118 | CapitaLand Limited Annual Report 2014

Appendix

Notes to the Financial Statements

Year ended 31 December 2014

2

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(cont’d)

2.1 Basis of preparation

(cont’d)

(a) Changes in accounting policies

(cont’d)

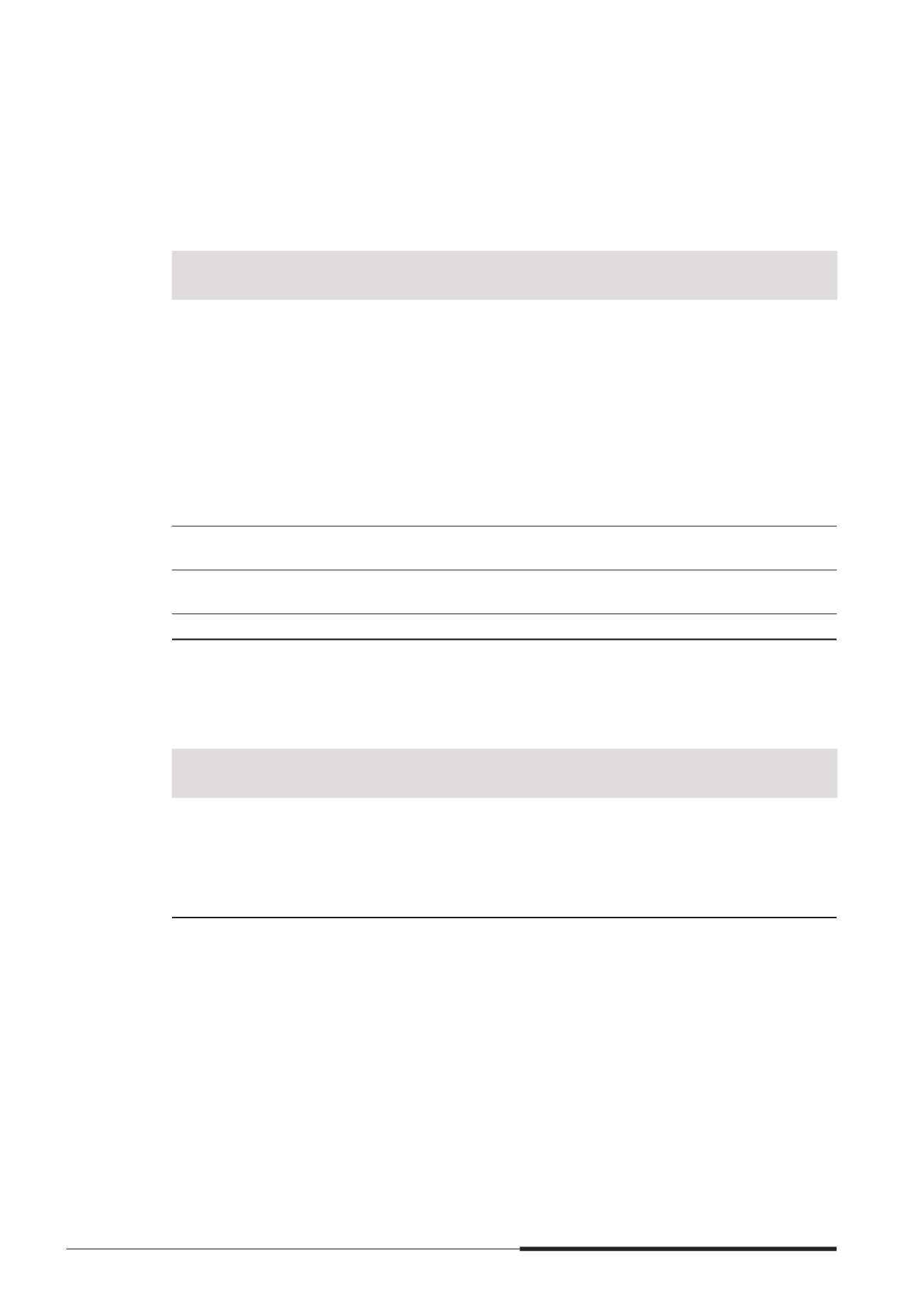

(vi) Summary of quantitative impact

(cont’d)

Income Statement

As previously

reported

^

$’000

Subsidiaries

(note 2.1(a)(i))

$’000

As restated

$’000

The Group

Year ended 31 December 2013

Revenue

2,967,030

544,003

3,511,033

Cost of sales

(2,136,498)

(137,448)

(2,273,946)

Other operating income

302,448

373,758

676,206

Administrative expenses

(379,673)

(27,536)

(407,209)

Other operating expenses

(72,304)

(77,832)

(150,136)

Finance costs

(386,251)

(95,426)

(481,677)

Share of results of associates (net of tax)

831,764

(245,832)

585,932

Share of results of joint ventures (net of tax)

193,227

123,453

316,680

Tax expense

(168,908)

(36,230)

(205,138)

Promt from continuing operations

1,150,835

420,910

1,571,745

Promt from discontinued operation

33,778

–

33,778

Promt for the year

1,184,613

420,910

1,605,523

Non-controlling interests

(334,818)

(430,463)

(765,281)

3URÀW DWWULEXWDEOH WR RZQHUV RI WKH &RPSDQ\

849,795

(9,553)

840,242

^

The comparative income statement has been restated to take into account the re-presentation of Australand’s results

as “discontinued operation” in accordance with FRS 105 Non-current Assets Held for Sale and Discontinued Operation

(note 39).

