212 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

34 FAIR VALUE OF ASSETS AND LIABILITIES

(cont’d)

(d) Level 3 fair value measurements

(cont’d)

(iii) Valuation processes applied by the Group

The signimcant non-mnancial asset of the Group categorised within Level 3 of the fair value hierarchy is

investment properties. Generally, the fair values of investment properties are determined by external,

independent property valuers, having appropriate recognised professional qualimcations and recent

experience in the location and category of property being valued. The valuation companies provide the

fair values of the Group’s investment property portfolio every six months. The valuation and its mnancial

impact are discussed with the Audit Committee and Board of Directors in accordance with the Group’s

reporting policies.

35 COMMITMENTS

As at the balance sheet date, the Group and the Company had the following commitments

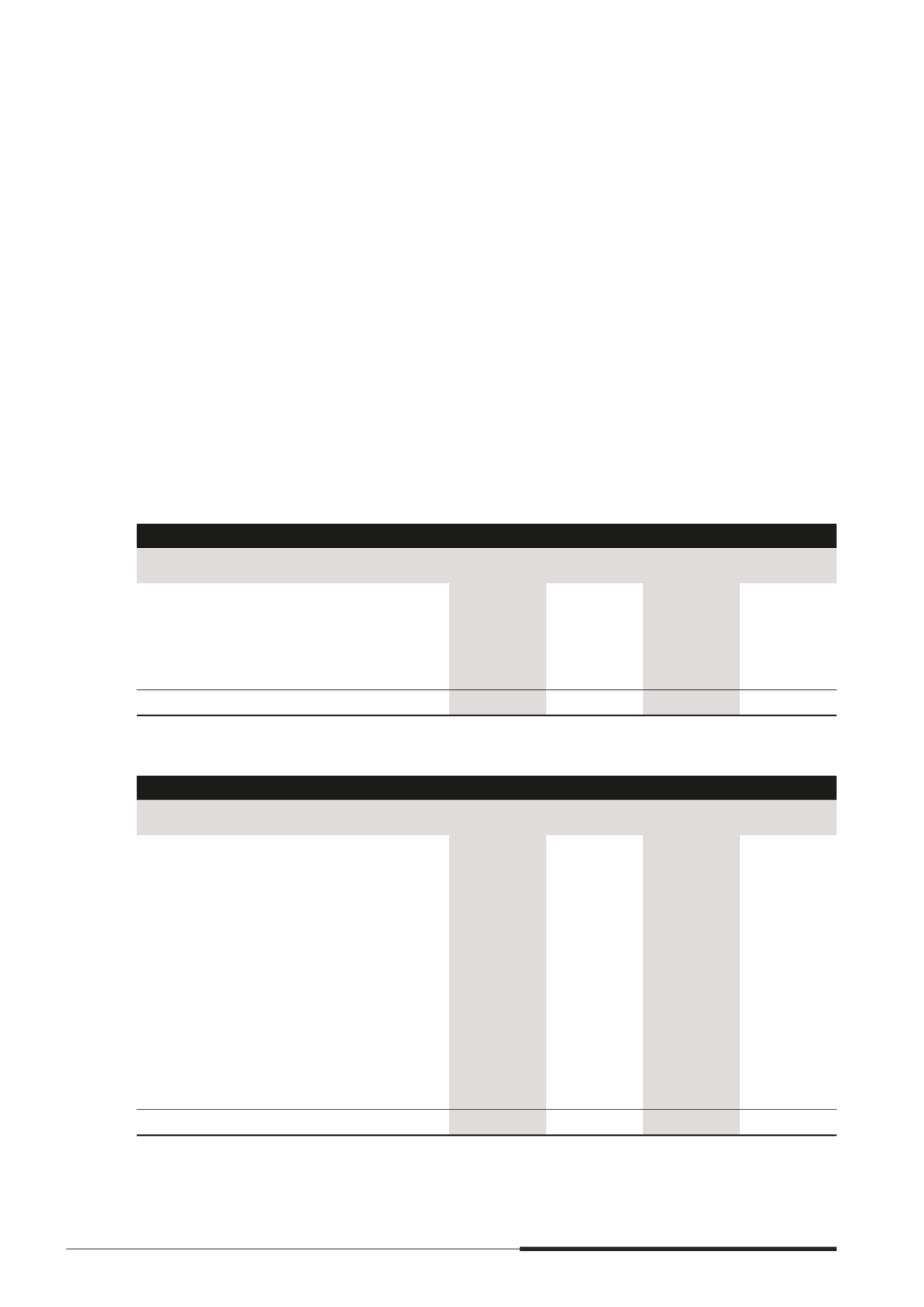

(a) Operating lease

The Group leases a number of ofmces, motor vehicles, ofmce equipments and serviced apartments under

operating leases. The leases have tenure ranging from one to 30 years, with an option to renew the lease

after that date. Lease payments are usually revised at each renewal date to renect the market rate. Future

minimum lease payments for the Group and the Company on non-cancellable operating leases are as follows

