214 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

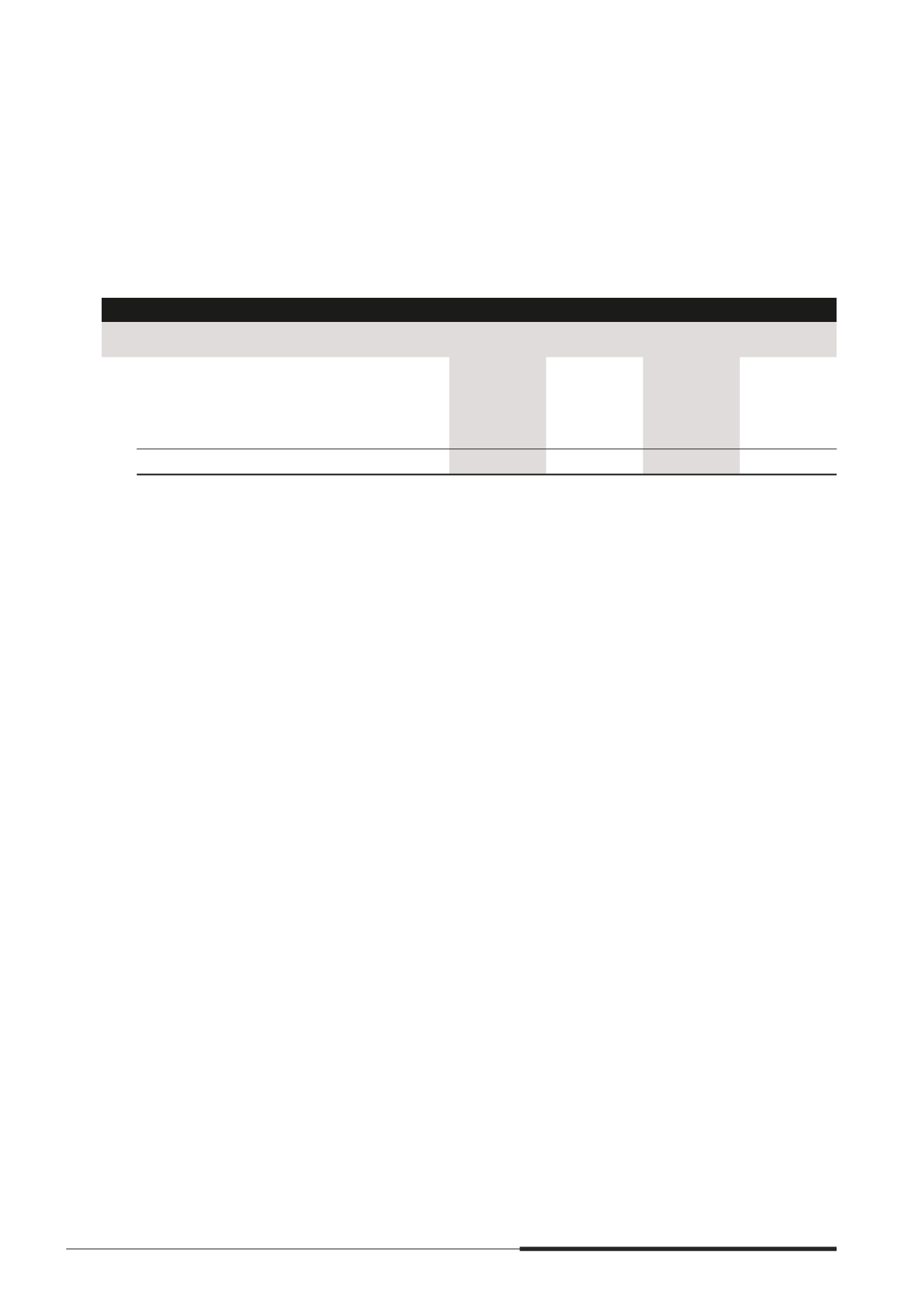

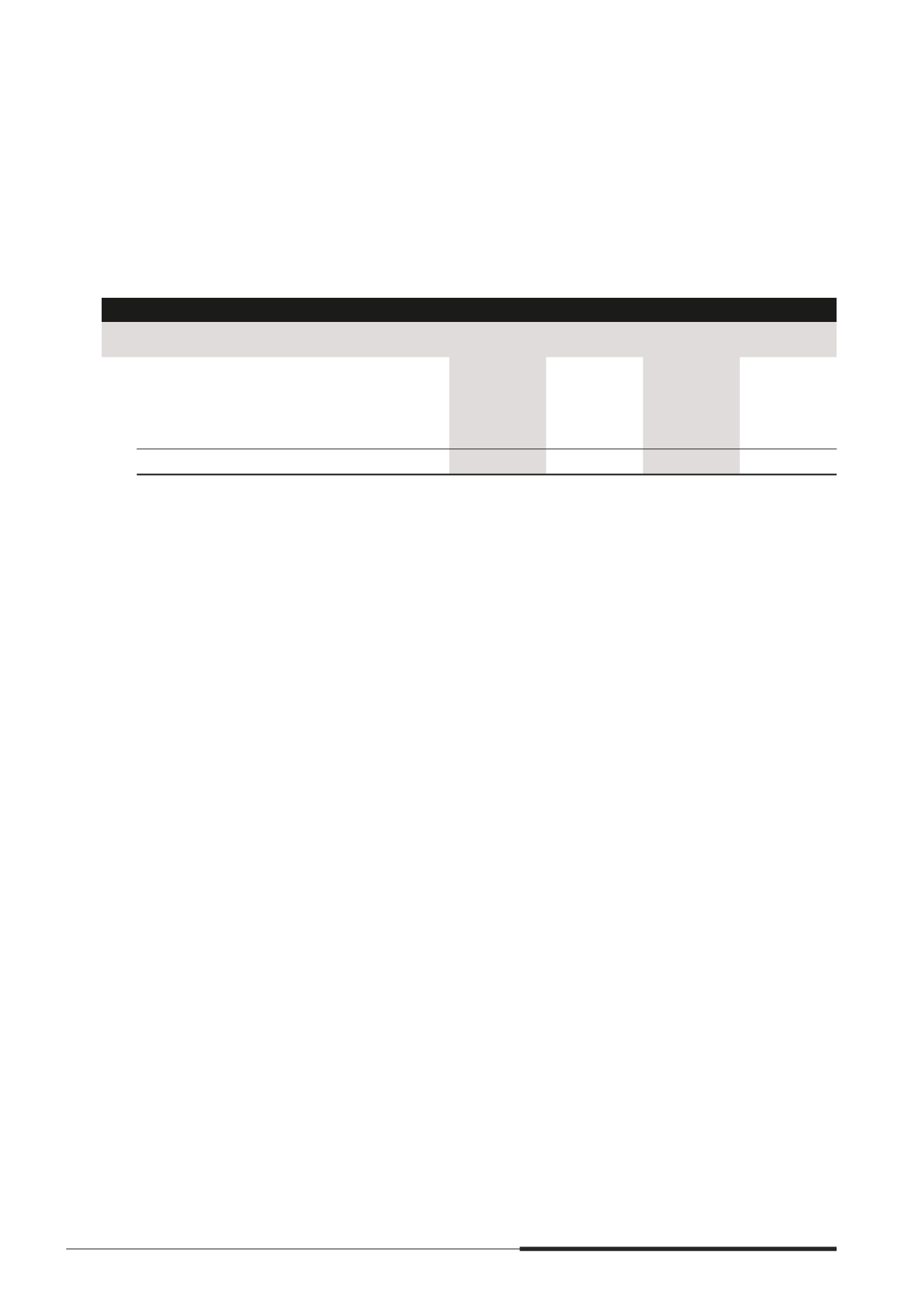

36 FINANCIAL GUARANTEE CONTRACTS

The Group accounts for its mnancial guarantees as insurance contracts. There are no terms and conditions attached

to the mnancial guarantee contracts that would have a material effect on the amount, timing and uncertainty of

the Group’s and the Company’s future cash nows. At balance sheet date, the Group and the Company do not

consider that it is probable that a claim will be made against the Group and the Company under the mnancial

guarantee contracts. Accordingly, the Group and the Company do not expect any net cash outnows resulting

from the mnancial guarantee contracts. The Group and the Company issue guarantees only for their subsidiaries

and related parties.

The Group

The Company

2014

$’000

2013

$’000

2014

$’000

2013

$’000

(a) Guarantees given to banks to secure

banking facilities provided to

- subsidiaries

–

–

2,202,021

2,929,639

- joint ventures

7,978

8,367

–

–

7,978

8,367

2,202,021

2,929,639

(b) Undertakings by the Group and the Company

(i) A subsidiary of the Group has provided several undertakings on cost overrun, security margin, interest

shortfall and an indemnity for bankers’ guarantee issuance on a several basis as well as a project

completion undertaking on a joint and several basis, in respect of a term loan amounting to $433.0

million (2013 $869.1 million) and bankers’ guarantee facility amounting to $133.9 million (2013 $133.9

million) granted to an associate. As at 31 December 2014, the total amount outstanding under the

facilities was $433.0 million (2013 $736.8 million).

(ii) A subsidiary of the Group has provided an undertaking on security margin on a joint and several basis,

in respect of term loan and revolving loan facilities amounting to $1,618.0 million (2013 $1,618.0 million)

granted to a joint venture. As at 31 December 2014, the amount outstanding under the facilities was

$1,618.0 million (2013 $1,618.0 million).

(iii) Certain subsidiaries of the Group in China, whose principal activities are the trading of development

properties, would in the ordinary course of business act as guarantors for the bank loans taken by

the buyers to mnance the purchase of residential properties developed by these subsidiaries. As at

31 December 2014, the outstanding notional amount of the guarantees amounted to $178.8 million

(2013 $182.2 million).