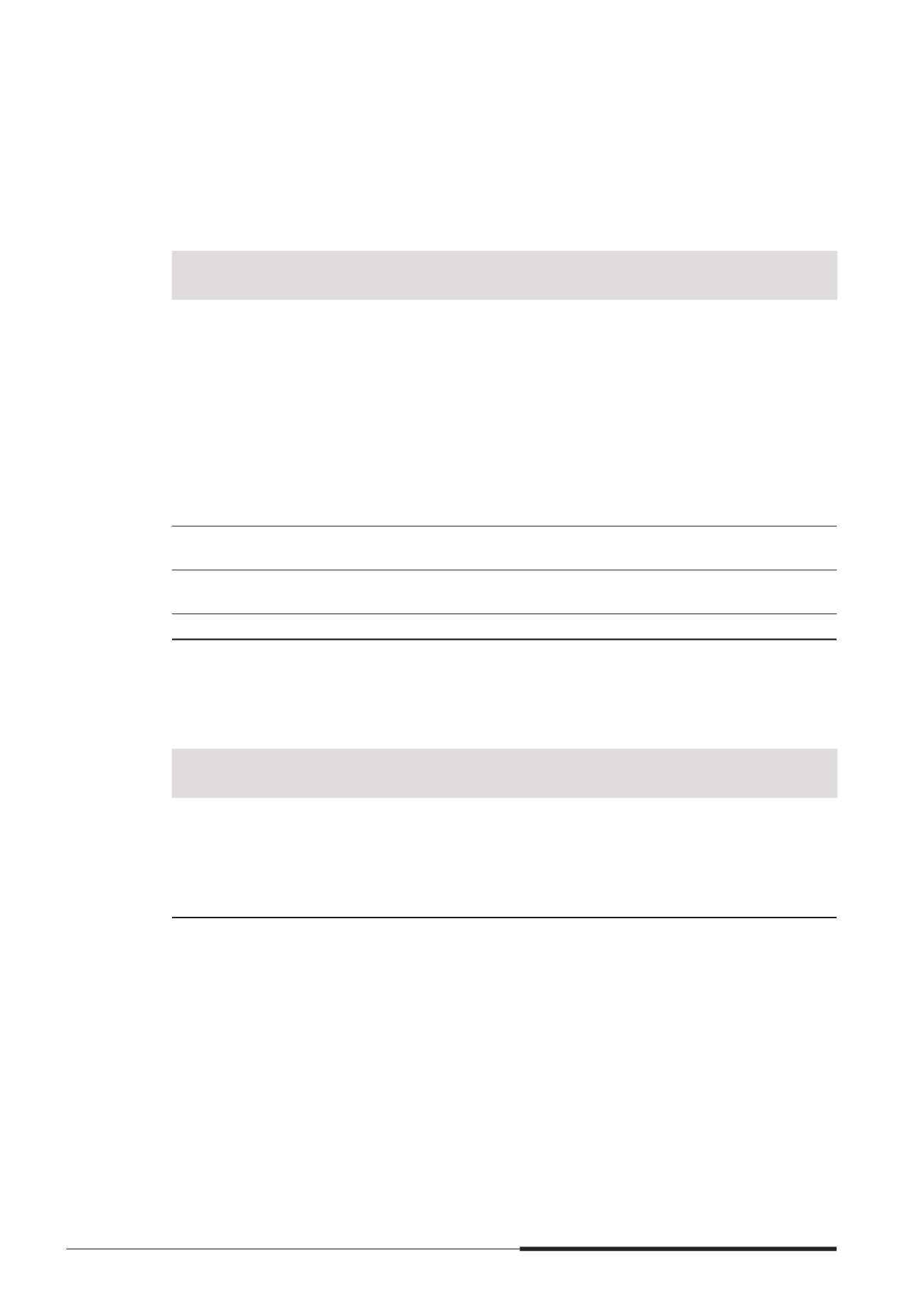

Consolidated Statement of Cash Flows

As previously

reported

$’000

Subsidiaries

(note 2.1(a)(i))

$’000

As restated

$’000

The Group

Year ended 31 December 2013

Net cash generated from operating activities

522,991

433,197

956,188

Net cash generated from investing activities

696,081

(326,131)

369,950

Net cash used in mnancing activities

(828,069)

(41,167)

(869,236)

The accounting policies set out below have been applied consistently to all periods presented in these

mnancial statements, and have been applied consistently by the Group entities, except as explained in

note 2.1(a), which addresses changes in accounting policies.