Positioning for the Future | 67

Overview

The Group strives to maintain a prudent capital structure

and actively reviews its cashnows, debt maturity

promle and overall liquidity position on an ongoing

basis. The main sources of the Group’s operating

cashnows are derived from rental income from our

investment properties, fees and residential sales.

As part of its liquidity management to support its

funding requirements, investment needs and growth

plans, the Group actively diversimes its funding sources

by putting in place a mix of undrawn banking facilities

and capital market programmes.

The global mnancial outlook has improved but risks remain

with the lacklustre recovery in the Eurozone economies

and slower growth in China. Against this backdrop,

the Group continues to maintain a healthy balance sheet.

The Group’s total gross debt of S$16.0 billion was

marginally higher as compared to S$15.9 billion

last year. Net debt as at 31 December 2014 was

S$13.2 billion as compared to S$9.6 billion as at

December 2013. The increase in net debt was mainly

due to the cash consideration paid in the privatisation of

CMA during the year.

Finance costs for the Group were S$439.5 million for the

year ended 2014. This was about 9% lower compared to

S$481.7 million last year. Finance costs were lower as the

average interest rate and level of borrowings were both

lower in 2014. The reduction in mnancing costs is a result

of capital management initiatives undertaken in 2013.

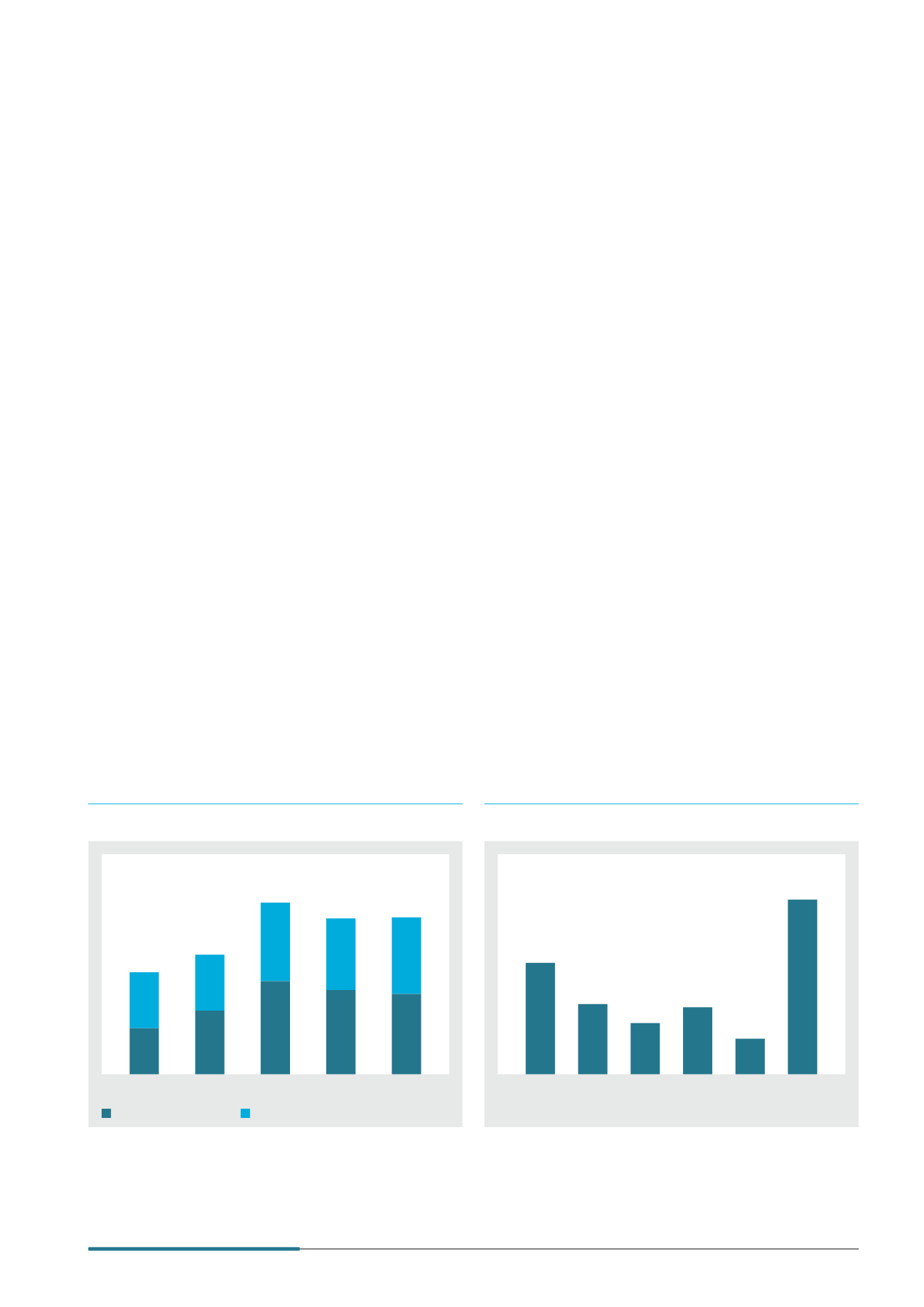

Sources of Funding

As at year end, 51% of the Group’s total debt was funded

by bank borrowings and the balance 49% was raised

through capital market issuances. The Group continues

to seek diversimed and balanced sources of funding to

ensure mnancial nexibility and mitigate concentration risk.

Commitment of Funding

As at end 2014, the Group is able to achieve 99% of its

funding from committed facilities. The balance 1% was

funded by nexible uncommitted short term facilities.

