Positioning for the Future | 49

Enterprise Risk Management

Risk management is an integral part of CapitaLand’s

business at both the strategic and operational level.

A proactive approach towards riskmanagement supports

the attainment of the Group’s business objective and

corporate strategy of ONE CapitaLand, thereby creating

and preserving value.

The Group recognises that risk management is about

opportunities as much as it is about threats. To capitalise

on opportunities, the Group has to take risks. Therefore,

risk management is not about pursuing risk minimisation

as a goal but rather optimising the risk-reward relationship,

within known and agreed risk appetite levels. The Group

therefore takes risks in a prudent manner for justimable

business reasons.

The Board of Directors (Board) is responsible for the

governance of risk across the Group. The responsibilities

include determining the Group’s risk appetite, overseeing

the Group’s Enterprise Risk Management (ERM)

Framework, regularly reviewing the Group’s risk promle,

material risks and mitigation strategies, and ensuring

the effectiveness of risk management policies and

procedures. For these purposes, it is assisted by the

Risk Committee (RC), established in 2002, to provide

dedicated oversight of risk management at the Board

level.

The RC currently comprises four independent board

members and meets on a quarterly basis. The meetings

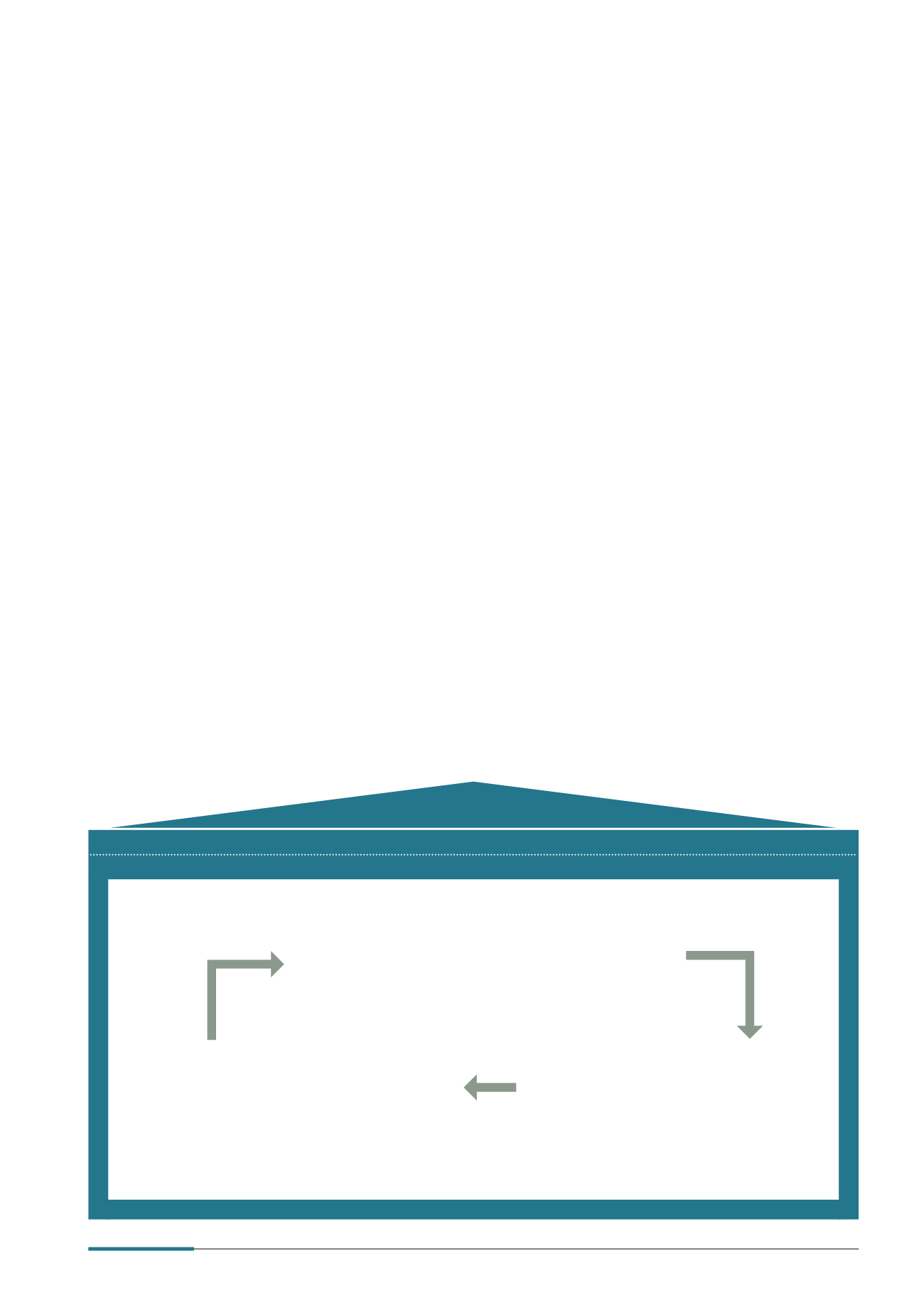

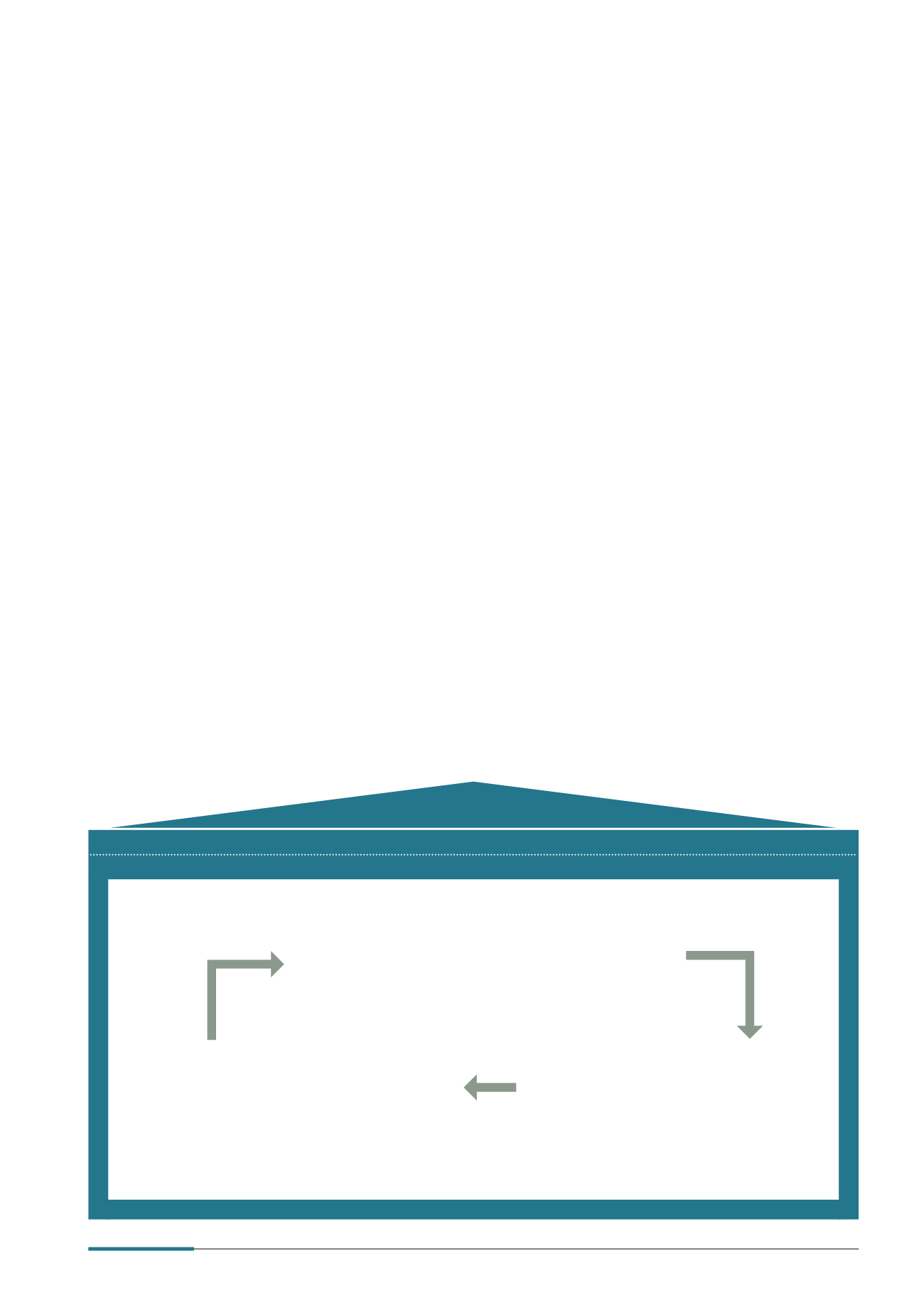

t Accept

t Avoid

t Mitigate

e.g. Business

Continuity Management

t Transfer

e.g. Contractual Risk

Management & Insurance

t Key Risk Indicators

t 2uarterly Risk

Reporting

t Portfolio Monitoring

of Financial Risk

e.g. Country

Concentration, F9, etc

ERM Framework

Risk Strategy

%RDUG 2YHUVLJKW 6HQLRU 0DQDJHPHQW ,QYROYHPHQW

