66 | CapitaLand Limited Annual Report 2014

Performance Overview

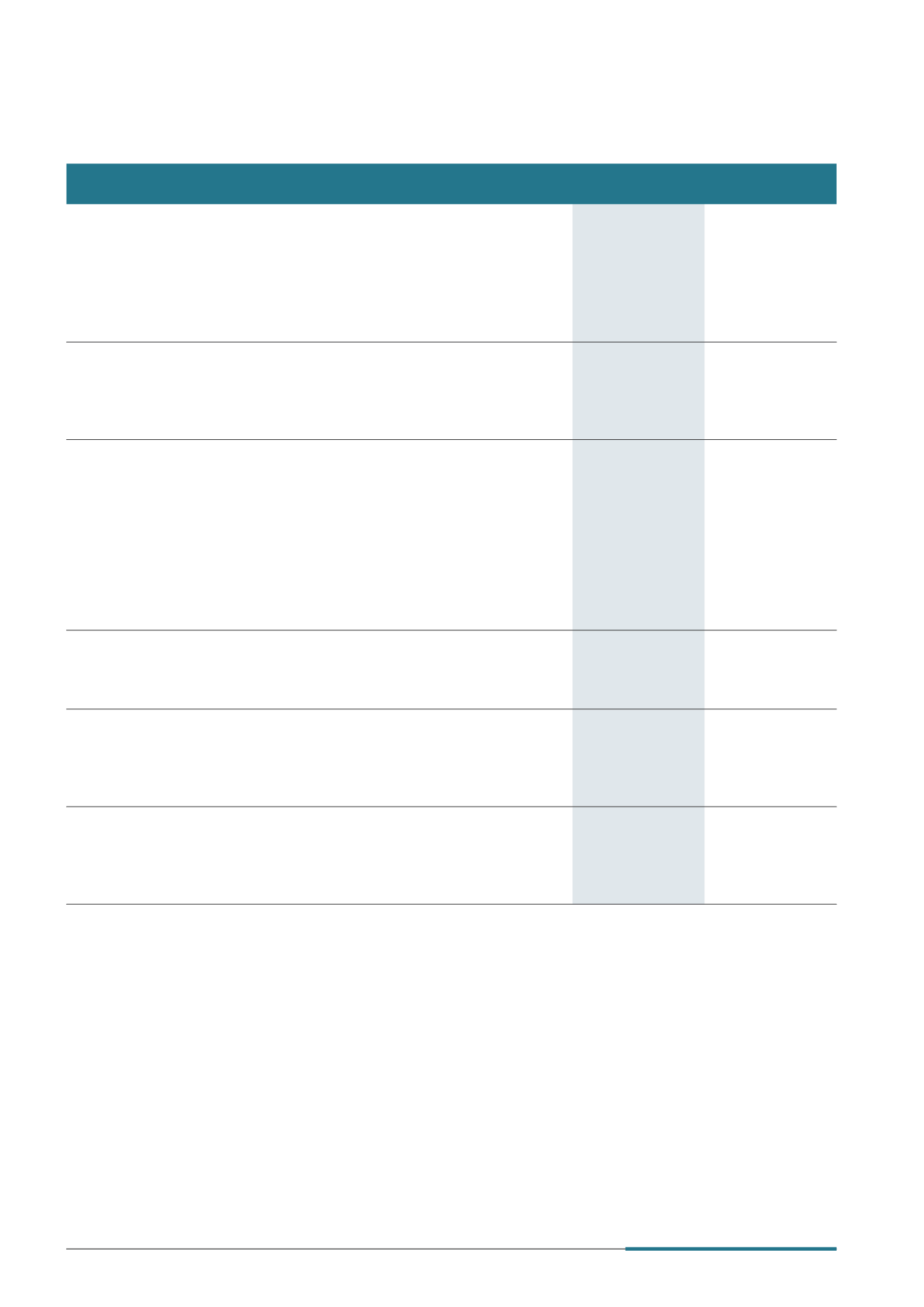

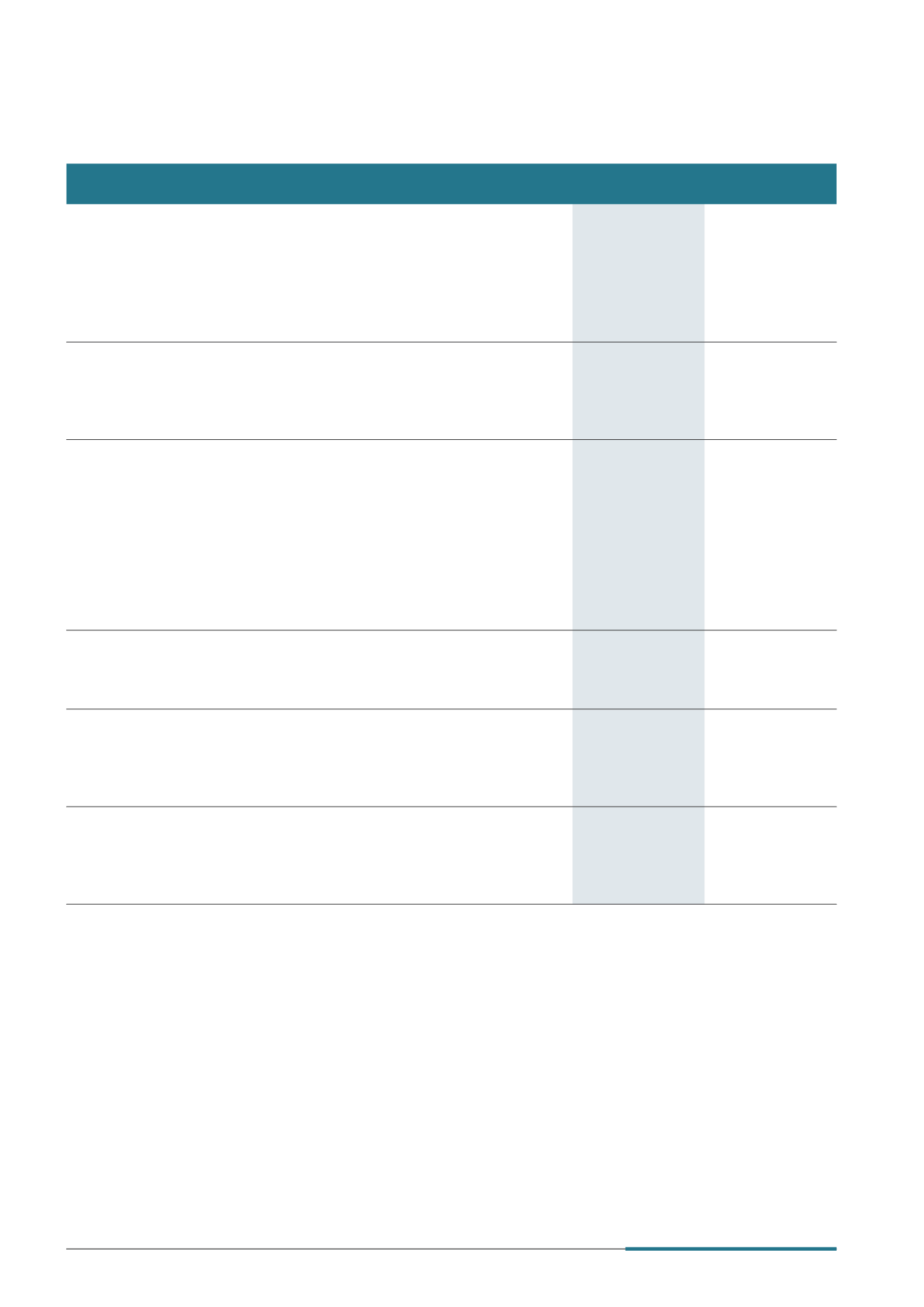

7UHDVXU\ +LJKOLJKWV

2014

2013

Restated

1

%DQN )DFLOLWLHV DQG $YDLODEOH )XQGV 6 PLOOLRQ

Bank facilities available

13,202

12,278

Amount utilised for loans

8,211

8,563

Available and unutilised

4,991

3,715

Cash and mxed deposit balances

2,749

6,306

Unutilised facilities and funds available for use

7,740

10,021

'HEW 6HFXULWLHV &DSDFLW\ 6 PLOOLRQ

Debt securities capacity

15,697

15,837

Debt securities issued (net of debt securities purchased)

7,775

7,373

Unutilised debt securities capacity

2

7,922

8,464

/HYHUDJH 5DWLRV 6 PLOOLRQ

Gross debt

15,986

15,936

Cash and cash equivalents

2,749

6,306

Net debt

13,237

9,630

Equity

23,219

24,455

Net debt equity ratio (times)

0.57

0.39

Total assets (net of cash)

41,364

38,757

Net debt/Total assets (net of cash) (times)

0.32

0.25

6HFXUHG 'HEW 5DWLR

6 PLOOLRQ

Secured debt

5,849

5,341

Percentage of secured debt

37%

34%

,QWHUHVW &RYHU 5DWLR 6 PLOOLRQ

Earnings before net interest, tax, depreciation and amortisation

2,739

2,616

Net interest expense

382

458

Interest cover ratio (times)

7.2

5.7

,QWHUHVW 6HUYLFH 5DWLR 6 PLOOLRQ

Operating cashnow before interest and tax

2,038

2,583

Net interest paid

443

557

Interest service ratio (times)

4.6

4.6

Business Review

1

Comparatives have been restated to take into account the retrospective adjustment relating to FRS 110 Consolidated Financial Statements

which require the Group to consolidate CapitaCommercial Trust, CapitaMalls Malaysia Trust and Ascott Residence Trust.

2

This includes Euro Medium Term Note Programmes.