140 | CapitaLand Limited Annual Report 2014

Appendix

5

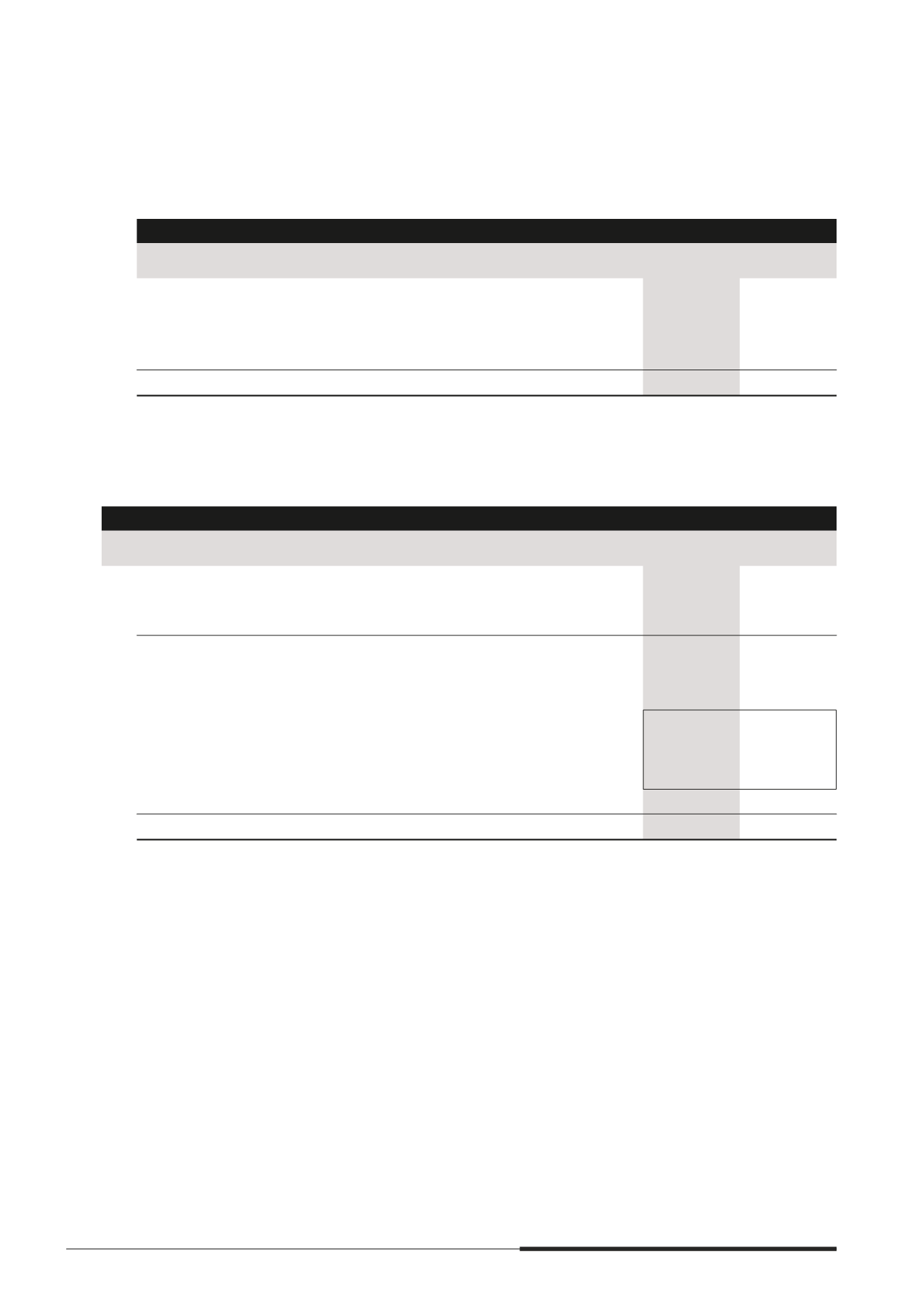

INVESTMENT PROPERTIES

(cont’d)

(e) Investment properties of the Group are held mainly for use by tenants under operating leases. Minimum lease

payments receivable under non-cancellable operating leases of investment properties and not recognised

in the mnancial statements are as follows

The Group

2014

$’000

2013

$’000

Lease rentals receivable

Not later than 1 year

589,242

538,246

Between 1 and 5 years

1,294,963

940,382

After 5 years

180,075

111,090

2,064,280

1,589,718

(f) Contingent rents, representing income based on sales turnover achieved by tenants, amounted to $15.8

million for the year (2013 $7.0 million).

