Positioning for the Future | 111

Appendix

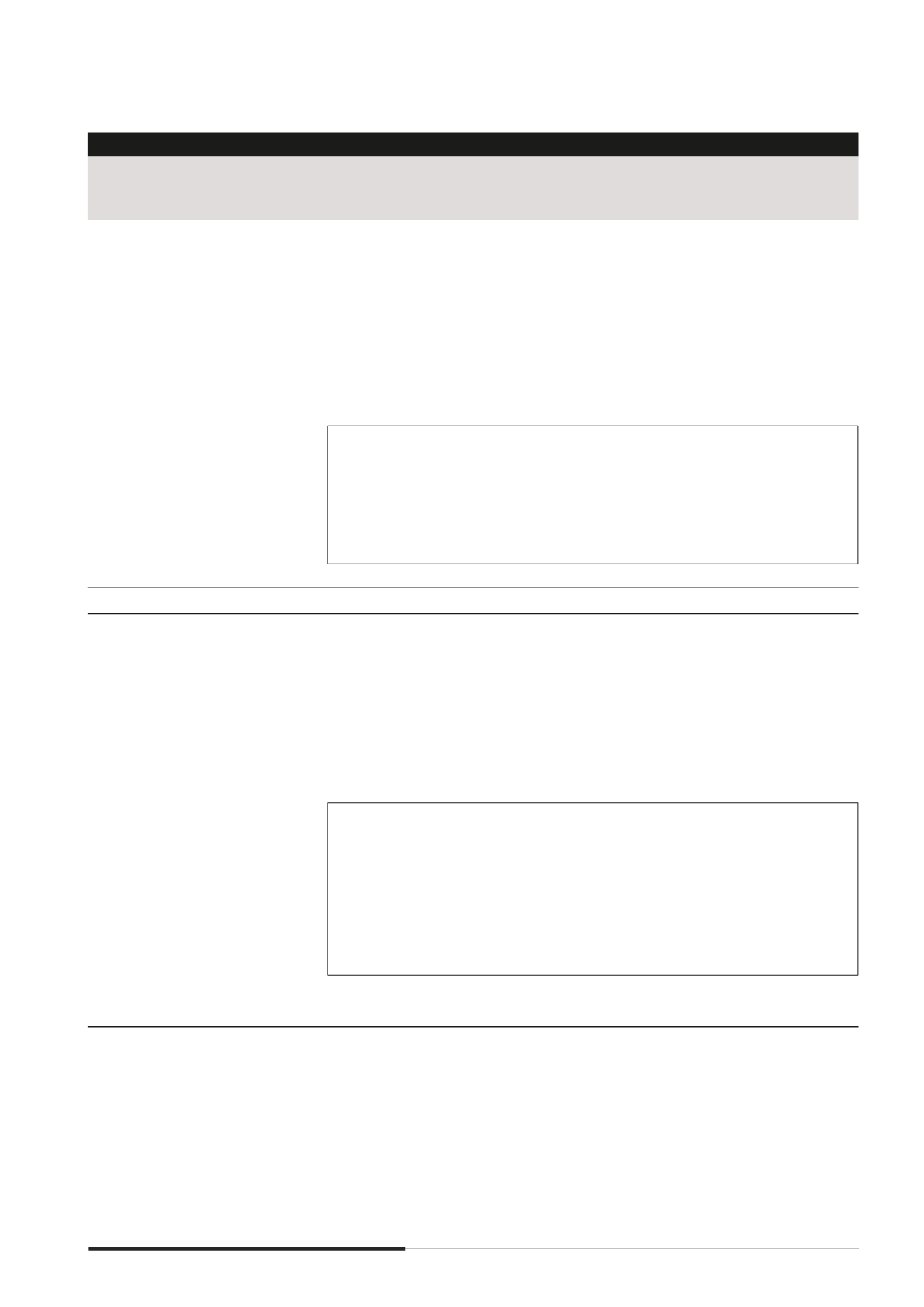

Statements of Changes in Equity

Year ended 31 December 2014

Attributable to owners of the Company

Share

Capital

$’000

Revenue

Reserves

$’000

Reserve

For Own

Shares

$’000

Capital

Reserves

$’000

Equity

Compensation

Reserve

$’000

Total

Equity

$’000

The Company

At 1 January 2014

6,302,207 2,992,741

(51,691)

287,245

53,415 9,583,917

Total comprehensive income

Promt for the year

–

585,102

–

–

–

585,102

Transactions with owners,

recorded directly in equity

Contributions by and

distributions to owners

Issue of shares under share plans

of the Company

1,939

–

–

–

–

1,939

Issue of treasury shares

–

–

14,702

–

(2,368)

12,334

Dividends paid

–

(340,648)

–

–

– (340,648)

Share-based payments

–

–

–

–

8,456

8,456

Reclassimcation of equity

compensation reserve

–

12,891

–

–

(13,155)

(264)

Total transactions with owners

1,939

(327,757)

14,702

–

(7,067) (318,183)

