Positioning for the Future | 75

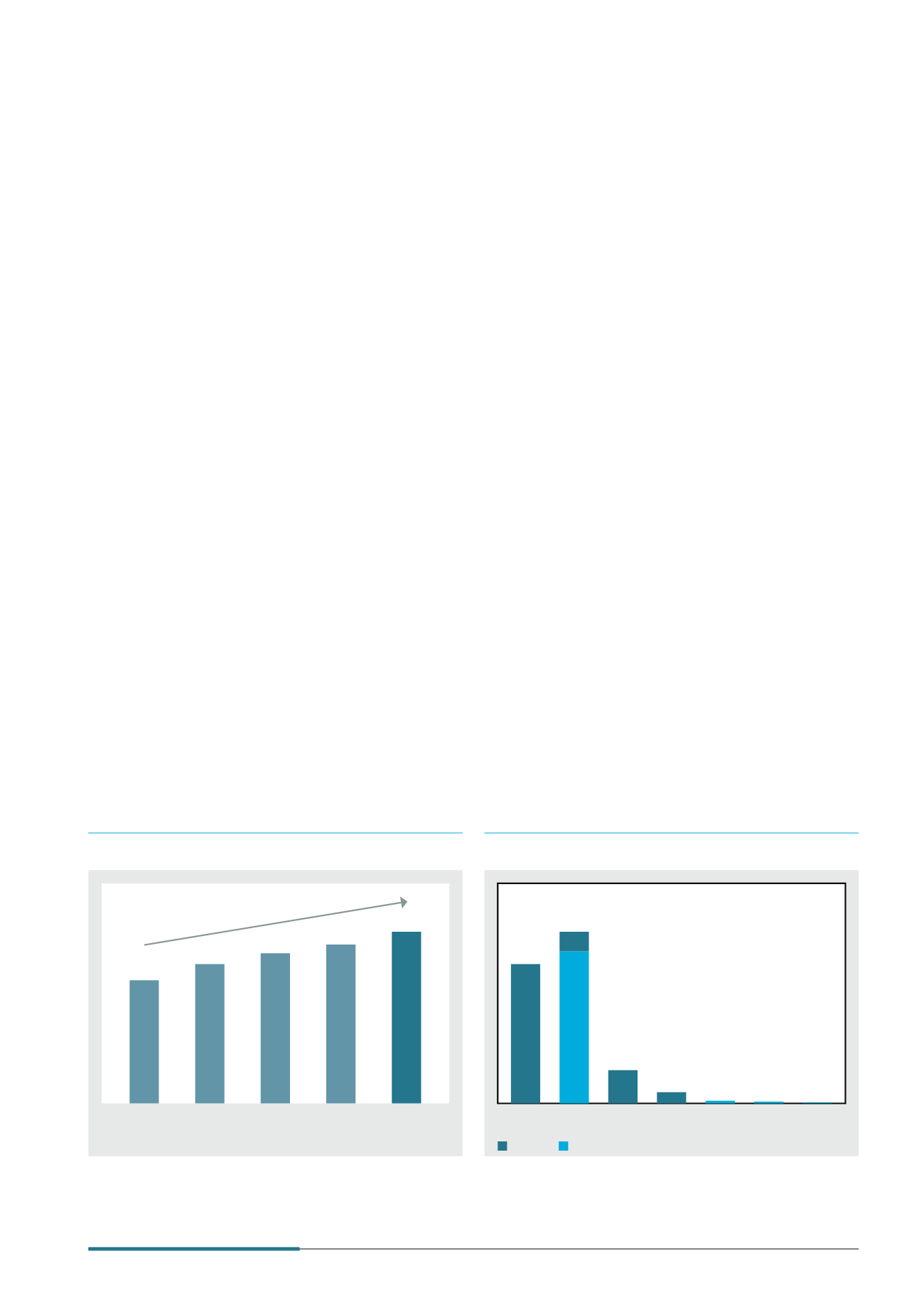

2010

2011

2012

2013

Restated

2014

30.4

34.4

37.1

39.2

42.4

CapitaLand Fund Management

CapitaLand is a leading real estate fund

manager in Asia, managing a total of

16 non-listed real estate vehicles and mve

listed Real Estate Investment Trusts (REITs)

with an aggregate Assets Under Management

(AUM) of S$42.4 billion. The majority of the

assets managed are located in CapitaLand’s

core markets of Singapore (38.7%) and China

(47.7%). Total management fees received by

the Group for its fund management business

in 2014 totalled S$145 million.

CapitaLand has a dedicated fund management unit that

works with the Group’s business units in the origination,

structuring and raising of private funding from global

capital partners. As a real estate developer-operator-owner

with multi-sector expertise and deep local knowledge of

the overseas markets it operates in, CapitaLand is able

to structure and customise a diverse variety of investment

options for its capital partners. The Group has a

respectable stable of global capital partners that includes

sovereign wealth funds, pension funds and insurance

companies. Non-listed real estate vehicles range from

private equity funds, club deals, to joint ventures,

where CapitaLand has a meaningful co-investment

stake that aligns the Group’s interest with that of its

capital partners.

Through its non-listed real estate vehicles and listed

REITs, CapitaLand is able to diversify its funding sources

while expanding its AUM. The fee income generated

from managing such funds and assets also enhances the

Group’s overall return on equity. The fund management

business offers an efmcient capital recycling platform

for the Group through which it matches the right capital

pricing with the appropriate real estate exposure across a

wide risk-reward spectrum.

