Positioning for the Future | 73

Ascott

Ascott is the largest international serviced

residence owner-operator in the world, with a

portfolio of quality serviced residences which it

manages and enhances through its operations

and award-winning brands spanning 89 cities

in 24 countries.

A Year of Tremendous Growth

2014 has been a year of tremendous growth for Ascott,

adding over 4,800 units to its global network through

acquisitions, management contracts, strategic alliances,

franchises and leases. As at 31 December 2014,

Ascott owns and manages over 38,300 units in

256 properties across more than 89 cities in Asia Pacimc,

Europe and the Gulf region.

In 2014, Ascott secured 21 management, lease and

franchise contracts, and acquired six properties, out of

which mve are acquired by Ascott Residence Trust

(Ascott Reit), extending its presence to seven new cities

in China, Indonesia, Laos, Myanmar and South Korea.

In China, Ascott successfully crossed its target of

12,000 apartment units this year, reinforcing its

leadership position as the largest international serviced

residence owner-operator in China with 69 properties

across 23 cities.

Ascott’s hospitality management and service fee income

remained stable at S$133 million. Overall, Revenue Per

Available Unit grew by 3% to S$123 in 2014, driven

mainly by growth in China, Europe and Japan.

Ascott continued to grow through acquisitions in 2014.

It acquired The Mercer in Hong Kong and

Ascott Kuningan Jakarta in Indonesia, for a total of

approximately S$179 million. Through Ascott Reit,

it acquired properties in Dalian, Tokyo and Greater

Sydney with an aggregate property value of

approximately S$307 million.

In addition, Ascott unlocked value through the

divestment of three serviced residence properties to

Ascott Reit, two of which were held by its 36.1%-owned

Ascott China Fund.

In 2014, Ascott continued to drive growth in China

through forming a strategic alliance with Vanke, a leading

developer in China. In Australia, Ascott acquired a 20%

stake in Quest Serviced Apartments (Quest) and expects

to invest up to S$560 million to acquire new properties

which Quest will secure for its franchise in Australia over

the next mve years.

Ascott continued its asset enhancement initiatives

(AEIs) to reposition and upgrade its products to drive

organic operational growth. Since 2013, close to

S$100 million was invested to refurbish various properties

in Asia and Europe. Results were positive as refurbished

properties achieved higher Average Daily Rate (ADR).

For instance, the ADR of refurbished Citadines Ramblas

Barcelona was lifted by 17% for its renovated rooms.

To cap off its 30

th

year of hospitality excellence,

Ascott received a total of 84 highly-coveted accolades in

the year, cementing its position as the global leader in the

serviced residence industry.

/RRNLQJ $KHDG

Ascott will continue to consolidate its position in key

markets and enhance the value of its portfolio through

acquisitions, robust AEIs and divesting properties for

optimal returns. Growth will be accelerated through

acquisitions, management contracts, strategic alliances

and franchises, to achieve its new target of 80,000 units

globally by 2020. Additional fee contribution is expected

to improve return on equity once Ascott reaches stabilised

operation scale.

