198 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

33 FINANCIAL RISK MANAGEMENT

(cont’d)

(d) Liquidity risk

(cont’d)

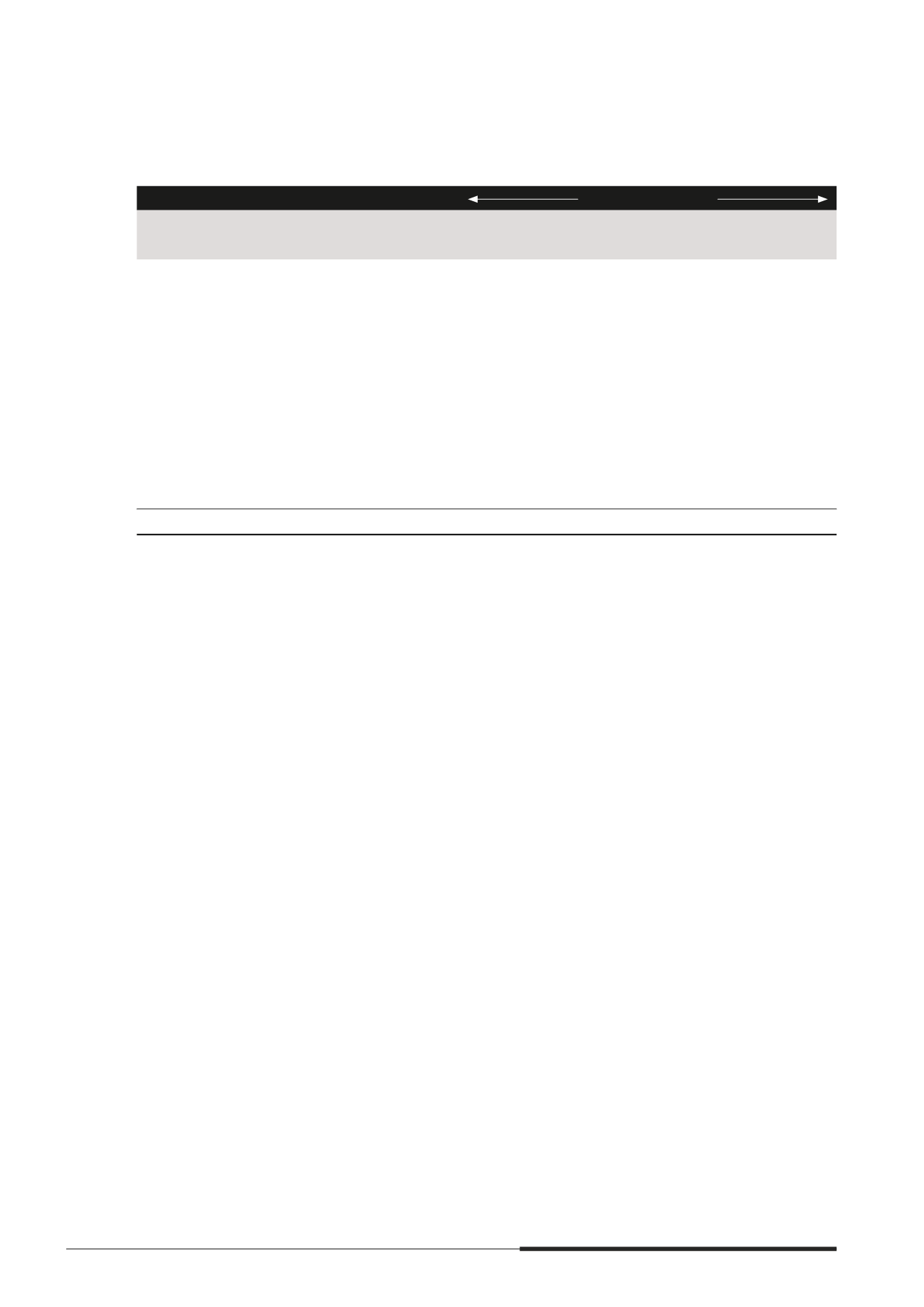

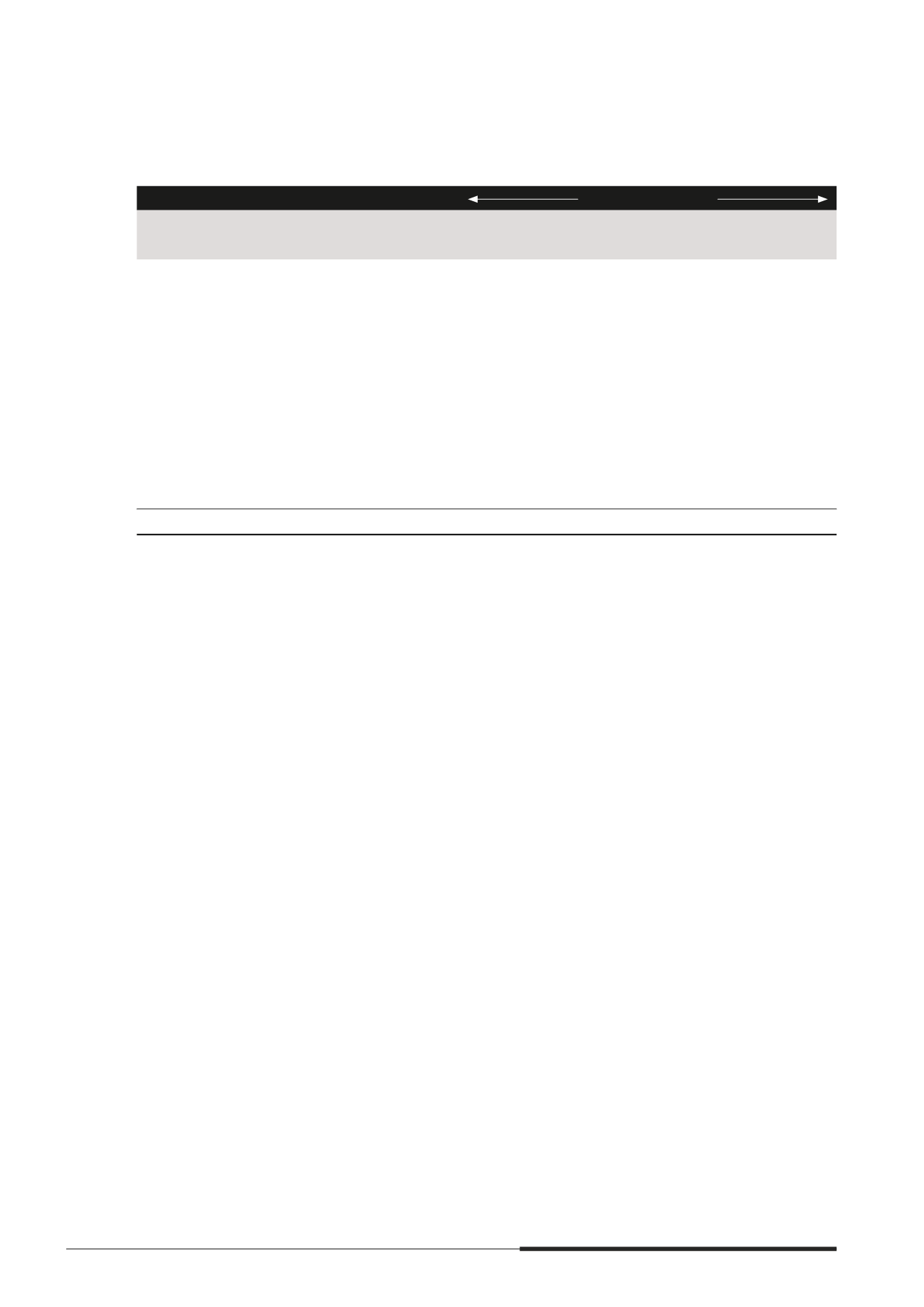

&RQWUDFWXDO FDVK ÁRZV

Carrying

amount

$’000

Total

$’000

Not later

than 1 year

$’000

Between

1 and 5 years

$’000

After

5 years

$’000

The Group

2013 (Restated)

Interest rate swaps

- assets

929

1,024

(1,072)

1,772

324

- liabilities

(30,295)

(49,836)

(24,106)

(25,730)

–

Forward foreign

exchange contracts

- assets

55

55

55

–

–

- liabilities

(938)

(938)

(938)

–

–

Cross currency swaps

- assets

7,960

17,522

1,482

8,020

8,020

- liabilities

(25,171)

(15,554)

(2,615)

(10,459)

(2,480)

(47,460)

(47,727)

(27,194)

(26,397)

5,864

H 2IIVHWWLQJ ÀQDQFLDO DVVHWV DQG ÀQDQFLDO OLDELOLWLHV

The disclosures set out in the tables below include mnancial assets and mnancial liabilities that

t

are offset in the Group’s and the Company’s balance sheets; or

t are subject to an enforceable master netting arrangement, irrespective of whether they are offset in the

balance sheets.

Financial instruments such as trade receivables and trade payables are not disclosed in the tables below

unless they are offset in the balance sheets.

The Group’s derivative transactions that are not transacted through an exchange, are governed by the

International Swaps and Derivatives Association (ISDA) Master Netting Agreements. In general, under such

agreements, the amounts due on a single day in respect of all transactions outstanding in the same currency

are aggregated into a single net amount and settled between the counterparties. In certain circumstances,

for example when a credit event such as a default occurs, all outstanding transactions under the agreement

are terminated, the termination value is assessed and set off into a single net amount to be settled.

The above ISDA agreements do not meet the criteria for offsetting in the balance sheets as a right of set-off

of recognised amounts is enforceable only following an event of default, insolvency or bankruptcy of the

Group or the counterparties. In addition, the Group and its counterparties do not intend to settle on a net

basis or to realise the assets and settle the liabilities simultaneously.