Positioning for the Future | 197

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

33 FINANCIAL RISK MANAGEMENT

(cont’d)

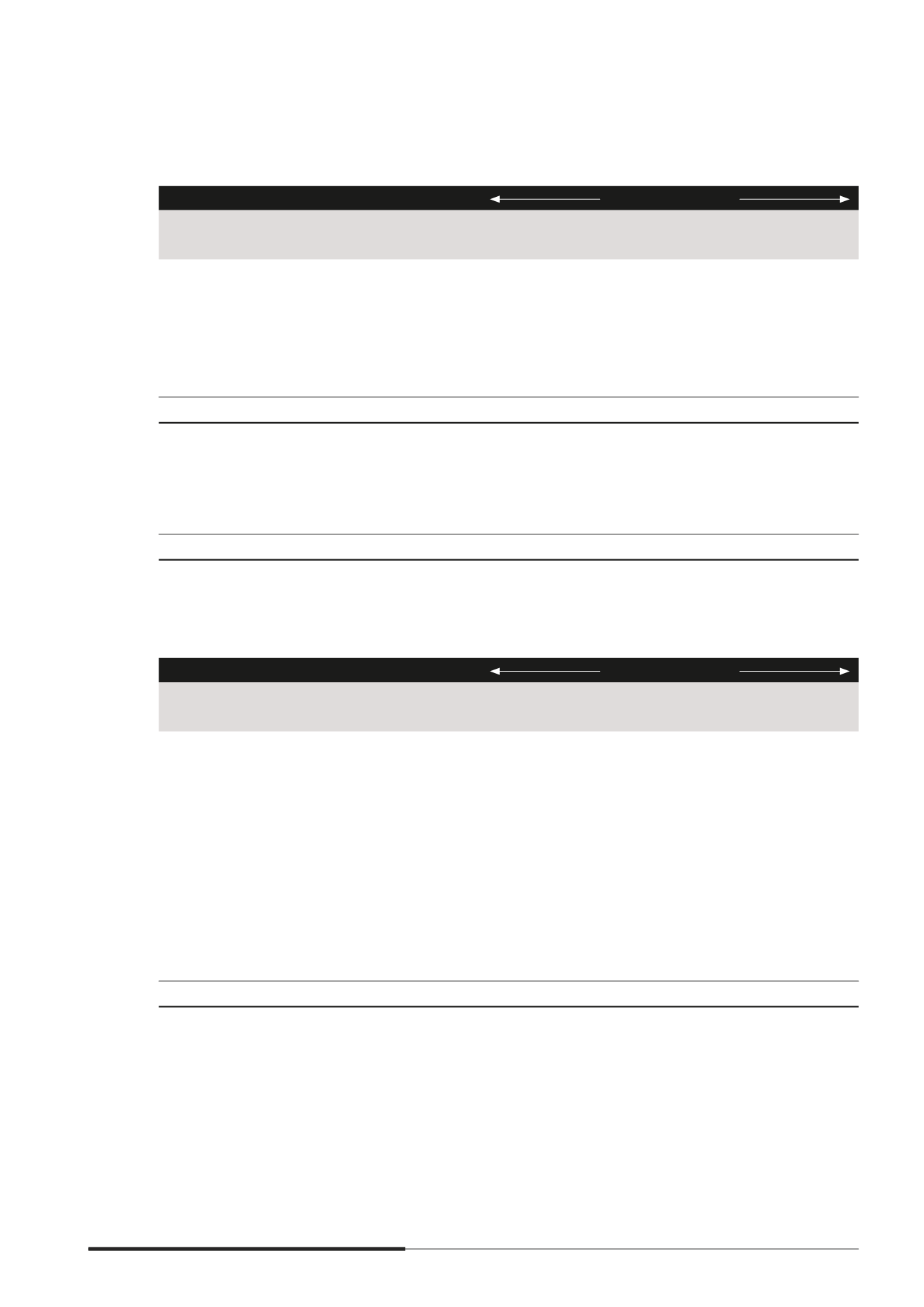

(d) Liquidity risk

(cont’d)

&RQWUDFWXDO FDVK ÁRZV

Carrying

amount

$’000

Total

$’000

Not later

than 1 year

$’000

Between

1 and 5 years

$’000

After

5 years

$’000

The Company

2014

Financial liabilities,

at amortised cost

Debt securities

(3,234,116)

(3,835,514)

(77,983) (1,165,269) (2,592,262)

Trade and other payables

#

(42,469)

(42,469)

(42,469)

–

–

(3,276,585)

(3,877,983)

(120,452) (1,165,269) (2,592,262)

2013

Financial liabilities,

at amortised cost

Debt securities

(3,190,458)

(3,918,364)

(69,845) (1,199,046) (2,649,473)

Trade and other payables

#

(1,347,580)

(1,347,580) (1,347,580)

–

–

(4,538,038)

(5,265,944) (1,417,425) (1,199,046) (2,649,473)

#

Excludes quasi-equity loans, progress billings, liability for employee benemts and provisions.