The non-listed real estate vehicles managed by

CapitaLand are typically invested in development

and value-added plays which aim to generate higher

risk-adjusted returns and capital appreciation for

CapitaLand and its capital partners. Once the assets

in these non-listed real estate vehicles have matured

into core assets and generate stable yields, there is the

available option of recycling these stabilised assets into

the listed REITs. Through this capital recycling process,

CapitaLand is able to realise some investment returns,

redeploy capital into new higher-yielding opportunities,

while retaining a signimcant stream of stable income

through its equity interests in these listed REITs.

Fund management and capital partnership remain

the cornerstone of CapitaLand’s business model.

CapitaLand will continue to grow its AUM through accretive

acquisitions, developments and asset enhancement

initiatives and will focus on building relationships with

capital partners to ensure a robust pool of alternative

funding sources to support the Group’s growth.

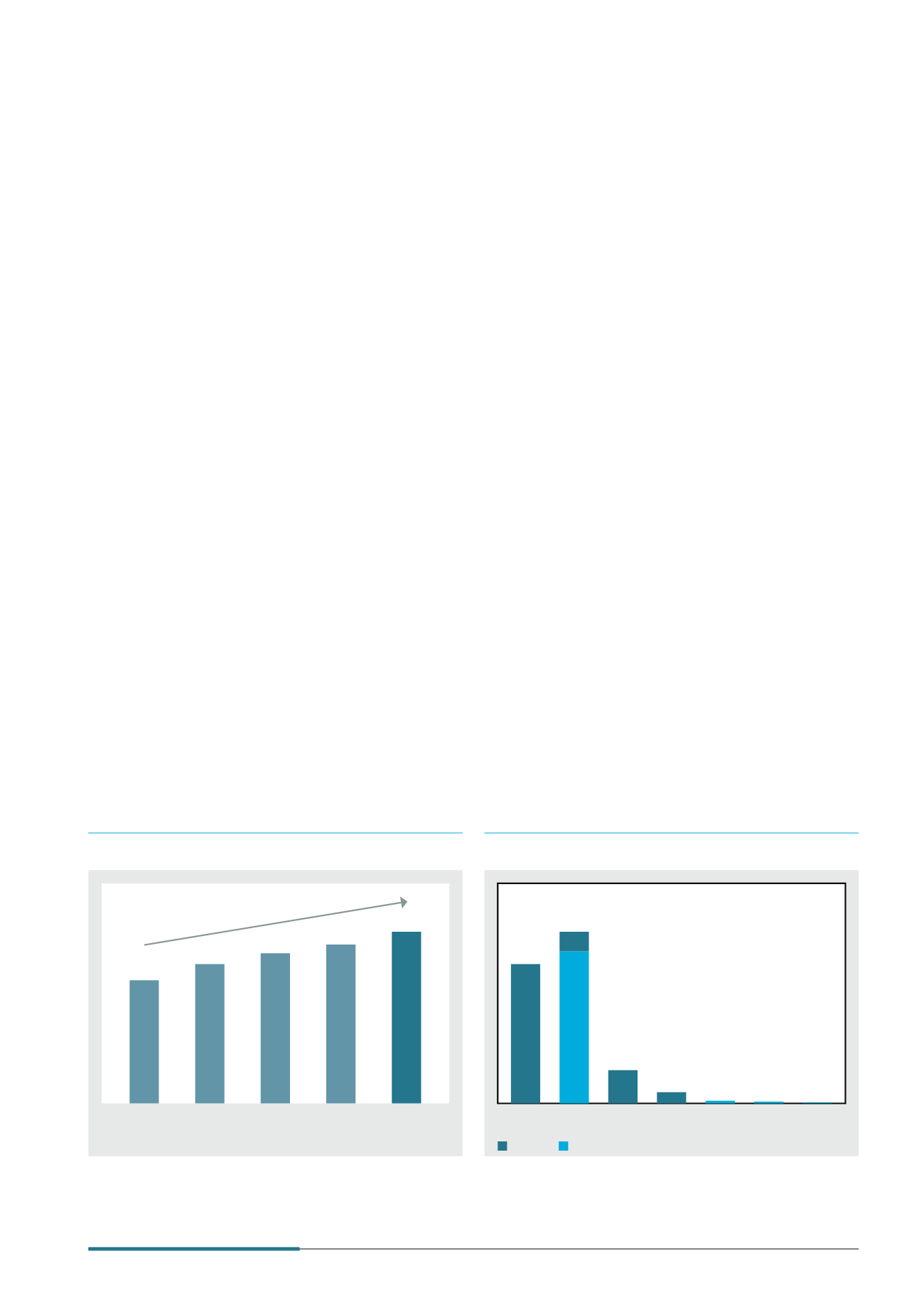

FY 2014 AUM Breakdown by Geography

(S$ billion)

Total AUM

1

(S$ billion)

Singapore China

Malaysia Japan India Vietnam

Asia &

Europe

2 REITs

1 REIT

1 REIT

2 non-

listed

1 non-

listed

1 non-

listed

1 REIT,

12 non-listed

CAGR 8.7%

16.4

17.9

3.9

1.3

0.3

0.2

0.1

2.3

REITs

Non-listed Real Estate Vehicles

2

1

Denotes total assets of REITs and non-listed real estate vehicles.

2

Includes private equity funds, club deals and JVs with capital partners.

Business Review