As part of its mnancial discipline, the Group constantly

reviews its portfolio to ensure that a prudent portion

of committed funding is put in place to match the

investments’ planned holding periods. Amidst the volatile

global economic climate, committed mnancing is secured

whenever possible to ensure that the Group has sufmcient

mnancial capacity to support its operations, investments

and future growth plans.

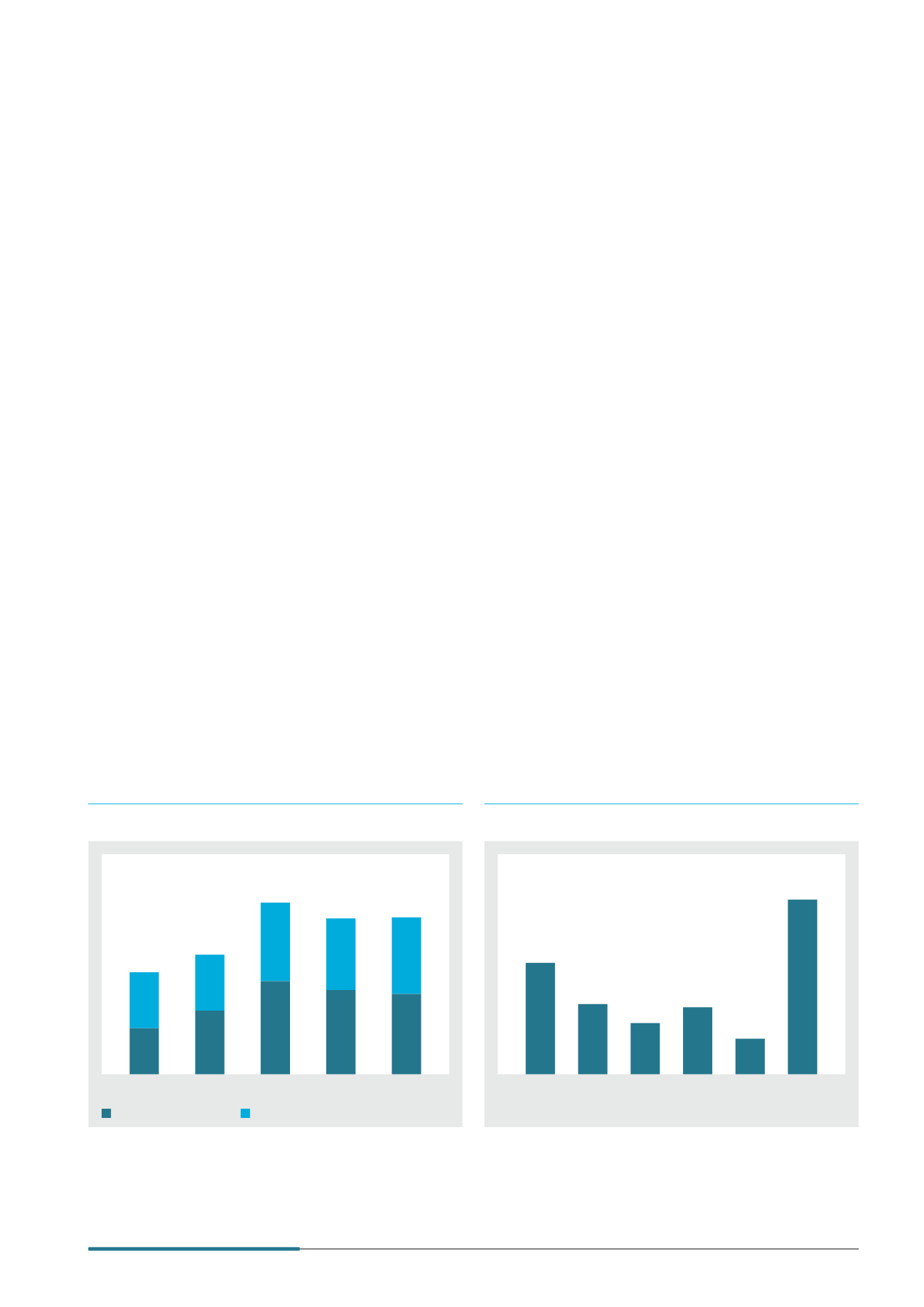

0DWXULW\ 3URÀOH

The Group has proactively built up sufmcient cash

reserves and credit lines to enable it to meet its short

term debt obligations, support its remnancing needs and

pursue opportunistic investments. The Group maintains

a healthy balance sheet and has unutilised bank lines

of about S$5.0 billion. To ensure mnancial discipline,

the Group constantly reviews its loan promle so as to

mitigate any remnancing risks, avoid concentration and

extend its maturity promle where possible. In reviewing the

maturity promle of its loan portfolio, the Group also took

into account any divestment or investment plans, interest

rate outlook and the prevailing credit market conditions.

'HEW 0DWXULW\ 3URÀOH

(S$ billion)

Within

1 year

2 years 3 years 4 years 5 years More than

5 years

22%

14%

10%

13%

7%

34%

3.5

2.2

1.6

2.1

1.1

5.5

Sources of Funding

(S$ billion)

2010

2011

2012

Restated

1

2013

Restated

1

2014

10.4

12.2

17.5

15.9

16.0

5.7

55%

46%

46%

46% 49%

51%

54%

54%

54%

5.7

8.0

9.5

6.5

4.7

45%

8.2

8.6

7.3

7.8

Bank and Other Loans

Debt Securities

Note Convertible Bonds are renected as held till mnal maturity.

Business Review

1

Comparatives have been restated to take into account the retrospective adjustment relating to FRS 110 Consolidated Financial Statements

which require the Group to consolidate CapitaCommercial Trust, CapitaMalls Malaysia Trust and Ascott Residence Trust.