208 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

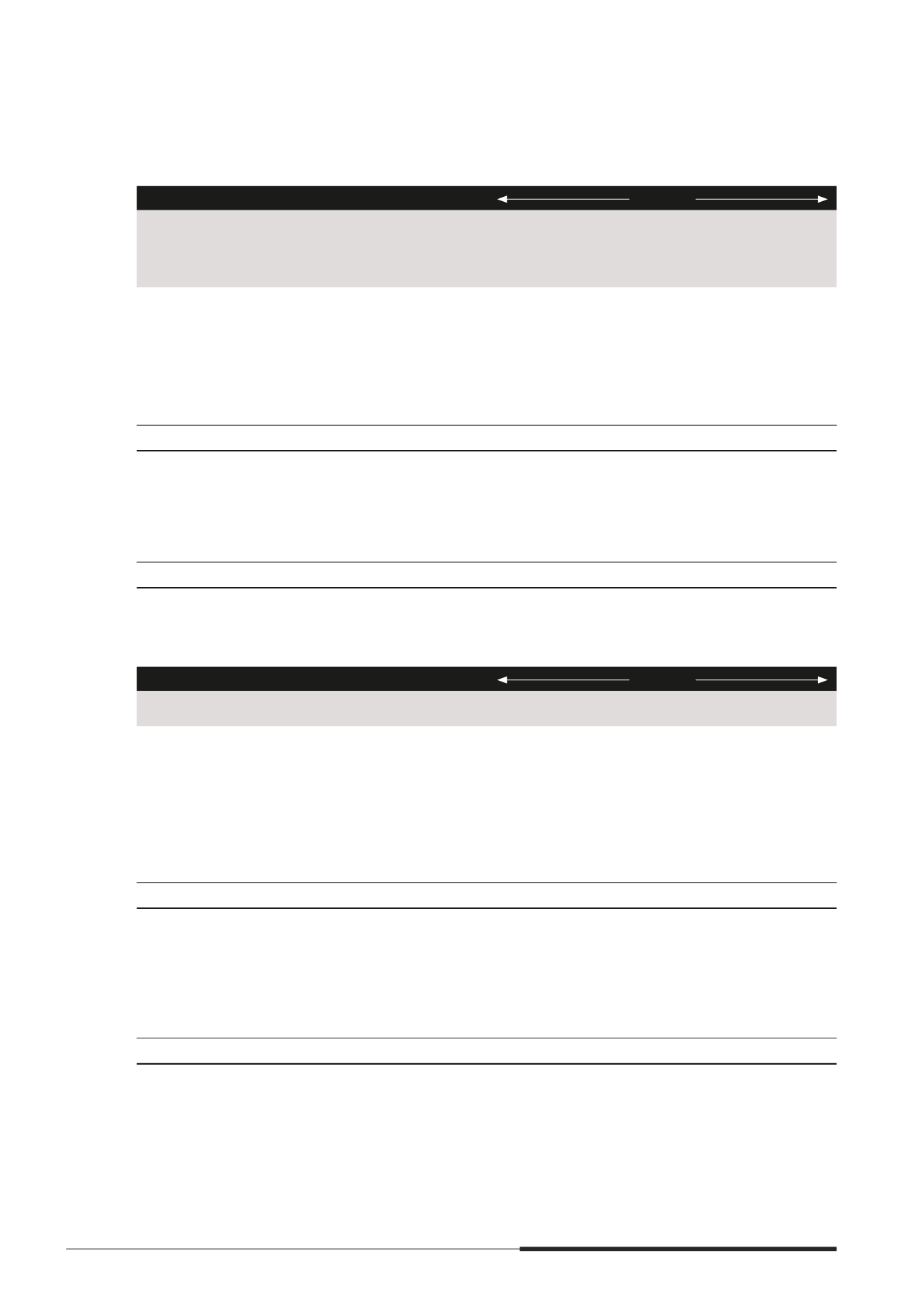

34 FAIR VALUE OF ASSETS AND LIABILITIES

(cont’d)

F $FFRXQWLQJ FODVVLÀFDWLRQV DQG IDLU YDOXHV

(cont’d)

Carrying amount

Fair value

Note

2WKHU ÀQDQFLDO

liabilities within

the scope of

FRS 39

$’000

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

The Company

2014

Financial liabilities

not measured

at fair value

Debt securities

20

(3,234,116)

(3,343,353)

–

–

(3,343,353)

(3,234,116)

(3,343,353)

–

–

(3,343,353)

2013

Financial liabilities

not measured

at fair value

Debt securities

20

(3,190,458)

(3,306,930)

–

–

(3,306,930)

