of net investment in foreign operations

324,103

– 324,103 155,683

– 155,683

Recognition of foreign exchange differences

in promt or loss

35,562

–

35,562

85,690

–

85,690

Change in fair value of available-for-sale

investments

3,283

–

3,283

2,511

–

2,511

Recognition of available-for-sale reserve

in promt or loss

(2,564)

–

(2,564) (2,980)

–

(2,980)

Effective portion of change in fair value

of cash now hedges

44,241

–

44,241

54,526

–

54,526

Recognition of hedging reserve in

promt or loss

831

–

831

35,674

–

35,674

Share of other comprehensive income

of associates and joint ventures

91,920

–

91,920 198,305

– 198,305

Recognition of share of other comprehensive

income of associates and joint ventures

in promt or loss

5

–

5

–

–

–

497,381

– 497,381 529,409

– 529,409

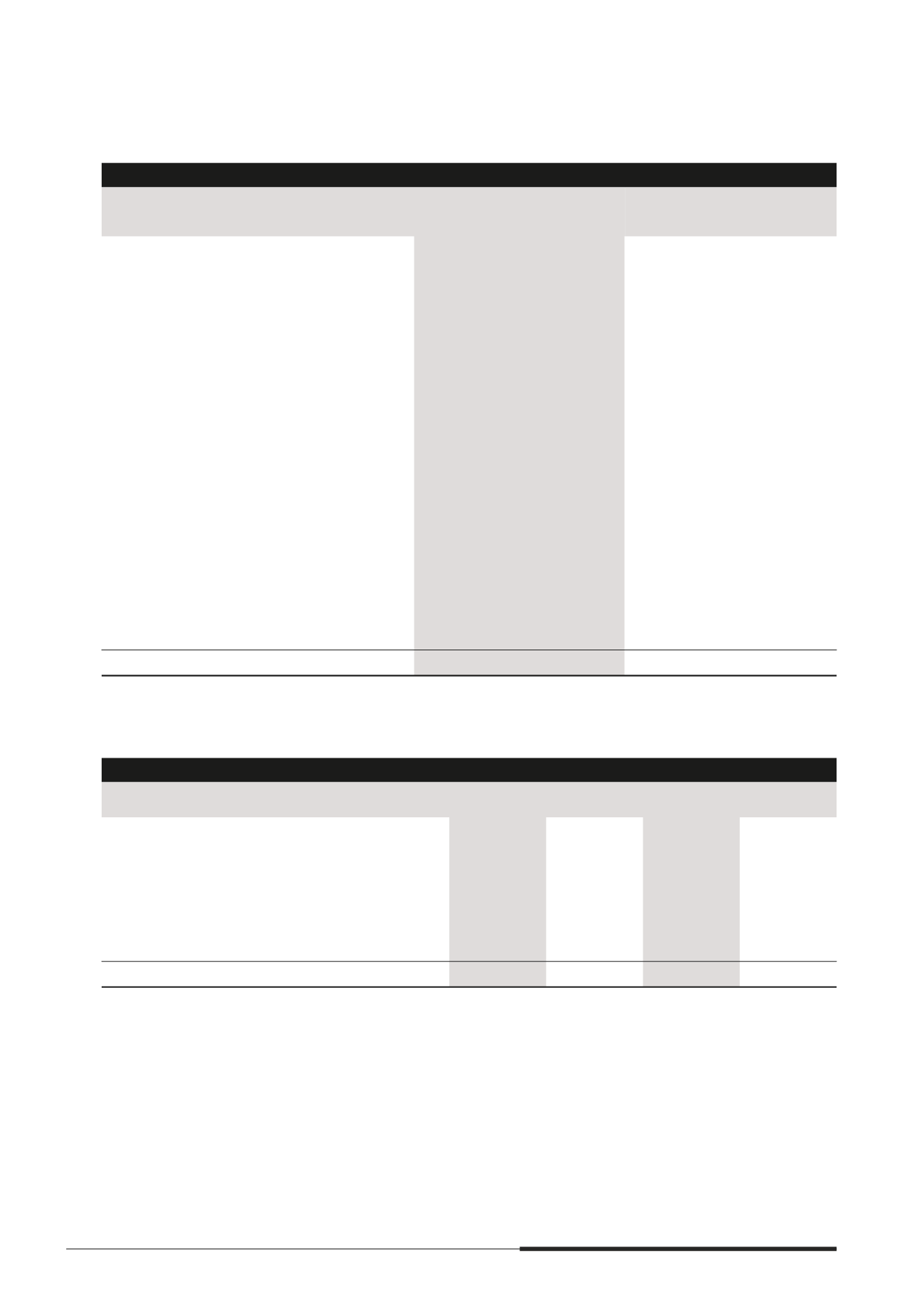

26 REVENUE

Revenue of the Group and of the Company is analysed as follows

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Trading of properties

2,202,323

1,942,455

–

–

Rental and related income

743,988

609,414

–

–

Fee income

376,714

379,892

72,535

65,530

Serviced residence rental and related income

597,012

553,443

–

–

Dividend income from subsidiaries

–

–

606,452

522,462

Others

4,561

25,829

–

–

3,924,598

3,511,033

678,987

587,992