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Lease payments payable

Not later than 1 year

45,656

56,638

8,366

7,405

Between 1 and 5 years

76,975

116,541

45,751

36,238

After 5 years

38,947

74,573

28,848

47,455

161,578

247,752

82,965

91,098

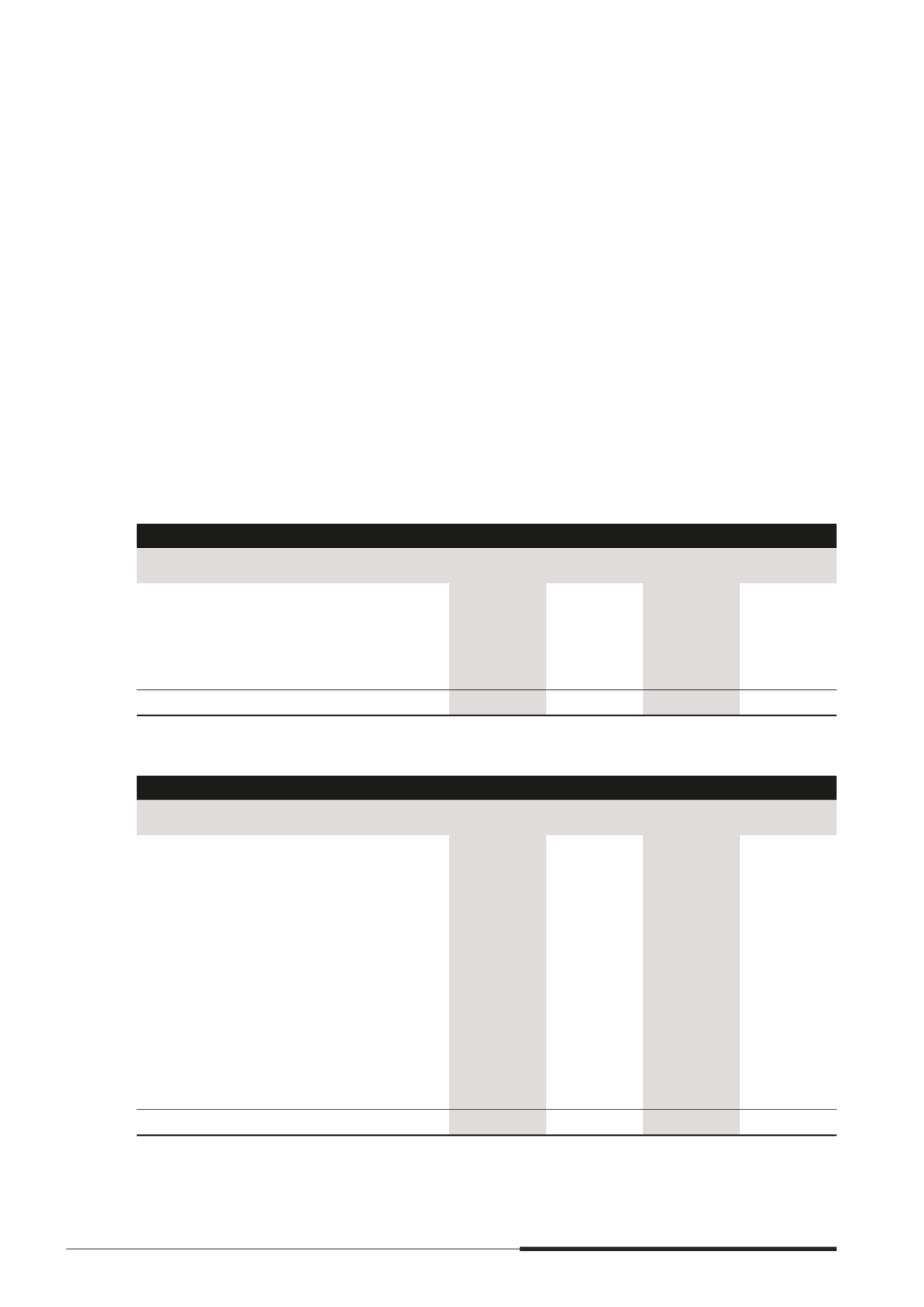

(b) Commitments

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Commitments in respect of

- capital expenditure contracted

but not provided for in the

mnancial statements

69,581

115,485

15,360

9,303

- development expenditure

contracted but not provided

for in the mnancial statements

1,864,722

1,664,312

–

–

- capital contribution in

associates and joint ventures

460,433

679,758

–

–

- purchase of land/properties

contracted but not provided

for in the mnancial statements

693,840

905,961

–

–

- shareholders’ loan committed

to a joint venture and associates

99,112

5,710

–

–

3,187,688

3,371,226

15,360

9,303