(3,190,458)

(3,306,930)

–

–

(3,306,930)

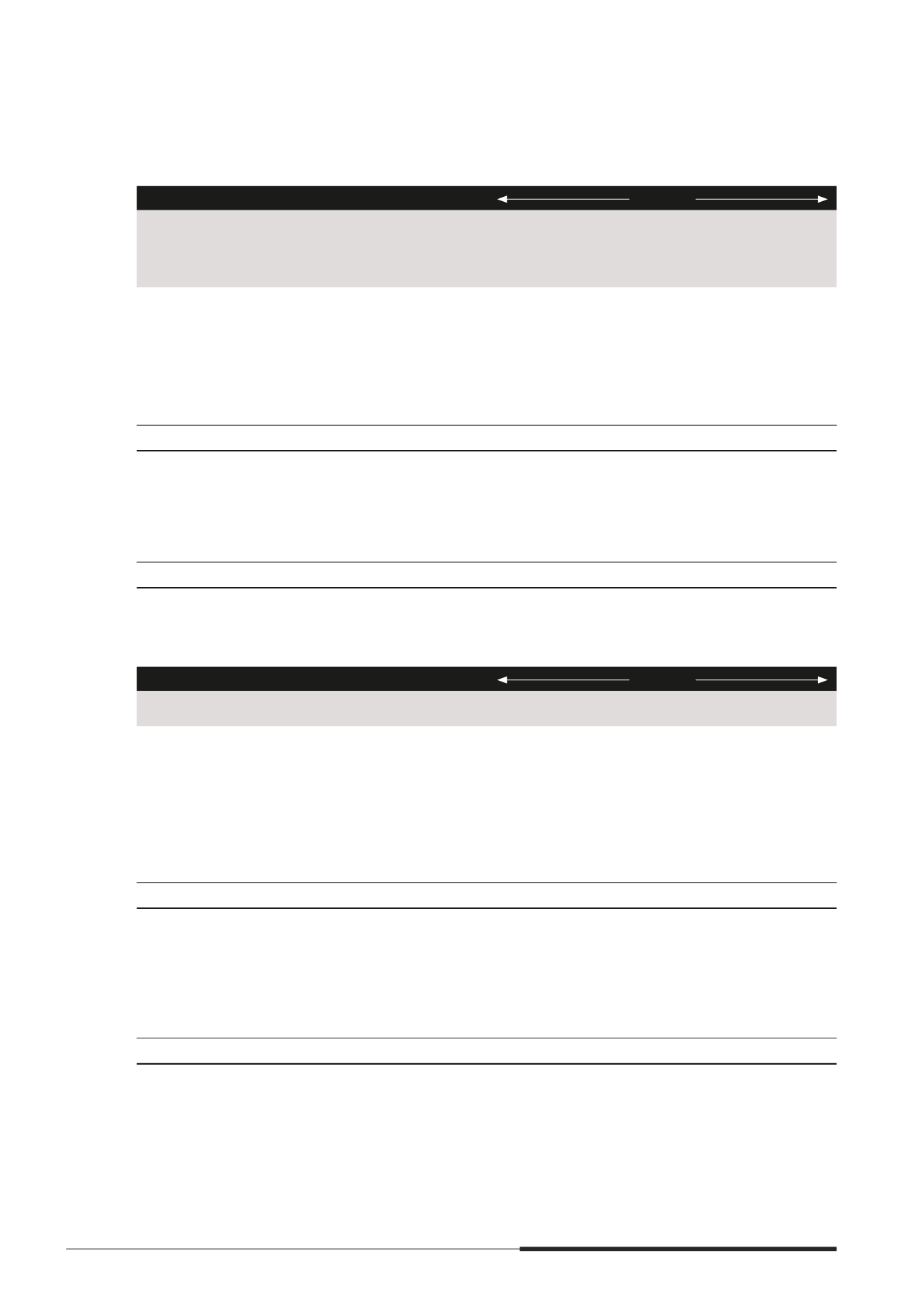

The following table shows the carrying amounts and fair values of signimcant non-mnancial assets, including

their levels in the fair value hierarchy.

Fair value

Note

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

The Group

2014

1RQ ÀQDQFLDO DVVHWV

measured at

fair value

Investment properties

5

–

– 17,149,198 17,149,198

Assets held for sale

15

–

–

191,403

191,403

–

– 17,340,601 17,340,601

2013 (Restated)

1RQ ÀQDQFLDO DVVHWV

measured at

fair value

Investment properties

5

–

– 15,495,934 15,495,934

Assets held for sale

15

–

–

87,033

87,033

–

– 15,582,967 15,582,967