Positioning for the Future | 221

Appendix

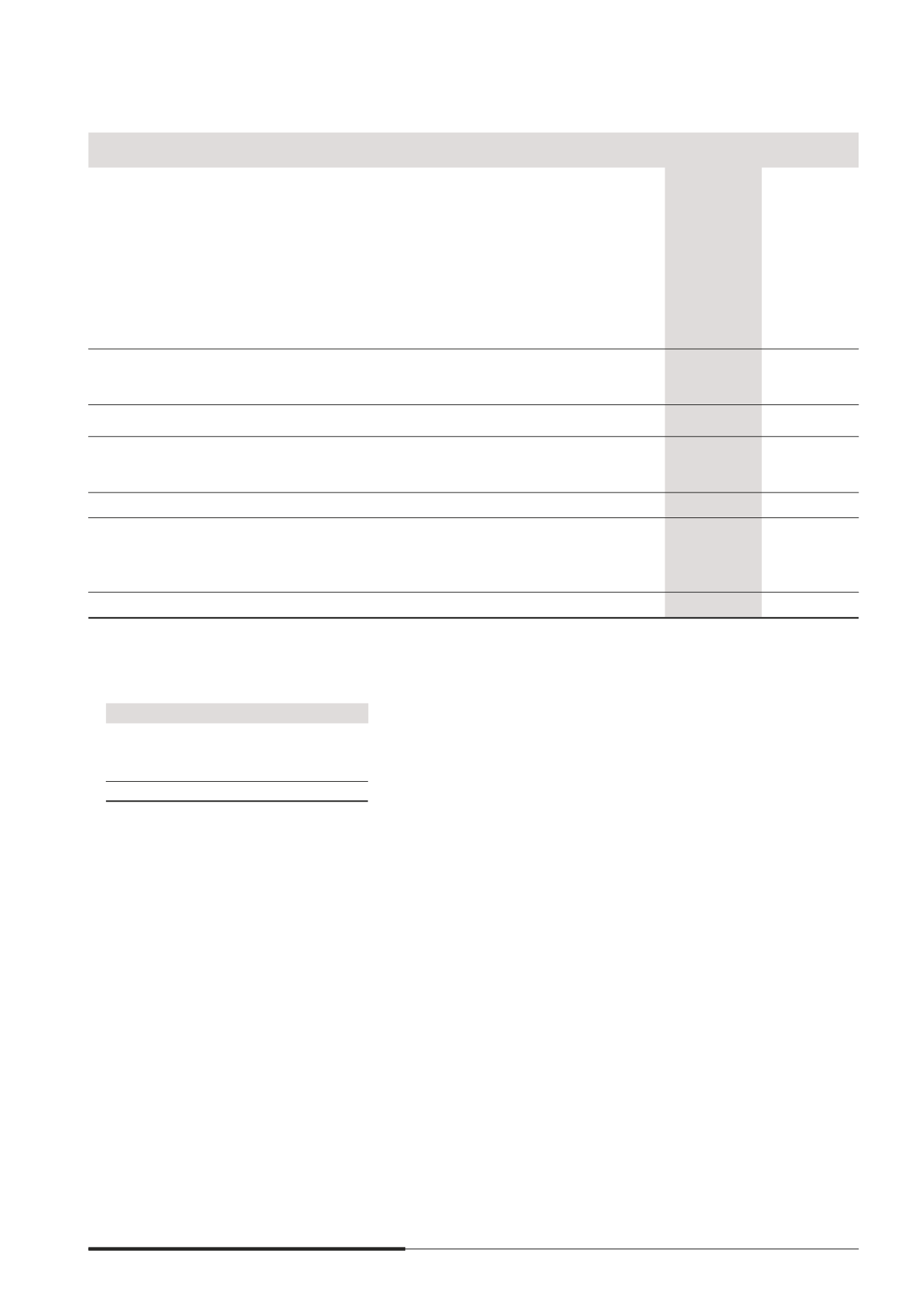

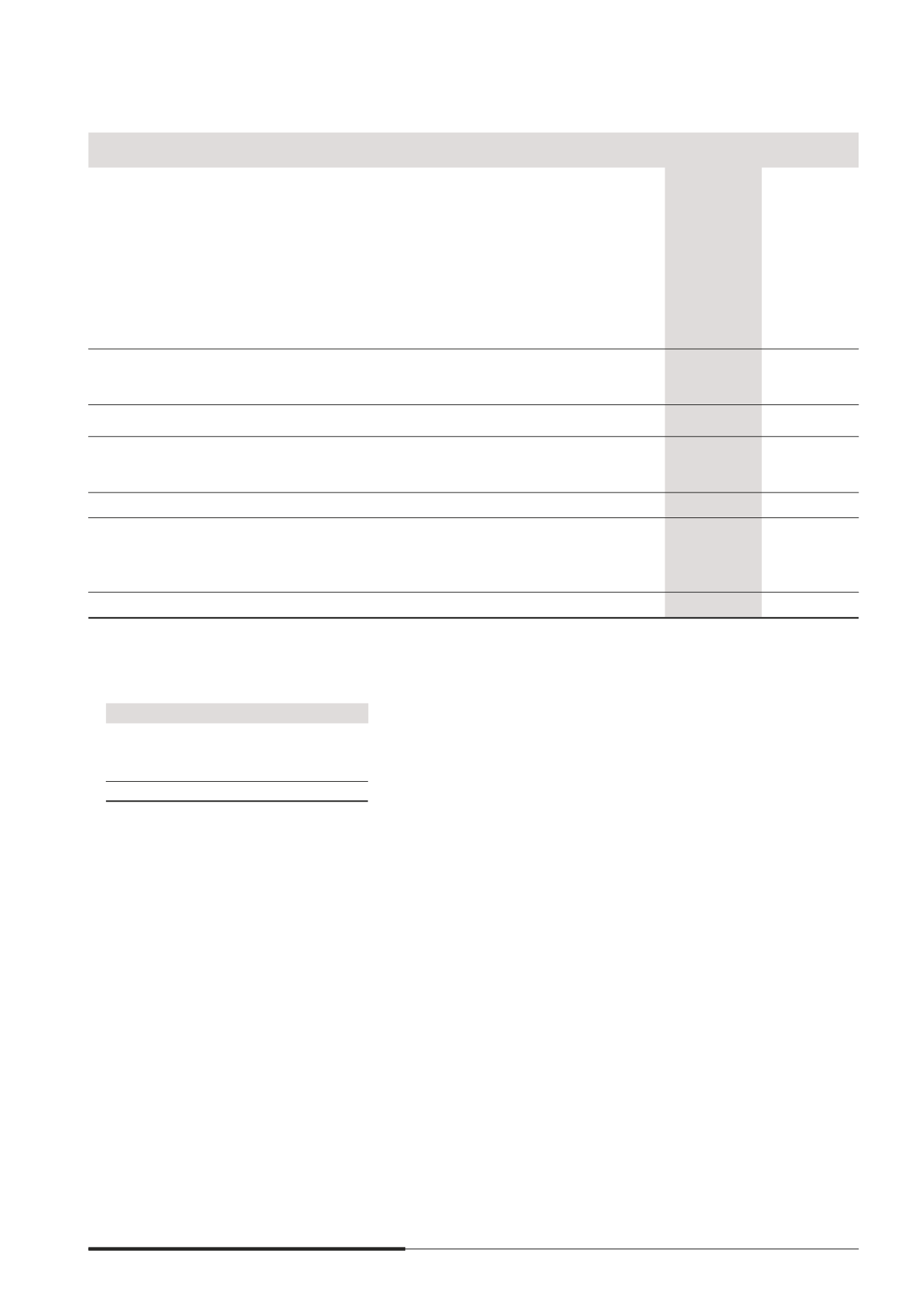

Economic Value Added Statement

Note

2014

S$ million

2013

S$ million

Restated*

Continuing and Discontinued Operations

1HW 2SHUDWLQJ 3URÀW %HIRUH 7D[

1,046.6

885.7

Adjust for

Share of results of associates and joint ventures

986.2

925.0

Interest expense

446.1

545.4

Others

61.0

85.8

$GMXVWHG 3URÀW %HIRUH ,QWHUHVW DQG 7D[

2,539.9

2,441.9

Cash operating taxes

1

(319.4)

(385.2)

1HW 2SHUDWLQJ 3URÀW $IWHU 7D[ 123$7

2,220.5

2,056.7

Average capital employed

2

35,573.6

39,443.5

Weighted average cost of capital (%)

3

6.50

6.00

Capital Charge (CC)

2,312.3

2,366.6

Economic Value Added (EVA) [NOPAT - CC]

(91.8)

(309.9)

Non-controlling interests

55.7

(9.6)

Group EVA attributable to owners of the Company

(36.1)

(319.5)

1 The reported current tax is adjusted for the statutory tax impact of interest expense.

2 Monthly average capital employed included equity, interest-bearing liabilities, timing provision, cumulative goodwill and present value of

operating leases.

Major Capital Components:

S$ million

Borrowings

16,033.4

Equity

19,069.8

Others

470.4

Total

35,573.6

3 The weighted average cost of capital is calculated as follows

i) Cost of Equity using Capital Asset Pricing Model with market risk premium at 5.75% (2013 6.00%) per annum;

ii) Risk-free rate of 2.40% (2013 1.32%) per annum based on yield-to-maturity of Singapore Government 10-year Bonds;

iii) Ungeared beta ranging from 0.57 to 1.00 (2013 0.62 to 0.97) based on the risk categorisation of CapitaLand’s strategic business

units; and

iv) Cost of Debt rate at 3.00% (2013 2.89%) per annum using 5-year Singapore Dollar Swap Offer rate plus 150 basis points (2013 200

basis points).

* Comparatives for 2013 have been restated to take into account the retrospective adjustments relating to FRS 110 Consolidated Financial

Statements.