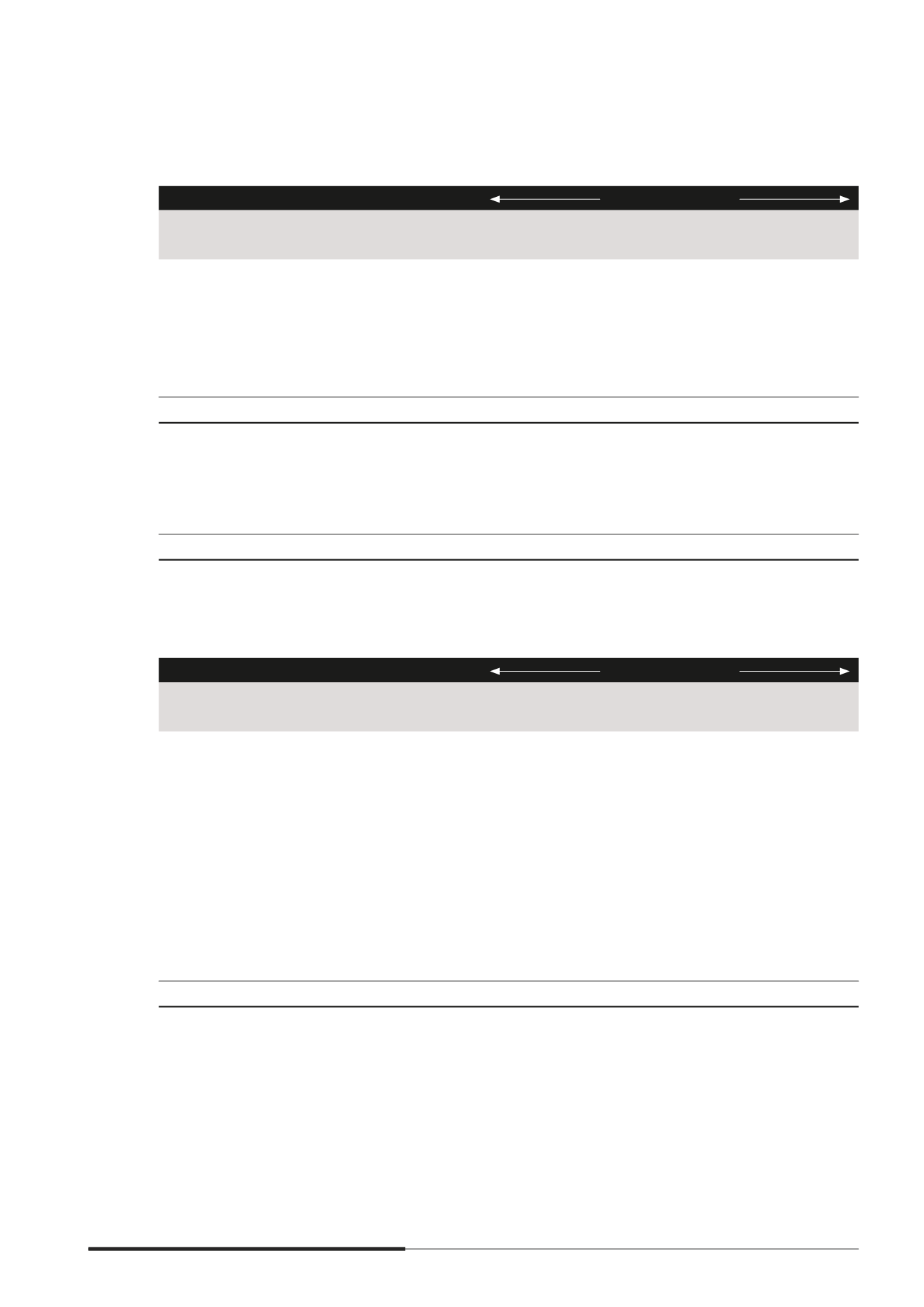

The following table indicates the periods in which the cash nows associated with derivatives that are cash

now hedges are expected to occur and affect the promt or loss

&RQWUDFWXDO FDVK ÁRZV

Carrying

amount

$’000

Total

$’000

Not later

than 1 year

$’000

Between

1 and 5 years

$’000

After

5 years

$’000

The Group

2014

Interest rate swaps

- assets

1,852

4,859

2,045

2,814

–

- liabilities

(19,876)

(26,336)

(14,700)

(11,208)

(428)

Forward foreign

exchange contracts

- assets

9

9

9

–

–

- liabilities

(319)

(319)

(319)

–

–

Cross currency swaps

- assets

56,488

20,989

1,993

10,862

8,134

- liabilities

(40,298)

(26,477)

(4,640)

(18,432)

(3,405)

(2,144)

(27,275)

(15,612)

(15,964)

4,301