220 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

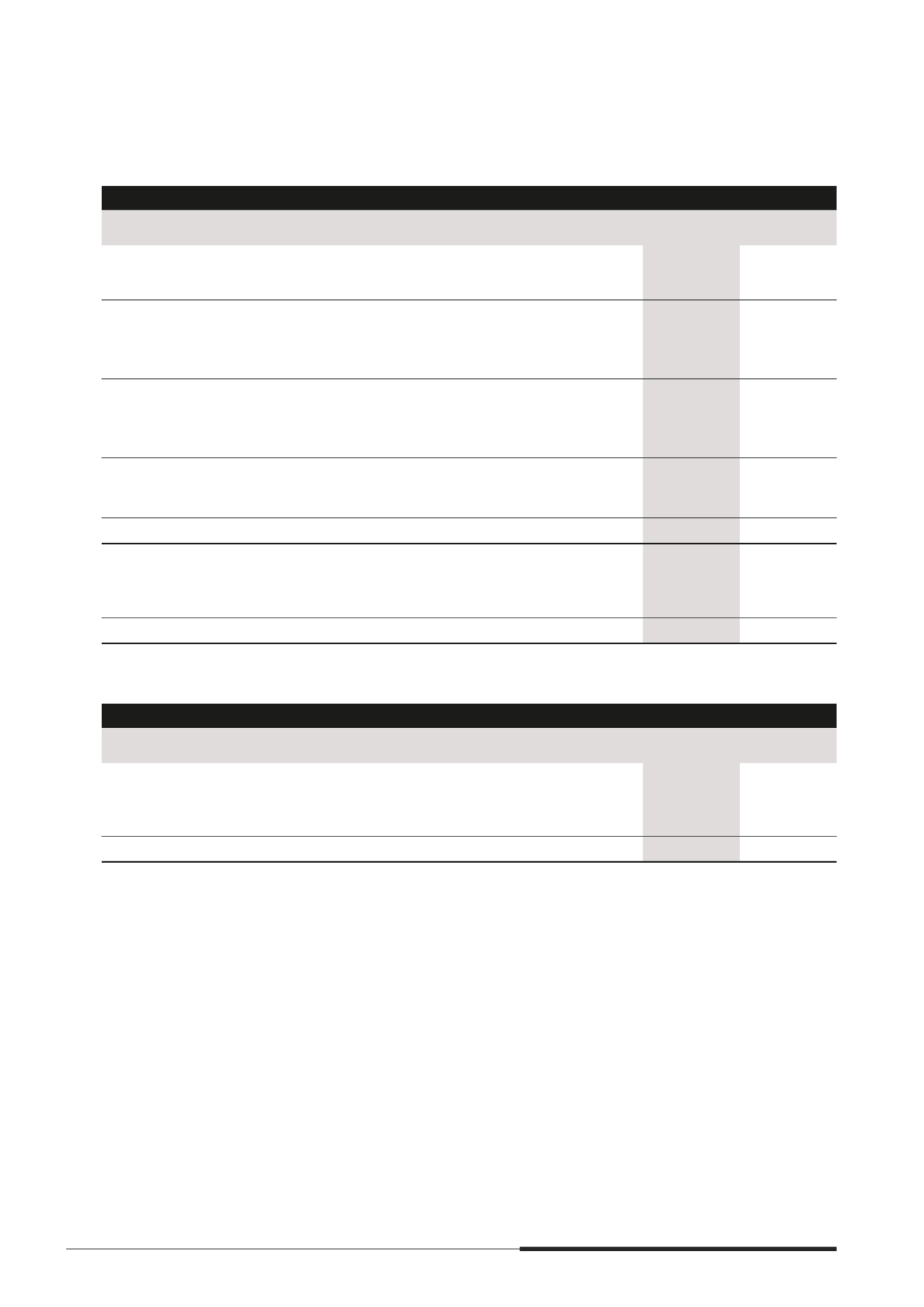

39 DISCONTINUED OPERATION

(cont’d)

The results of the discontinued operation are as follows

The Group

2014

$’000

2013

$’000

Revenue

–

1,010,457

Cost of sales

–

(755,209)

*URVV SURÀW

–

255,248

Other operating income

–

78,679

Administrative expenses

–

(137,954)

Other operating expenses

–

(5,484)

3URÀW IURP RSHUDWLRQV

–

190,489

Finance costs

–

(58,239)

Share of results of associates

16,300

32,123

Share of results of joint ventures

–

(9,746)

3URÀW EHIRUH JDLQ RQ VDOH RI GLVFRQWLQXHG RSHUDWLRQ

16,300

154,627

Gain/(Loss) on sale of discontinued operation

19,059

(120,849)

Tax on gain on sale of discontinued operation

(6,225)

–

3URÀW IRU WKH \HDU

29,134

33,778

3URÀW DWWULEXWDEOH WR

Owners of the Company

29,134

(34,327)

