Positioning for the Future | 217

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

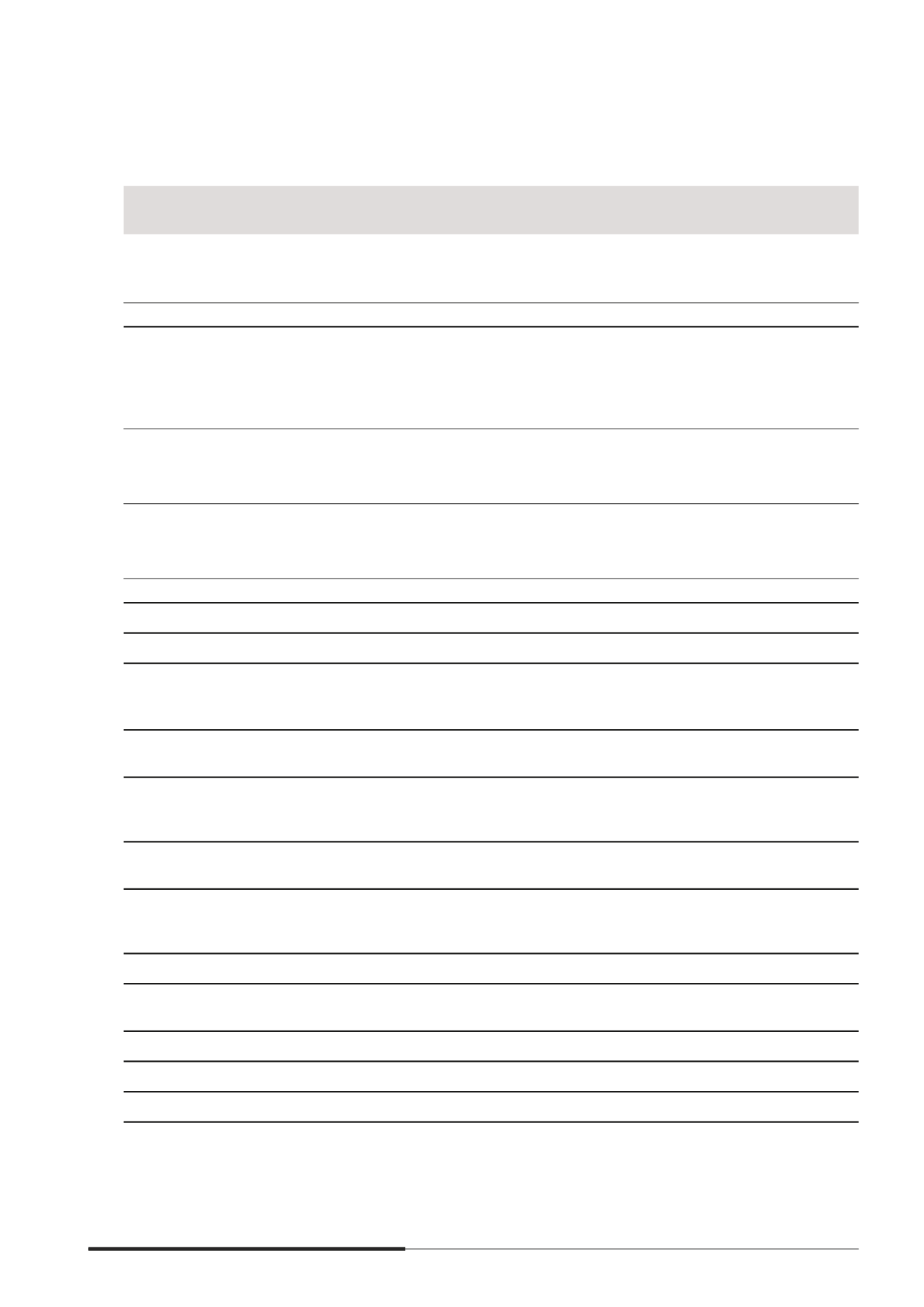

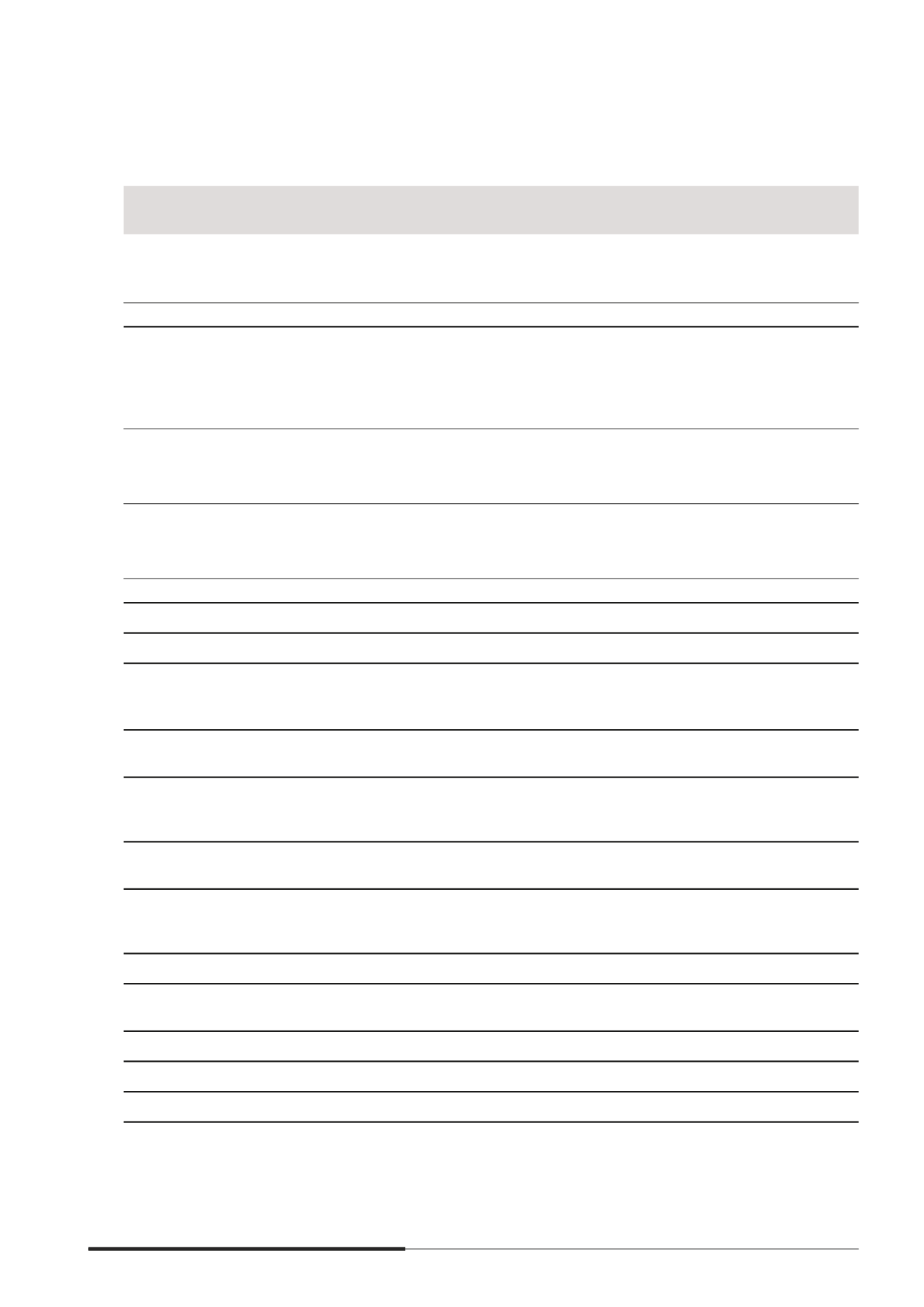

38 OPERATING SEGMENTS

(cont’d)

Operating Segments – 31 December 2014

CapitaLand

Singapore

$’000

CapitaLand

China

$’000

CapitaMalls

Asia

$’000

Ascott

$’000

Others

$’000

Elimination

$’000

Total

$’000

Revenue

External revenue

1,232,921

636,186 1,177,468

682,895

195,128

– 3,924,598

Inter-segment revenue

8,616

1,314

276

39

405,931

(416,176)

–

Total revenue

1,241,537

637,500 1,177,744

682,934

601,059

(416,176) 3,924,598

Segmental results

Company and

subsidiaries

611,113

170,603

440,325

248,883

636,795

(640,714) 1,467,005

Associates

67,196

202,996

303,384

48,957

5,934

(1,639)

626,828

Joint ventures

124,374

35,502

201,453

(344)

(17,878)

–

343,107

Earnings before

interest and tax

802,683

409,101

945,162

297,496

624,851

(642,353) 2,436,940

Finance costs

(439,473)

Tax expense

(266,908)

Promt from

continuing operations

1,730,559

Promt from

discontinued operation

29,134

3URÀW IRU WKH \HDU

1,759,693

Segment Assets

