Positioning for the Future | 215

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

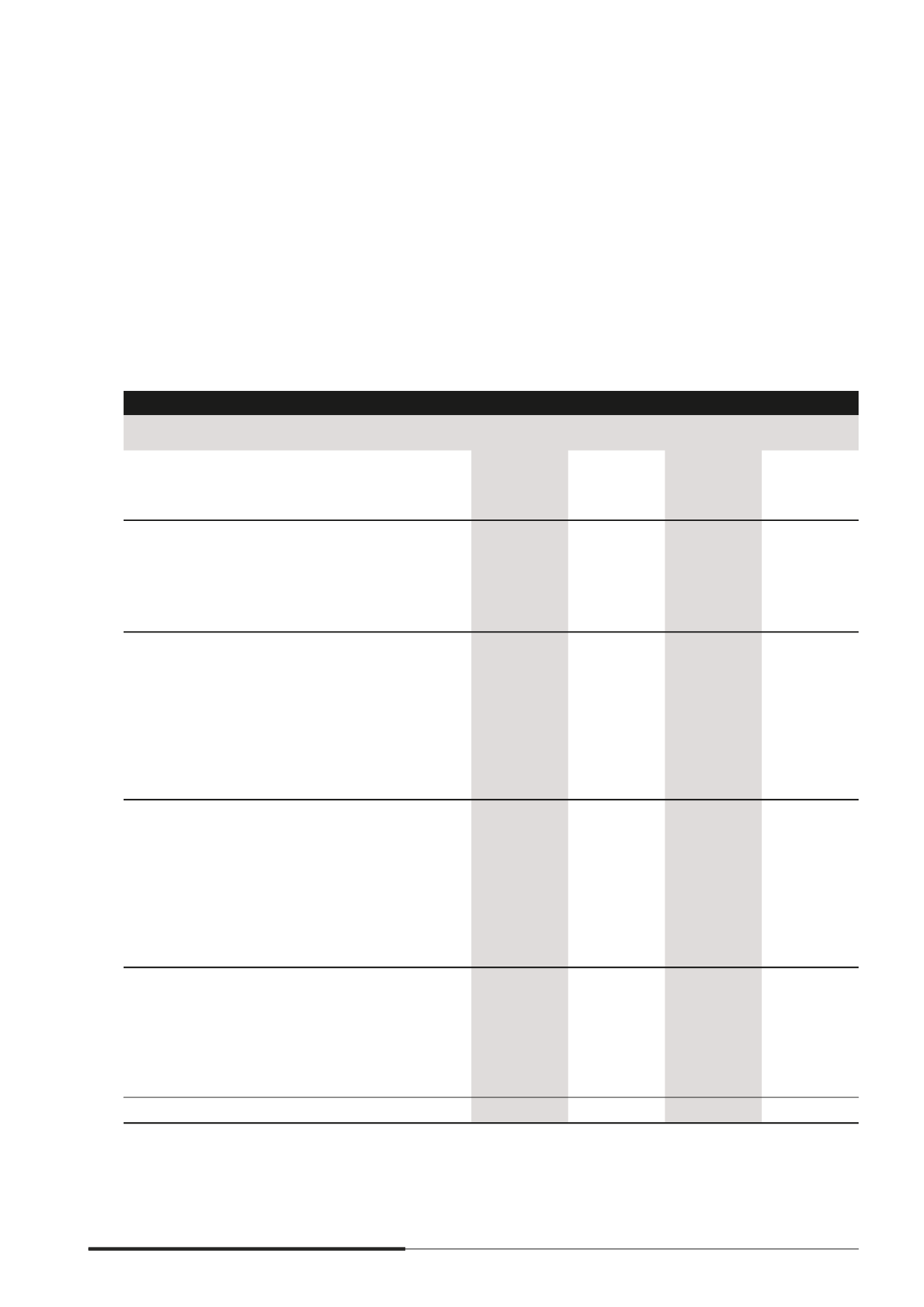

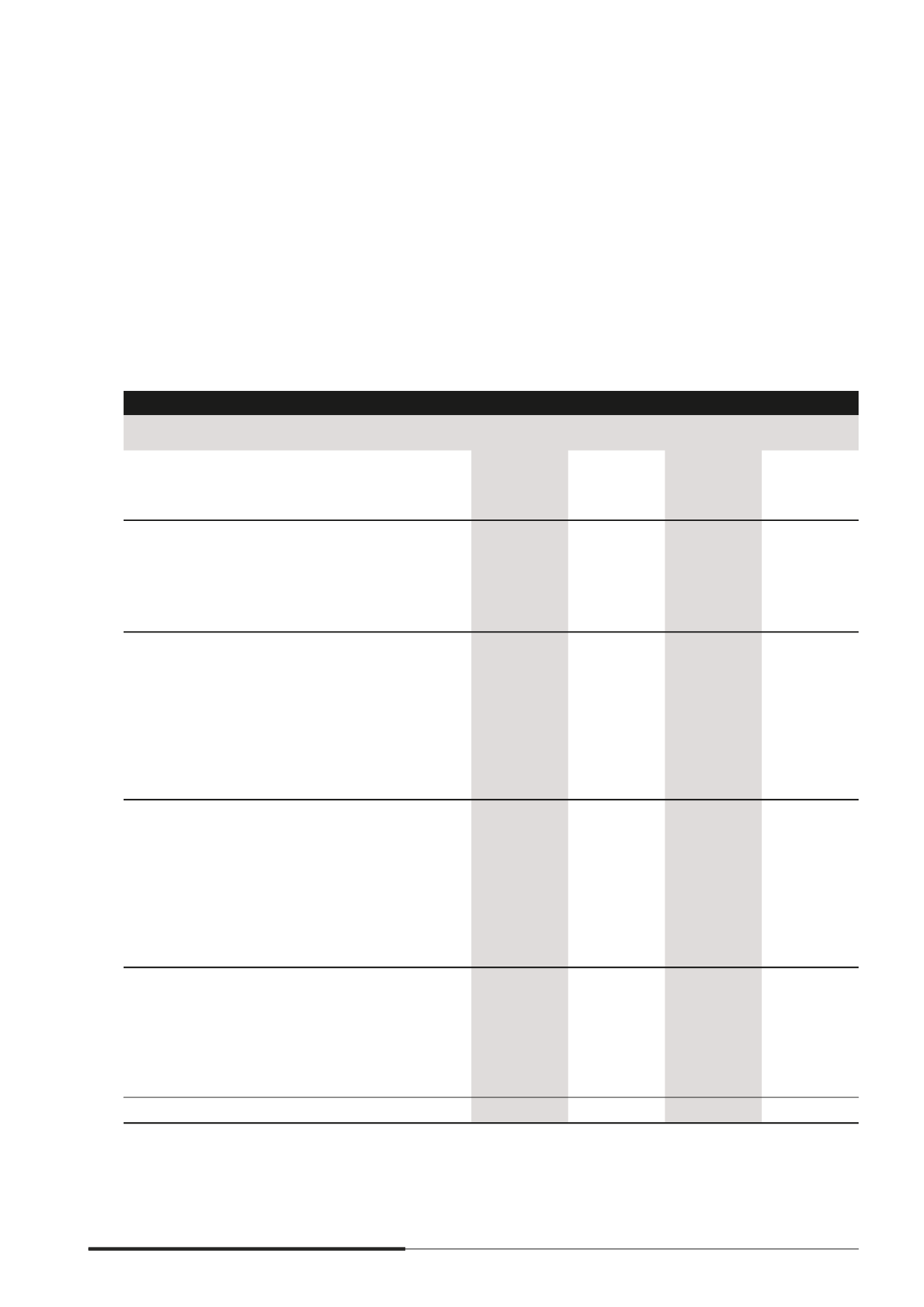

37 SIGNIFICANT RELATED PARTY TRANSACTIONS

For the purposes of these mnancial statements, parties are considered to be related to the Group if the Group has

the direct and indirect ability to control the party, jointly control or exercise signimcant innuence over the party in

making mnancial and operating decisions, or vice versa, or where the Group and the party are subject to common

control or common signimcant innuence. Related parties may be individuals or other entities.

The Group considers the directors of the Company, and Executive Management Council comprising the President

& Group CEO, key management ofmcers of the corporate ofmce and CEOs of the strategic business units, to be

key management personnel in accordance with FRS 24 Related Party Disclosures.

In addition to the related party information disclosed elsewhere in the mnancial statements, there were signimcant

related party transactions which were carried out in the normal course of business on terms agreed between the

parties as follows

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

Restated

Restated

