Positioning for the Future | 65

Borrowings

As at 31 December 2014, the Group’s gross debt stood

at S$16.0 billion. With a cash balance of S$2.8 billion,

the net debt as at 31 December 2014 was S$13.2 billion.

The increase in net debt was mainly due to the cash

consideration paid for the privatisation of CMA during

the year.

6KDUHKROGHUVҋ (TXLW\

As at 31 December 2014, issued and paid-up ordinary

share capital (excluding treasury shares) of the Company

comprised 4.3 billion shares at S$6.3 billion. The Group’s

total reserves increased from S$9.8 billion in December

2013 to S$10.5 billion in December 2014. This increase

was mainly contributed by the S$1,160.8 million net

promt for the year and exchange gains arising from

the translation of foreign operations, partially offset by

the goodwill arising from the privatisation of CMA and

payment of the 2013 dividends during the year.

As a result of the increase in total reserves,

the shareholders’ funds rose to S$16.8 billion as at end

2014 compared to S$16.1 billion in 2013. Accordingly,

the Group’s net tangible assets per share increased from

S$3.68 in 2013 to S$3.83 as at 31 December 2014.

This refers to the value of all real estate managed by CapitaLand group entities stated at 100% of the property carrying value.

The Group continues to grow its assets under

management, and as at 31 December 2014, the Group

managed S$70.6 billion of real estate assets, 9.3%

higher than FY 2013, which mrmly strengthens its position

as one of Asia’s largest real estate companies.

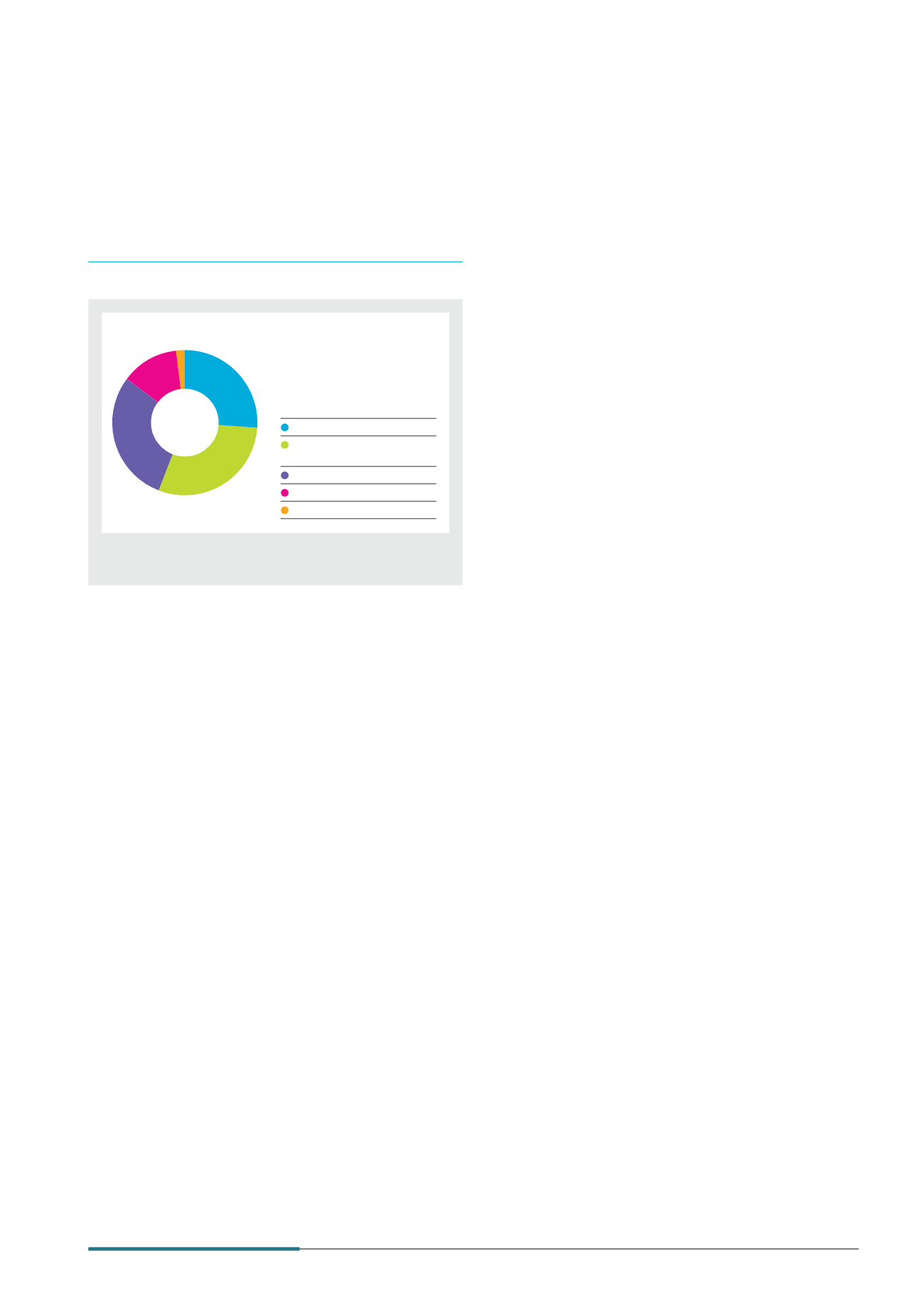

7RWDO $VVHWV E\ (IIHFWLYH 6WDNH

%

Residential & Ofmce Strata 26.2

Commercial & Integrated

Developments

1

29.9

Malls

29.3

Serviced residence

12.9

Others

1.7

1

Excluding residential component.

S$33.1b

Business Review