182 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

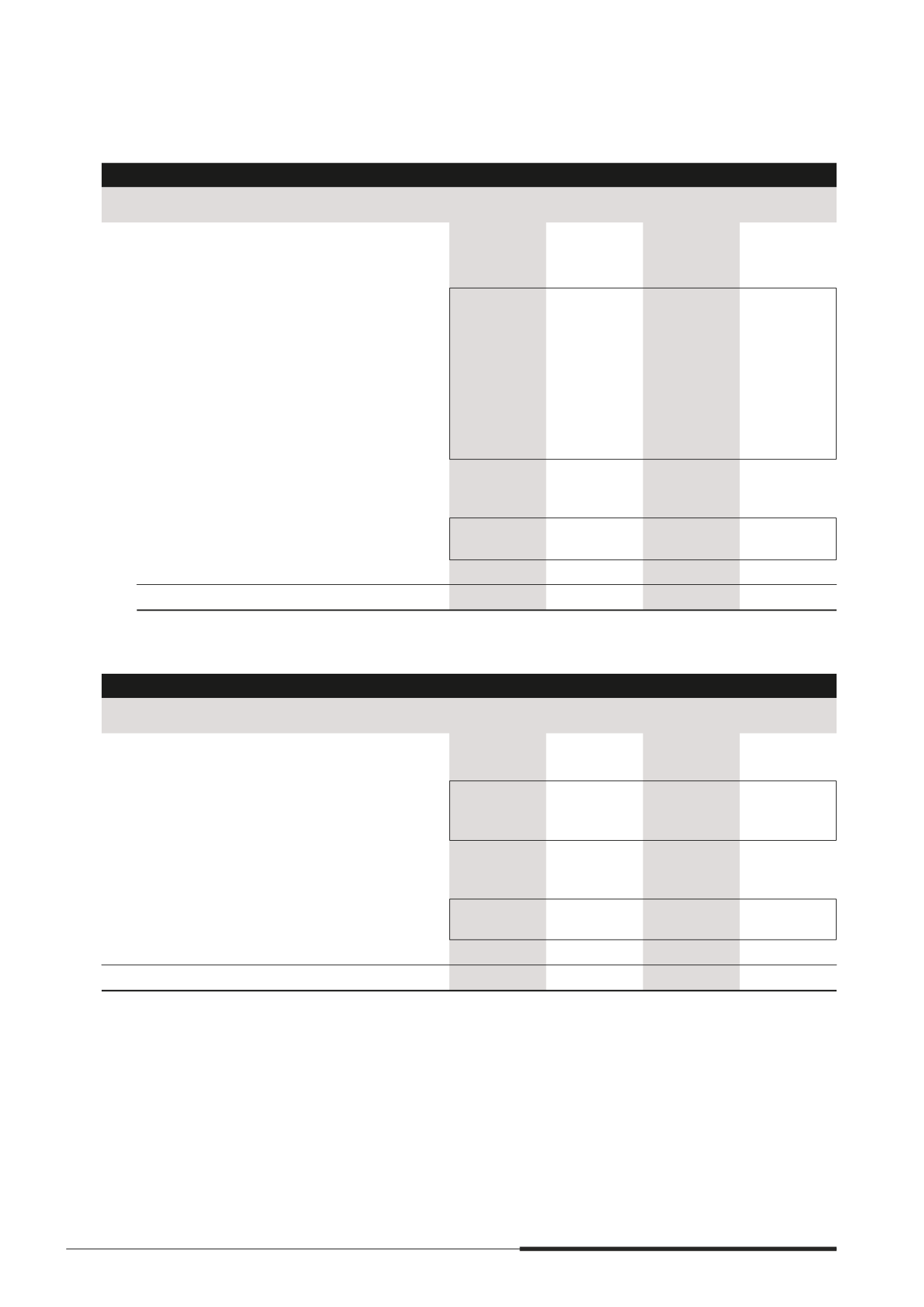

27 PROFIT BEFORE TAX

(cont’d)

The Group

The Company

Note

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

(d) Finance costs

Interest costs paid and payable

- on bank loans and overdrafts

200,259

224,100

271

–

- on debt securities

136,553

132,866

–

–

- to non-controlling interests

6,529

4,961

–

–

Convertible bonds

- interest expense

88,420

107,620

81,772

97,833

- amortisation of bond discount

44,191

62,207

40,799

56,771

- accretion of bond premium

2,352

6,782

2,352

6,782

Derivative mnancial instruments

1,331

(1,751)

–

–

Others

44,054

54,104

512

1,867

Total borrowing costs

523,689

590,889

125,706

163,253

Less

Borrowing costs capitalised in

- investment properties

5(d)