Non-controlling interest

–

68,105

3URÀW IRU WKH \HDU

29,134

33,778

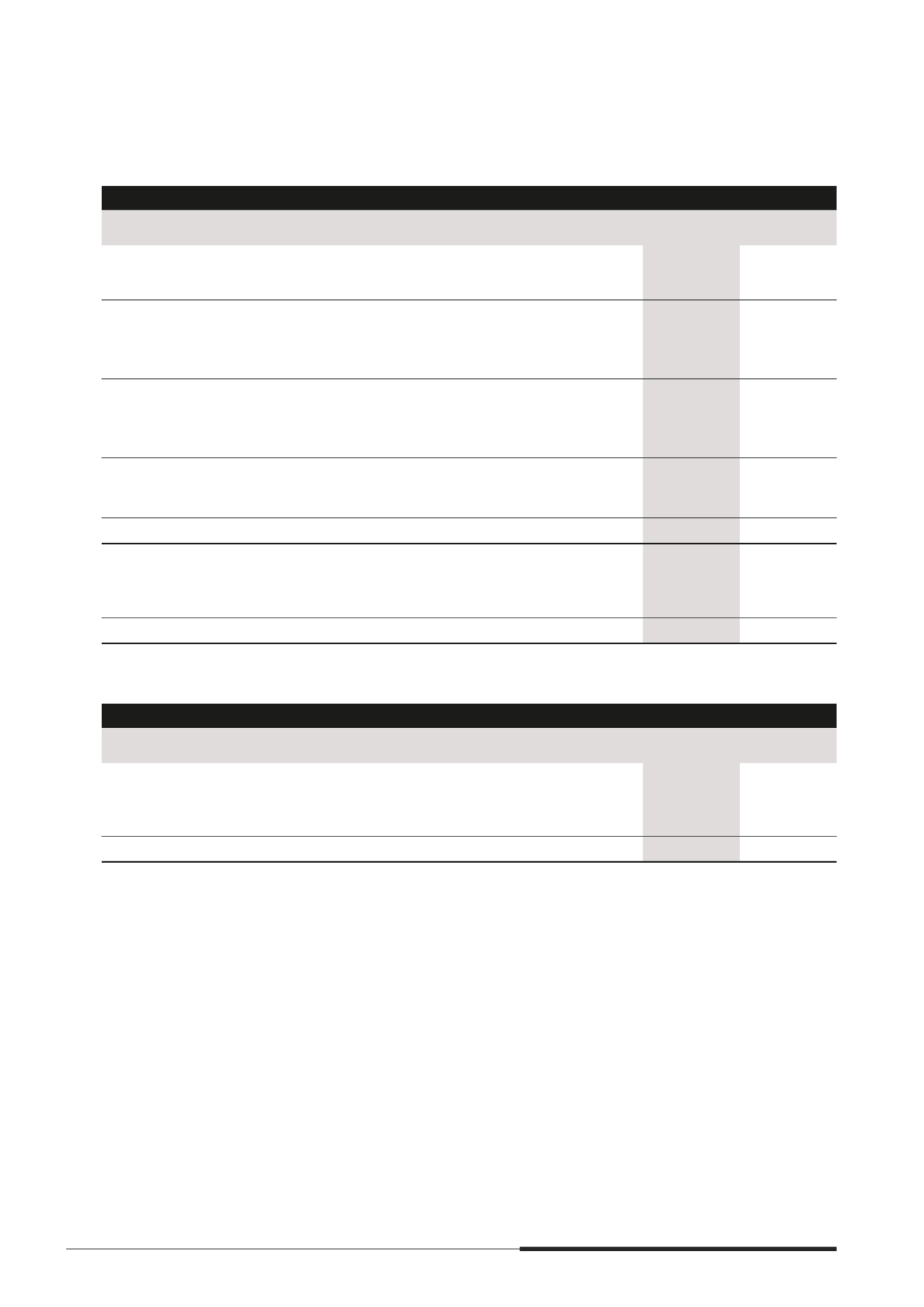

The impact of the discontinued operation on the consolidated cash now of the Group is as follows

The Group

2014

$’000

2013

$’000

Operating cash nows

–

189,556

Investing cash nows

952,356

461,493

Financing cash nows

–

(264,018)

7RWDO FDVK ÁRZV IURP GLVFRQWLQXHG RSHUDWLRQ

952,356

387,031

40 SUBSEQUENT EVENT

On 16 February 2015, the Group announced that it will acquire the remaining 60% equity interest in CapitaLand

Township Holdings Pte Ltd (CL Township), whose principal activity relates to township development in China,

for a cash consideration of $240 million. The Group will also sell its 40% equity interest in Surbana International

Consultants Holdings Pte Ltd (SIC), which provides building consultancy services and related businesses in Asia,

Africa and Middle East, for a cash consideration of $104 million. Upon completion of the acquisition, the Group’s

interest in CL Township will increase from 40% to 100% and CL Township will become a wholly-owned subsidiary

of the Group.

The full ownership of CL Township will allow the Group to integrate the township development business into

CL China; while the divestment of SIC is consistent with the Group’s strategy to focus resources on its core

businesses.

41 COMPARATIVE INFORMATION

Certain comparatives in the mnancial statements have been changed from prior year due to the changes in

accounting policies as described in note 2(a)(i).