Positioning for the Future | 141

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

6

SUBSIDIARIES

(cont’d)

(a) Unquoted shares, at cost (cont’d)

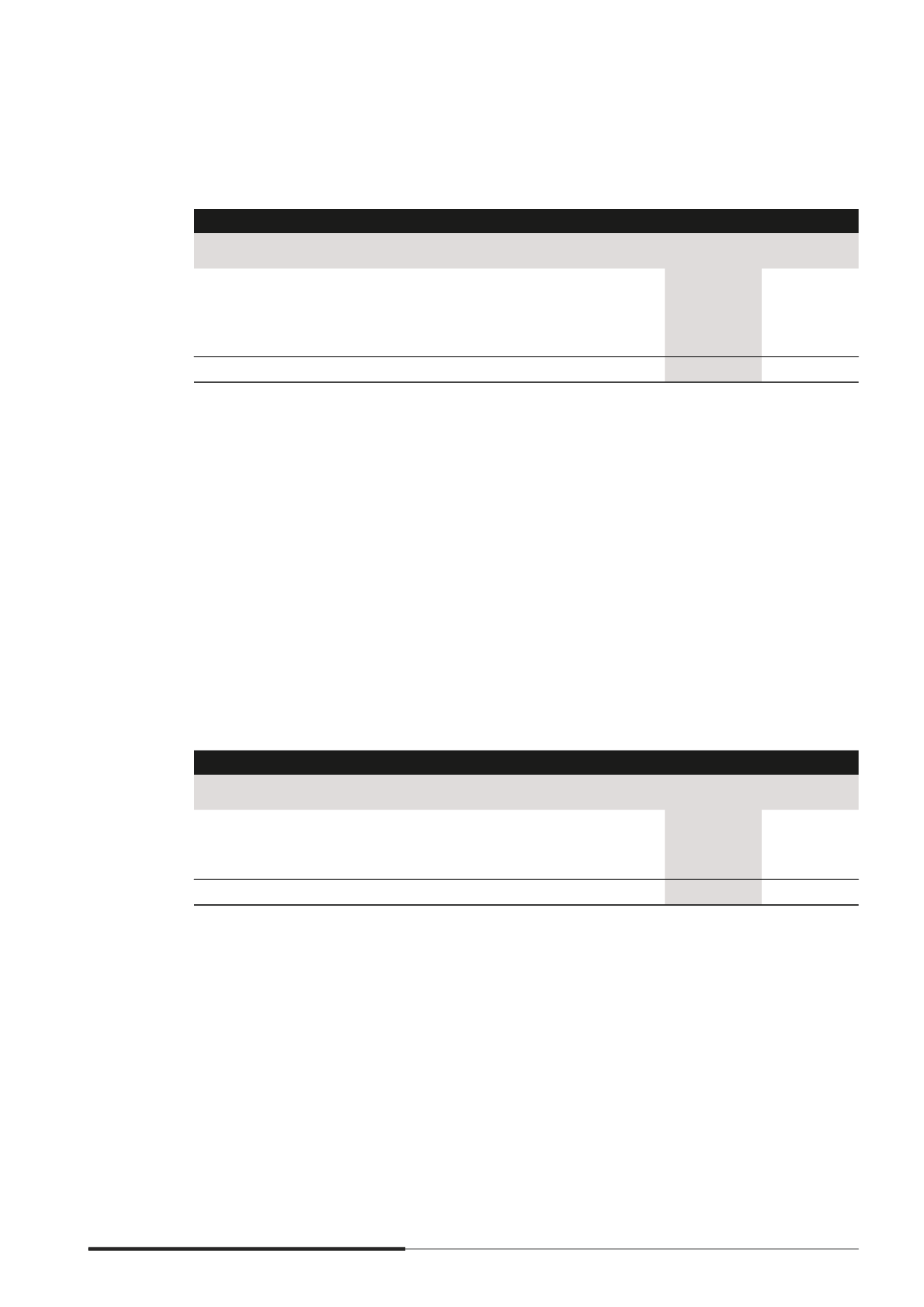

(iii) Movements in allowance for impairment loss were as follows

The Company

Note

2014

$’000

2013

$’000

At 1 January

(278,992)

(87,459)

Allowance during the year

27(c)(iii)

(9,832)

(191,961)

Reversal of allowance during the year

27(a)

49,760

–

Allowance utilised upon disposal of a subsidiary

–

428

At 31 December

(239,064)

(278,992)

The allowance for impairment loss amounting to $9.8 million for 2014 (2013 $192.0 million) was

recognised in respect of the Company’s investments in certain subsidiaries as a result of losses

incurred by these subsidiaries in their underlying investments. These investments are mainly in the

non-core markets and the Group has taken impairments on the value of these investments in view

of the deteriorating economic condition of these markets. The recoverable amounts for each of the

relevant subsidiaries were estimated based on the higher of the value in use calculations using cash

now projections based on forecasts covering a three-year period, or the fair value of the net assets as

at balance sheet date.