At 31 December 2014

6,304,146 3,250,086

(36,989)

287,245

46,348 9,850,836

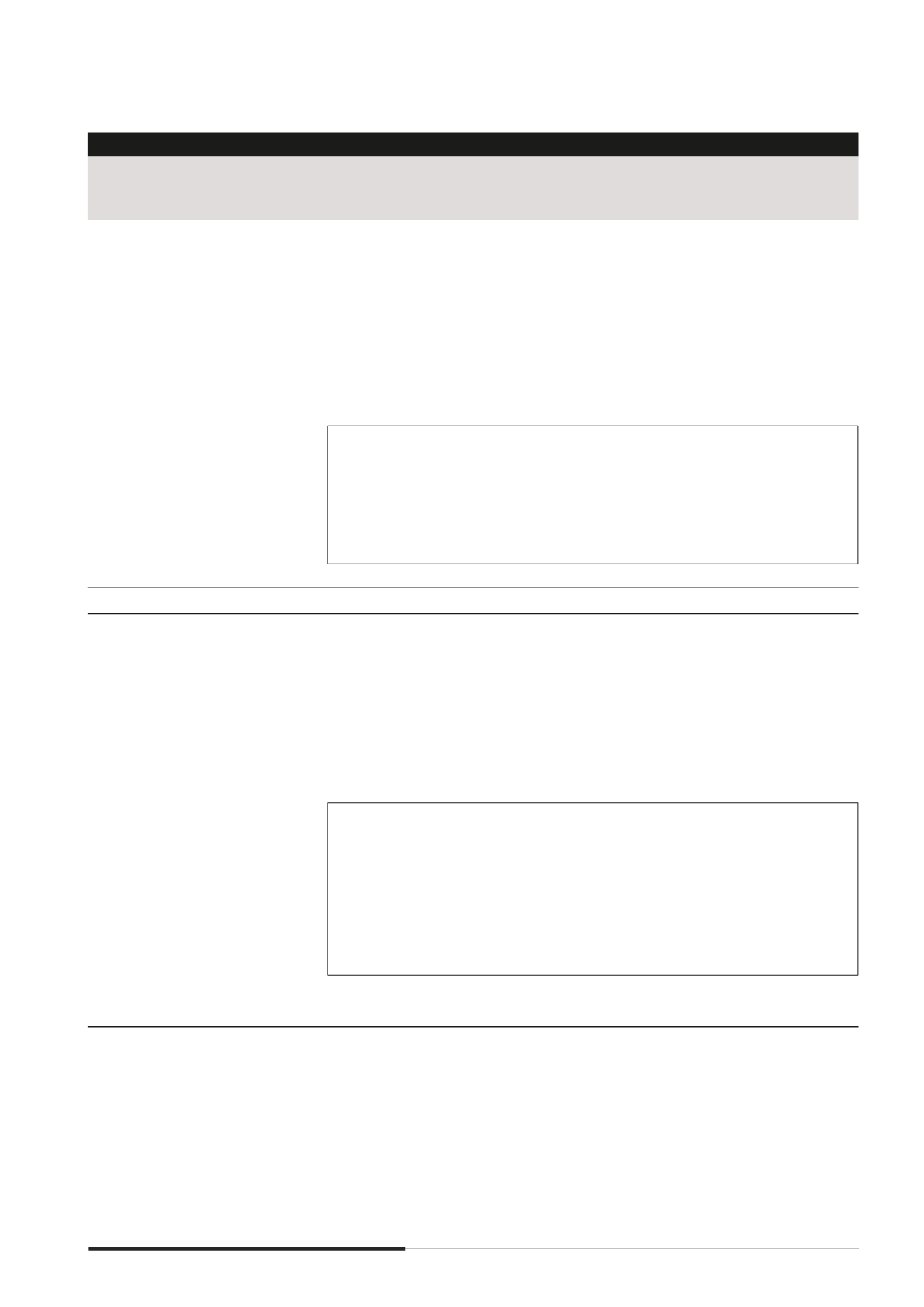

At 1 January 2013

6,300,011 3,125,358

(49,366)

383,490

46,701 9,806,194

Total comprehensive income

Promt for the year

–

153,443

–

–

–

153,443

Transactions with owners,

recorded directly in equity

Contributions by and

distributions to owners

Issue of shares under share plans

of the Company

2,196

–

–

–

–

2,196

Issue of treasury shares

–

–

14,349

–

(1,466)

12,883

Purchase of treasury shares

–

–

(16,674)

–

–

(16,674)

Dividends paid

–

(298,010)

–

–

– (298,010)

Equity portion of convertible bonds

issued

–

–

–

79,526

–

79,526

Repurchase of convertible bonds

–

11,950

–

(175,771)

– (163,821)

Share-based payments

–

–

–

–

8,180

8,180

Total transactions with owners

2,196

(286,060)

(2,325)

(96,245)

6,714 (375,720)

At 31 December 2013

6,302,207 2,992,741

(51,691)

287,245

53,415 9,583,917

The accompanying notes form an integral part of these mnancial statements.