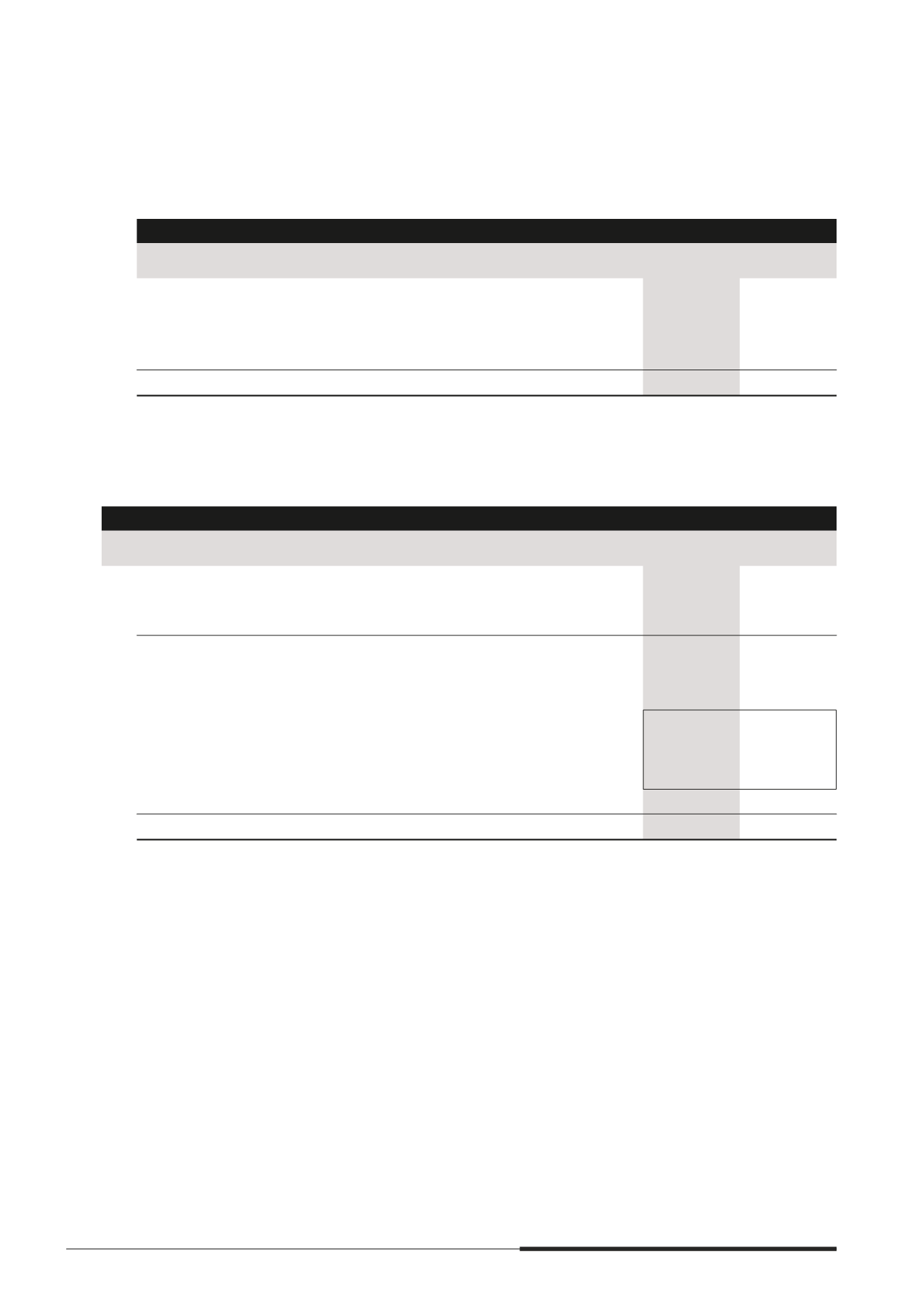

6

SUBSIDIARIES

The Company

2014

$’000

2013

$’000

(a) Unquoted shares, at cost

6,957,295

7,439,486

Less

Allowance for impairment loss

(239,064)

(278,992)

6,718,231

7,160,494

Add

Amounts due from subsidiaries

Loan accounts

- interest bearing

3,101,250

3,101,250

- interest free

3,245,518

2,737,322

Less

Allowance for doubtful receivables

(258,698)

(259,438)

6,088,070

5,579,134

12,806,301 12,739,628

(i) The loans to subsidiaries form part of the Company’s net investment in the subsidiaries. These loans

are unsecured and settlement is neither planned nor likely to occur in the foreseeable future.

(ii) As at 31 December 2014, the effective interest rates for amounts due from subsidiaries ranged from

1.85% to 2.95% (2013 1.85% to 2.95%) per annum.

Notes to the Financial Statements

Year ended 31 December 2014