11,753,783 10,497,957 13,245,960 6,886,655 8,447,364 (6,718,231) 44,113,488

Segment Liabilities

4,166,311 3,153,220 4,681,717 3,163,167 5,740,542

– 20,904,957

Other segment items:

Interest income

7,444

11,384

19,242

9,213

10,005

–

57,288

Depreciation and

amortisation

(5,299)

(1,694)

(10,536)

(38,285)

(13,683)

–

(69,497)

(Provision made)/

Reversal of provision

for foreseeable losses

(80,500)

(8,334)

–

(11,500)

17,523

–

(82,811)

Allowance for impairment

losses for assets

(1,898)

(79)

(557)

(23)

(20,277)

(39,929)

(62,763)

Fair value gains/(losses)

on investment properties

and assets held for sale

327,744

38,902

24,152

72,311

(6,188)

–

456,921

Share-based expenses

(5,809)

(5,784)

(26,189)

(4,664)

(10,274)

–

(52,720)

Gains/(Losses) on

disposal of investments

1,863

7,782

(8,614)

2,835

1,238

–

5,104

Associates

580,514 2,818,578 5,065,528

285,962

39,117

–

8,789,699

Joint ventures

1,226,687

478,234 2,196,431

3,055

86,754

–

3,991,161

Capital expenditure

#

444,569

78,006

185,443

386,758

95,029

–

1,189,805

#

Capital expenditure consists of additions of property, plant and equipment, investment properties and intangible assets.