210 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

34 FAIR VALUE OF ASSETS AND LIABILITIES

(cont’d)

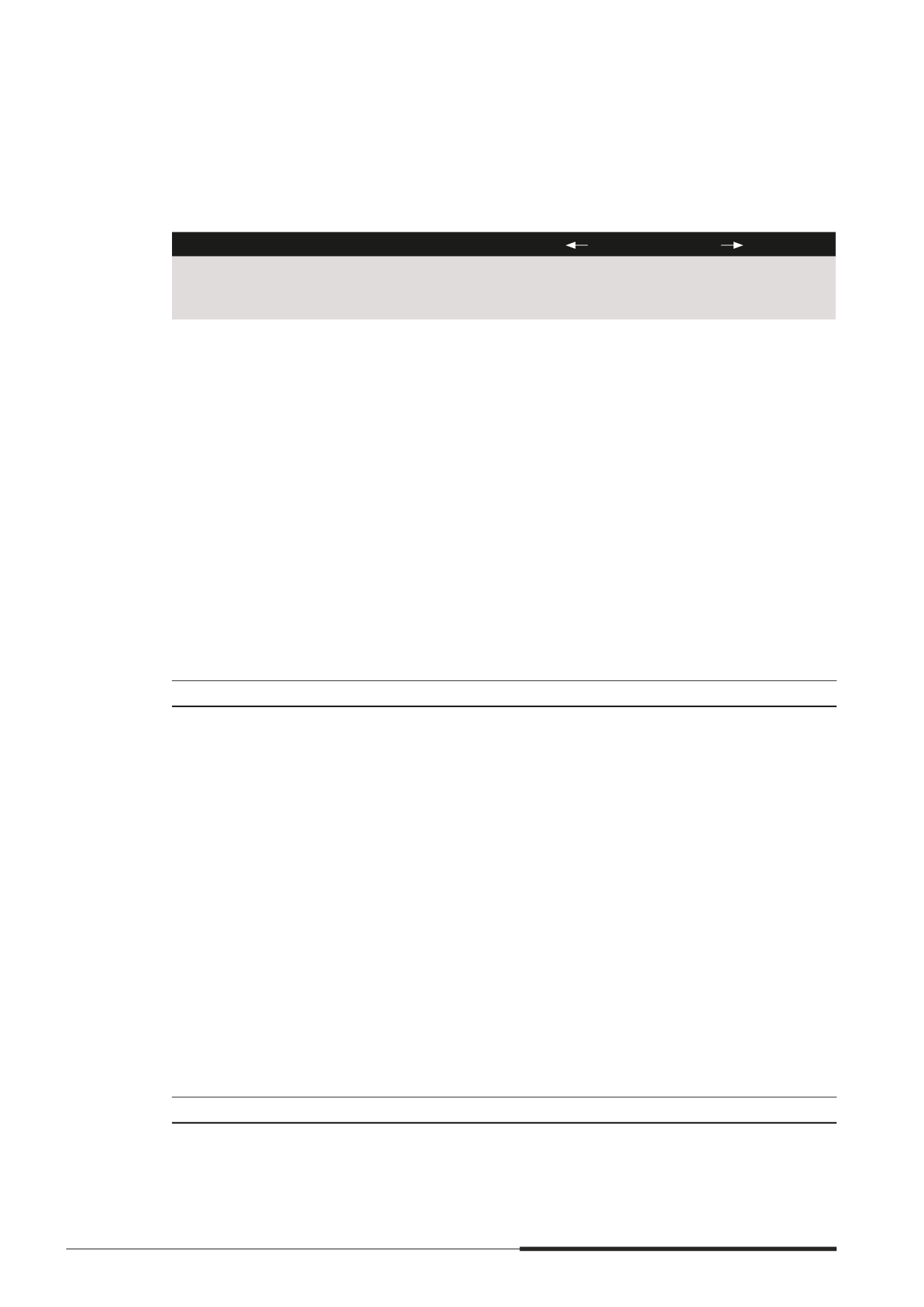

(d) Level 3 fair value measurements

(i) Reconciliation of Level 3 fair value

The movements of mnancial and non-mnancial assets classimed under Level 3 are presented as follows

Investment properties

Note

Unquoted

equity

securities

$’000

Completed

$’000

Under

development

$’000

Assets

held

for sale

$’000

The Group

2014

Balance as at 1 January 2014,

restated

213,626 13,389,035

2,106,899

87,033

Acquisition of subsidiaries

31(b)

–

363,514

–

–

Additions

–

420,791

641,116

–

Disposals

(2,575)

(89,175)

–

(5,456)

Changes in fair value recognised

in the promt or loss

–

393,709

57,386

5,826

Changes in fair value recognised

in other comprehensive income

3,283

–

–

–

Reclassimcations (to)/from

development properties for sale

and property, plant and equipment

–

(232,512)

232,107

–

Reclassimcation from investment

in associates

–

–

–

104,000

Reclassimcations

–

1,313,465 (1,313,465)

–

Translation differences

(20,728)