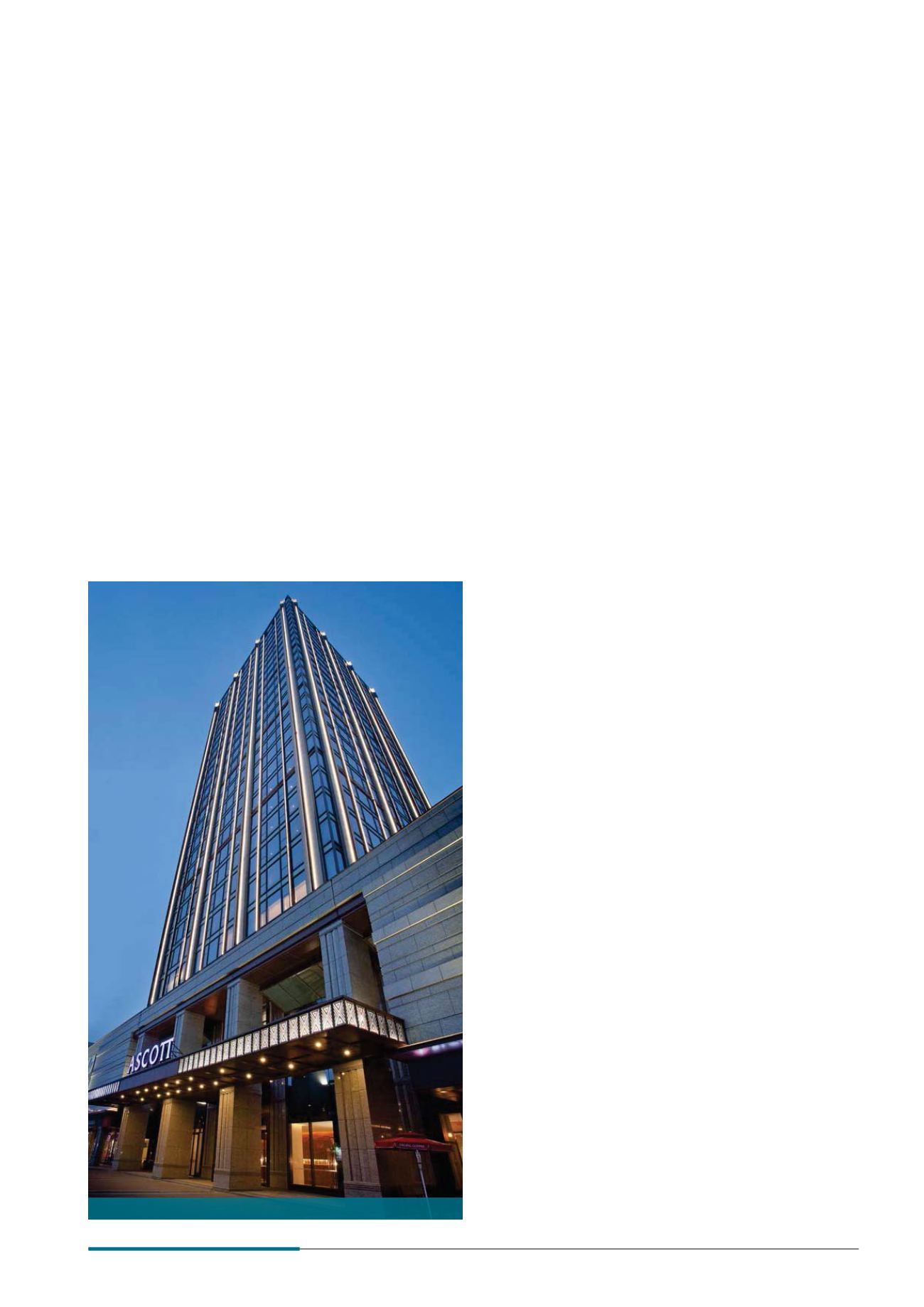

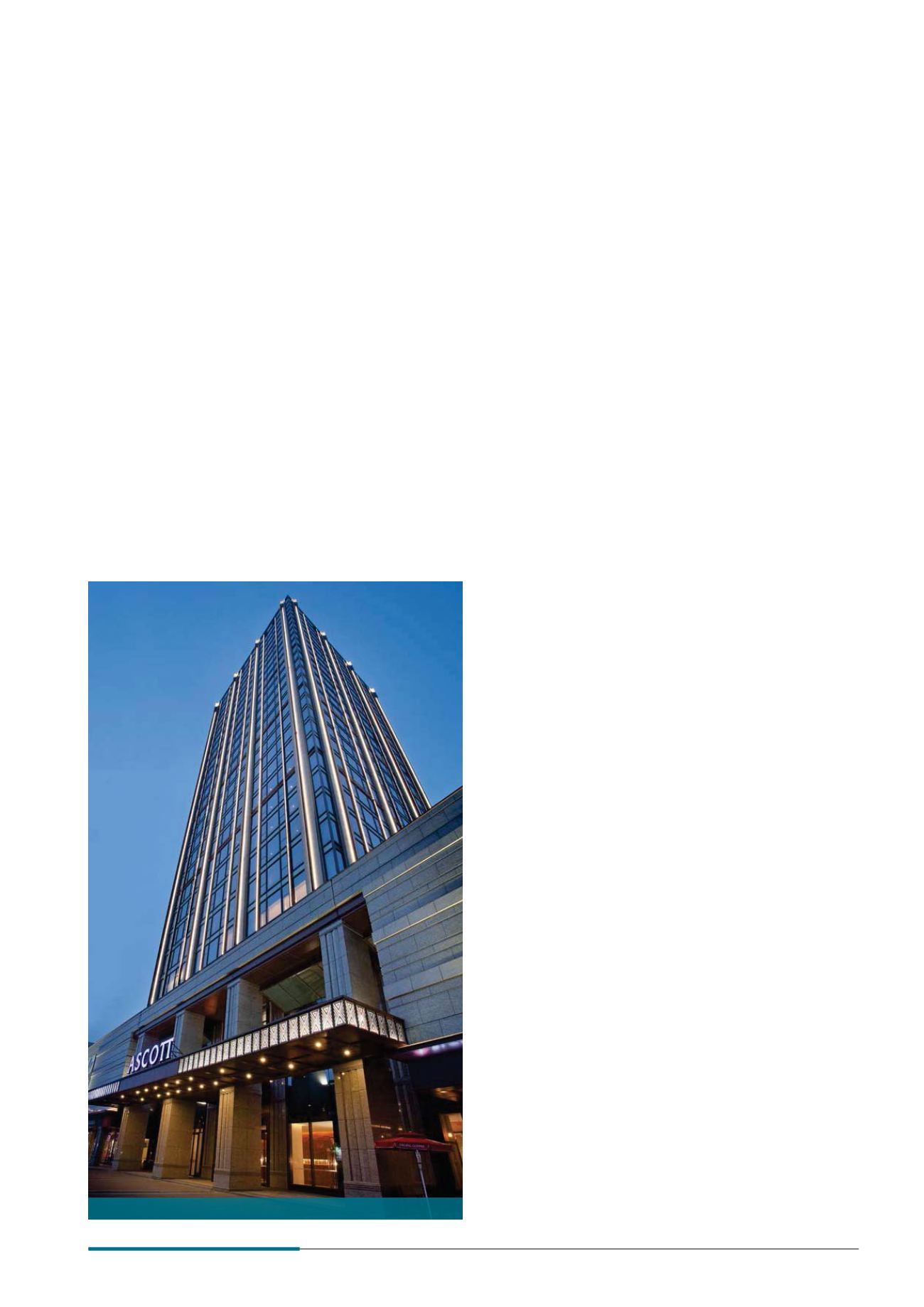

Ascott Midtown Suzhou, China

Business Review