,QWHUQDO &RQWURO 6\VWHP

Independent Review & Audit

5LVN $ZDUH &XOWXUH

t Risk Appetite

t Risk & Control

Self-Assessment

t Investment Risk Evaluation

t 2uantitative Analysis

t Scenario Analysis

t Whistle-blowing/

Business Malpractice

5LVN ,GHQWLÀFDWLRQ

& Assessment

Risk

Response

Risk Monitoring

& Reporting

Enterprise Risk Management Framework

are regularly attended by the President & Group CEO

(P&GCEO) as well as other key management staff.

The RC is assisted by the Risk Assessment Group

(RAG), a dedicated and independent in-house team

comprising highly specialised and professional

members with vast and diverse experience in mnancial,

operational and enterprise risk management.

The Board has approved the Group’s risk appetite

which determines the nature and extent of material risks

which the Group is willing to take to achieve its strategic

objectives. The Group’s Risk Appetite Statement (RAS)

is expressed via formal high-level and overarching

statements and incorporates accompanying risk limits

which determine specimc risk boundaries established at

an operational level. )aving considered key stakeholders’

interests, the RAS sets out explicit, forward-looking

views of the Group’s desired risk promle and is aligned to

the Group’s strategy and business plans.

A team comprising the P&GCEO and other key

management personnel is responsible for directing

and monitoring the development, implementation

and practice of ERM across the Group. Operationally,

a network of risk champions from the different Strategic

Business Units (SBUs) and corporate functions, as

well as various specialist support functions, are tasked

to develop, implement and monitor risk management

policies, methodologies and procedures in their

respective areas.

Corporate Governance & Transparency