Related Corporations

Project management fee income

1,980

2,246

–

–

Subsidiaries

Management fee income

–

–

72,535

65,530

IT and administrative support services

–

–

17,049

17,324

Rental expense

–

–

(7,099)

(4,040)

Others

–

–

(852)

707

Associates and Joint Ventures

Management fee income

279,706

244,029

–

–

Construction and project management income

47,342

49,177

–

–

Rental expense

(3,894)

(2,912)

(51)

(51)

Proceeds from sale of an investment

–

226,707

–

–

Consideration for acquisitions of investments

109,321

119,671

–

–

Accounting service fee, acquisition fee,

divestment fee, marketing income and others

16,543

45,852

(43)

(326)

Key Management Personnel

Purchase of shares pursuant to voluntary

cash offer for a subsidiary

5,076

–

–

–

Subscription of shares in a subsidiary pursuant

to rights issues

–

191

–

–

Repurchase of bonds by the Company

–

558

–

558

Interest paid/payable by the Company and

its subsidiaries

89

96

29

36

Remuneration of Key Management

Personnel

Salary, bonus and other benemts

14,121

13,240

8,027

7,364

Employer’s contributions to demned

contribution plans

110

109

60

52

Equity compensation benemts

8,494

5,818

4,616

3,387

22,725

19,167

12,703

10,803