In 2014, a reversal of impairment of $49.8 million was recognised in respect of a subsidiary as a result

of an increase in the recoverable amount. The recoverable amount was determined based on fair

value less costs of disposal. The fair value measurement was estimated using the net tangible assets

and categorised as Level 3 on the fair value hierarchy. The higher recoverable amount is due to better

operating performance of the subsidiary as a result of the improved market conditions in the country

where the subsidiary operates.

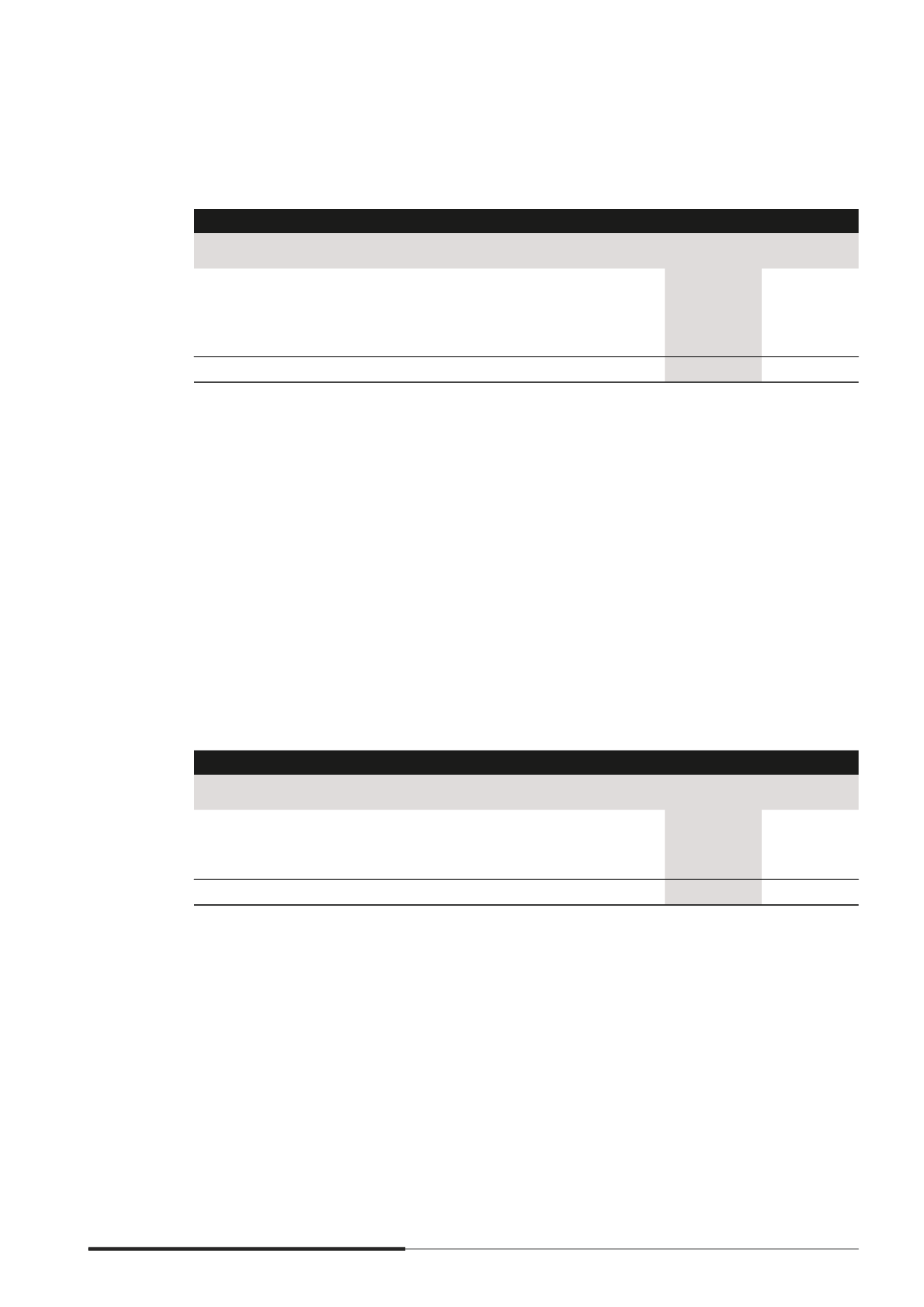

(iv) The movements in allowances for doubtful receivables in respect of the amounts due from subsidiaries

were as follows

The Company

Note

2014

$’000

2013

$’000

At 1 January

(259,438)

(186,247)

Allowance during the year

(22,197)

(73,191)

Reversal of allowance during the year

27(a)

22,937

–

At 31 December

(258,698)

(259,438)

The allowance/(reversal of allowance) for doubtful receivables were made based on estimated future

cash now recoveries.