146 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

7

ASSOCIATES

(cont’d)

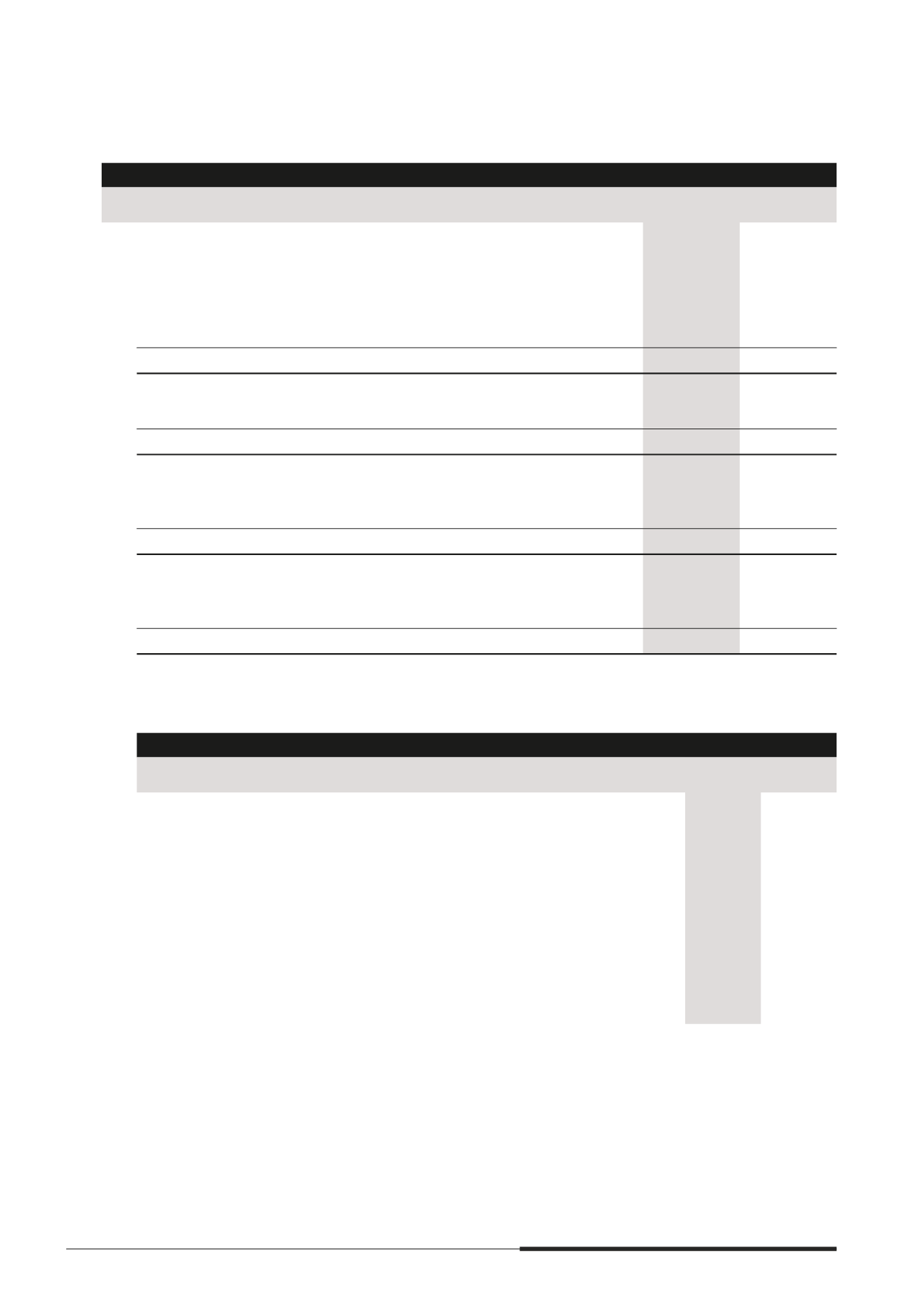

The Group

Note

2014

$’000

2013

$’000

Restated

(b) Amounts due from/(to) associates

Current accounts (unsecured)

- interest free (trade)

31,086

35,657

- interest free (non-trade)

34,479

87,466

- interest bearing (non-trade)

276,715

338,511

342,280

461,634

Less

Allowance for doubtful receivables

–

(2,544)

12

342,280

459,090

Current accounts (mainly non-trade and unsecured)

- interest free

(214,004)

(178,826)

- interest bearing

(132,523)

(389,284)

17

(346,527)

(568,110)

Non-current loans (unsecured)

- interest free

–

(276)

- interest bearing

(136,385)

(145,855)

21

(136,385)

(146,131)