(171,389)

37,717

–

Balance as at 31 December 2014

193,606 15,387,438

1,761,760

191,403

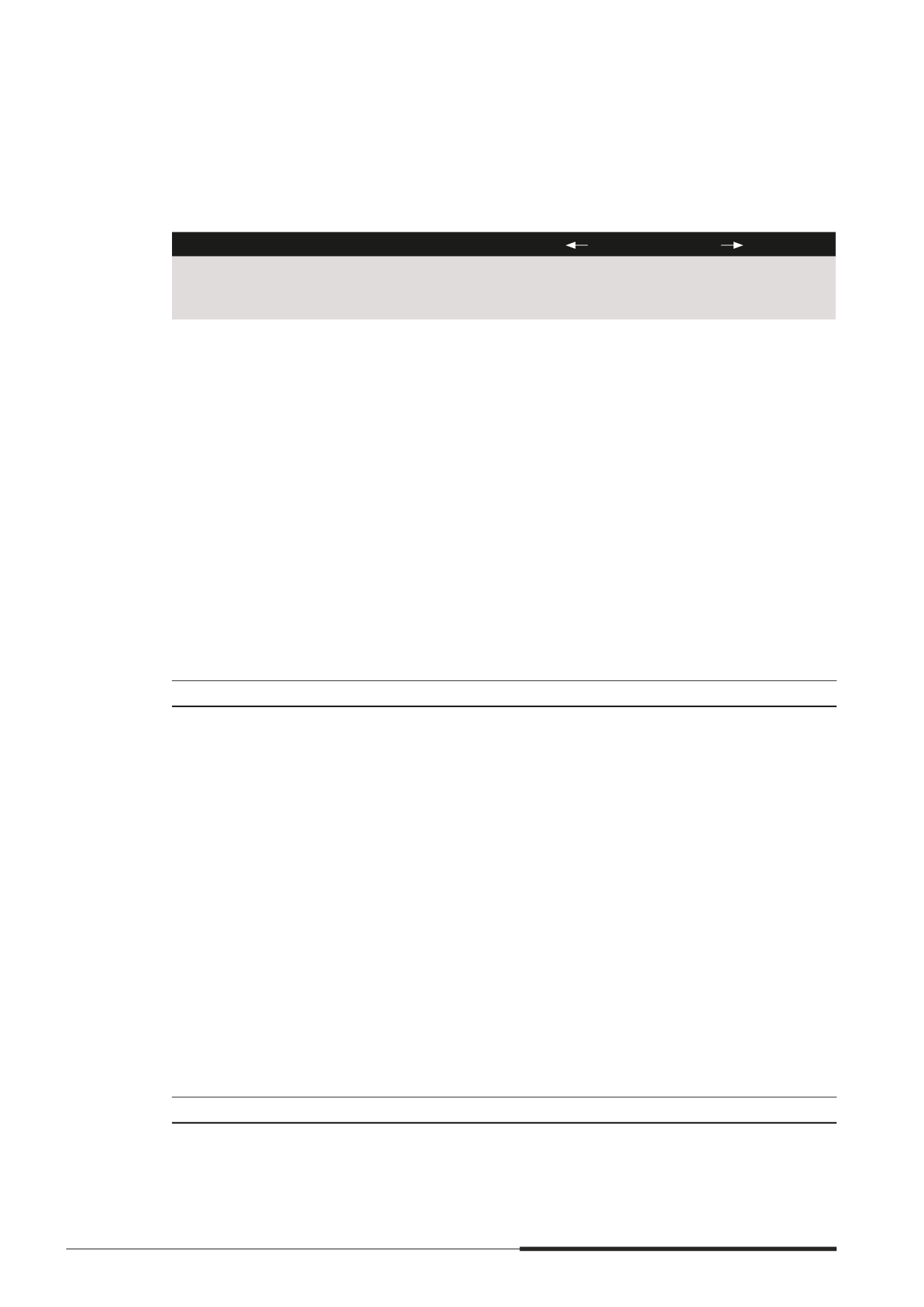

2013

Balance as at 1 January 2013,

restated

268,681 13,988,461

3,893,608

–

Acquisition of subsidiaries

–

303,379

443,329

–

Disposal of subsidiaries

(178) (2,779,866)

(597,083)

–

Capital reduction

(11,083)

–

–

–

Additions

–

138,811

690,811

–

Disposals/Written off

–

(276,620)

–

(106)

Changes in fair value recognised

in the promt or loss

–

452,308

^

9,150

–

Changes in fair value recognised

in other comprehensive income

1,699

–

–

–

Reclassimcations (to)/from

assets held for sale and

investment properties

–

(86,471)

–

86,471

Reclassimcations (to)/from

development properties for sale

and property, plant and equipment

–

(126,796)

(200,560)

668

Reclassimcations

–

2,147,802 (2,147,802)

–

Translation differences

(45,493)

(371,973)

15,446

–

Balance as at 31 December 2013

213,626 13,389,035

2,106,899

87,033

^

Included $16.3 million relating to a discontinued operation.