(39,706)

(53,899)

–

–

- development properties for sale

11(f)

(44,510)

(55,313)

–

–

(84,216)

(109,212)

–

–

439,473

481,677

125,706

163,253

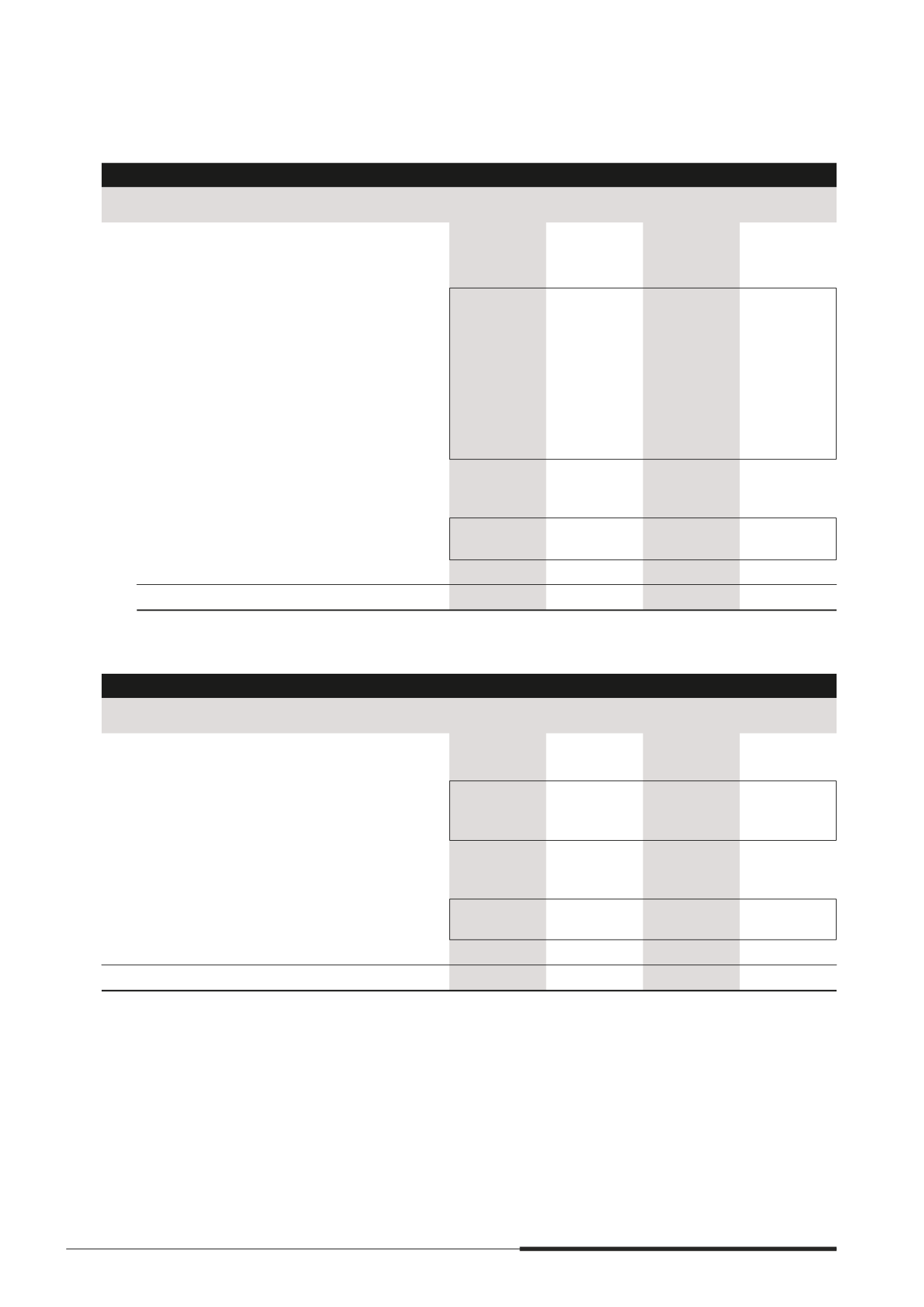

28 TAX EXPENSE

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Current tax expense

- Based on current year’s results

237,584

331,105

555

504

- Over provision in respect of prior years

(2,953)

(53,576)

–

–

- Group relief

(1,447)

(600)

205

(1,421)

233,184

276,929

760

(917)

Deferred tax expense

- Origination and reversal of temporary differences

40,468

(61,606)

(6,822)

(21,689)

- Over provision in respect of prior years

(6,744)

(10,185)

–

–

33,724

(71,791)

(6,822)

(21,689)

Total

266,908

205,138

(6,062)

(22,606)