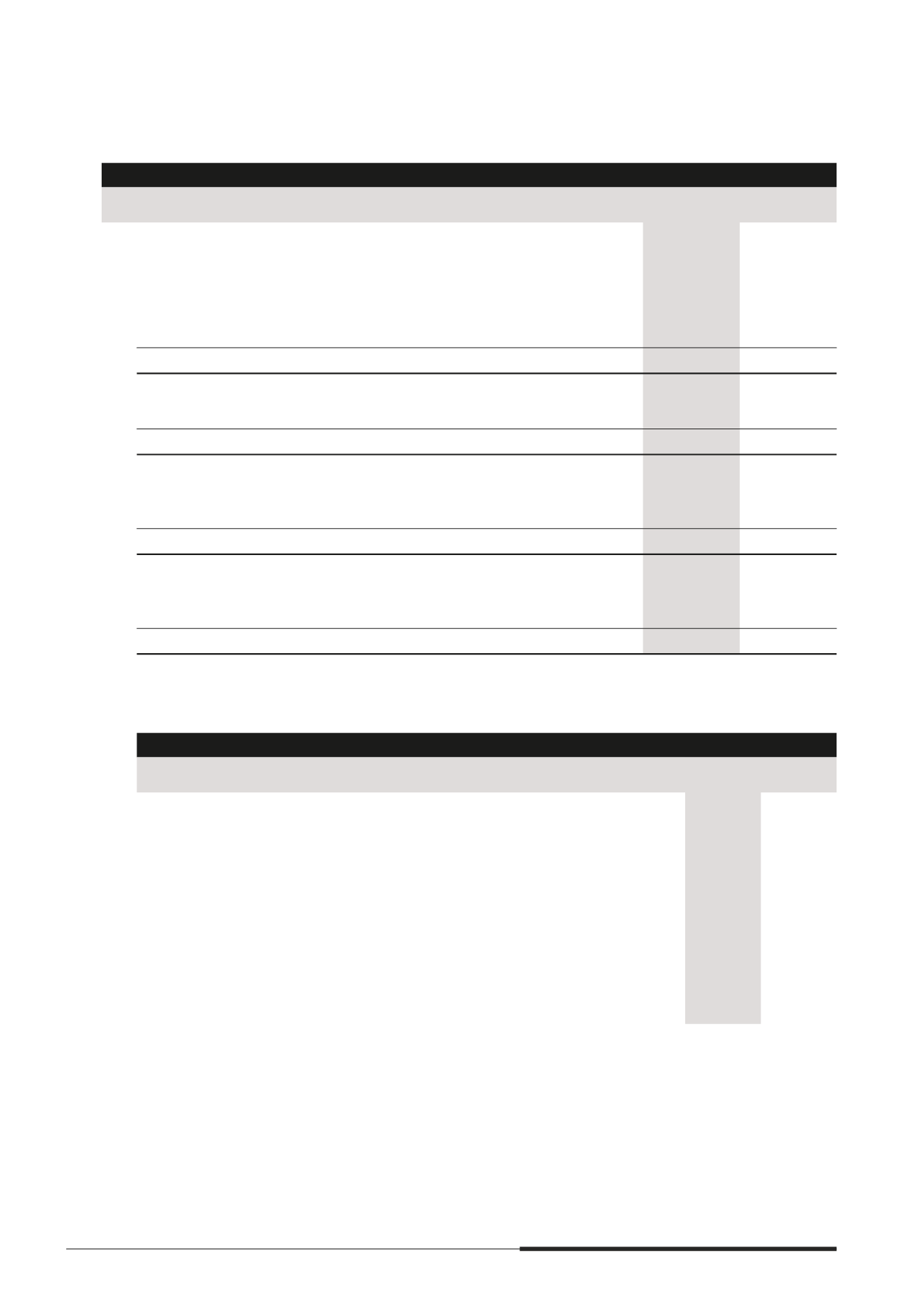

(c) The Group has three (2013 three) associates that are material and a number of associates that are individually

immaterial to the Group. All are equity-accounted. The following are the material associates

Effective interest

Name of Company

Nature of relationship

with the Group

Principal place

of business

2014

%

2013

%

CapitaMall Trust

1

(CMT)

Singapore-based REIT

Singapore

27.7

18.1

which invests in shopping

malls in Singapore

CapitaRetail China Trust

1

(CRCT)

Singapore-based REIT

China

26.9

16.7

which invests in shopping

malls in China

Rafnes City China Fund Ltd

2,3

(RCCF) Private equity fund which

China

55.0

49.8

invests in mve Rafnes City

integrated developments

in China

All the above associates are audited by KPMG LLP Singapore.

1

Indirectly held through CapitaMalls Asia Limited.

2

Indirectly held through CapitaMalls Asia Limited and CapitaLand China Holdings Pte Ltd.

3

Considered to be an associate as key decisions are made by an independent board which the Group does not have majority

control.